CHARGiQUiTY

Invest Now

Raised

$22,300

Days Left

22

Business Description

Overview:

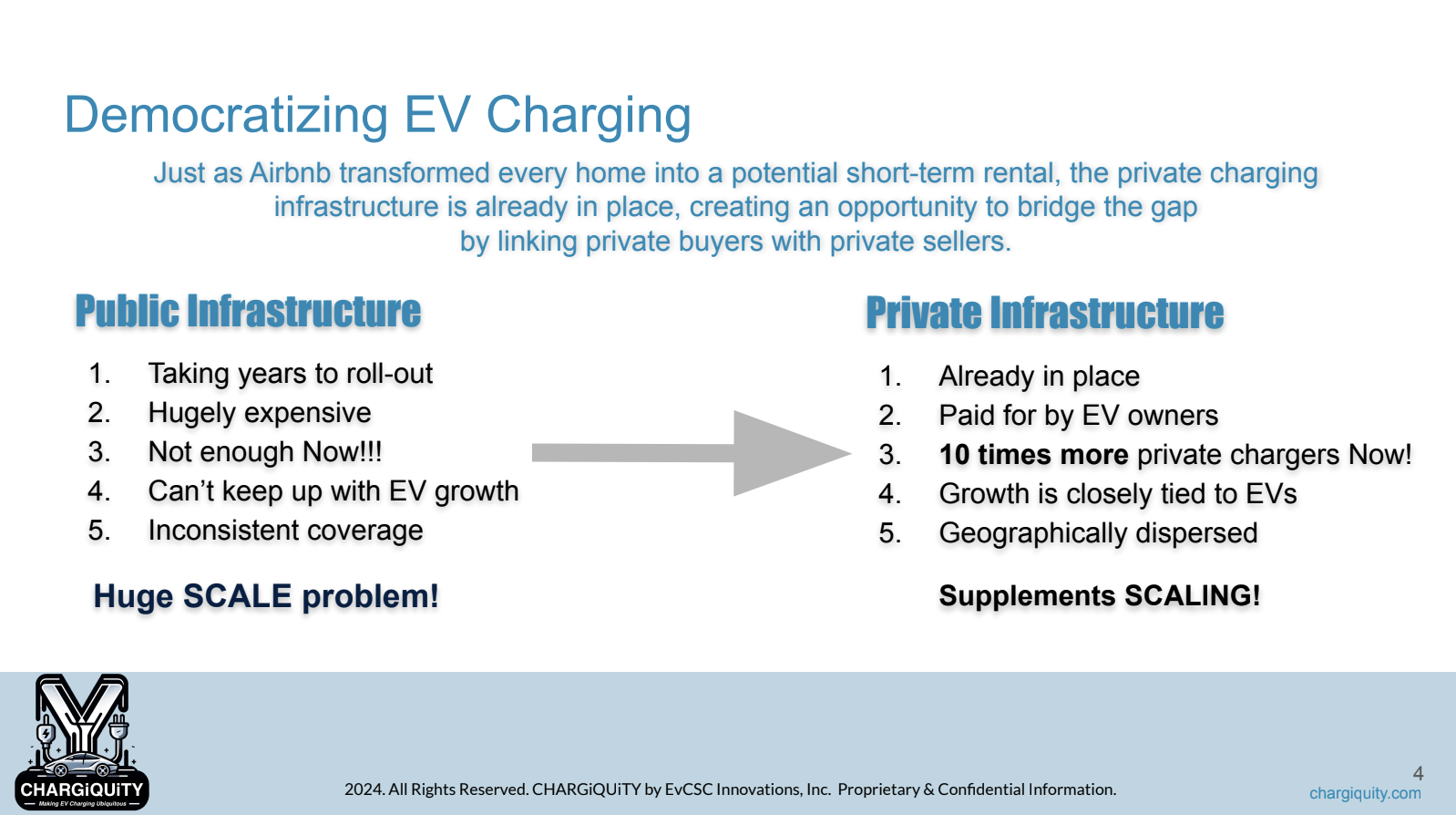

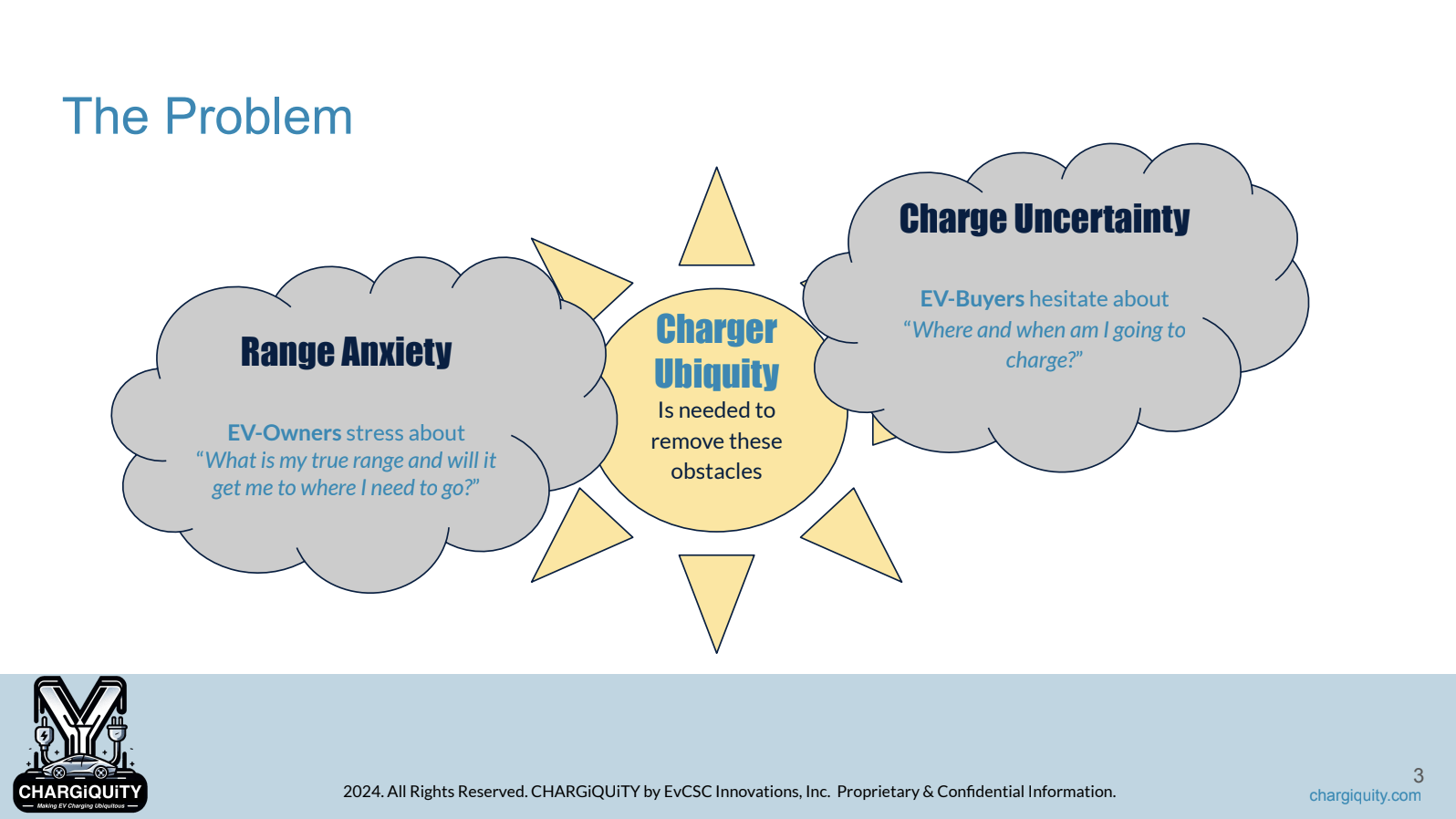

CHARGiQUiTY aims to make EV charging stations widely accessible by empowering and incentivizing everyday people to share their home charging stations. This approach supplements the existing public charging network, effectively increasing the number of charging options available to EV drivers. By doing so, CHARGiQUiTY alleviates the fear of running out of charge and the uncertainty of finding a charging station, thereby promoting the broader adoption of electric vehicles.

We offer our EV Charge Share Controller devices to home charger owners, enabling them to monetize access to their chargers through charge share fees. These fees are facilitated by our adapter and API, which seamlessly connects with existing charger finder apps. This creates a win-win situation: EV drivers gain convenient access to a vast network of home chargers, while charger owners earn additional income from their existing infrastructure.

By leveraging the existing trend of shared economies and catering to the growing number of EV owners, we are poised to revolutionize the EV charging landscape. Our solution not only addresses the current limitations of public charging infrastructure but also empowers individuals to actively participate in and benefit from the transition to electric mobility.

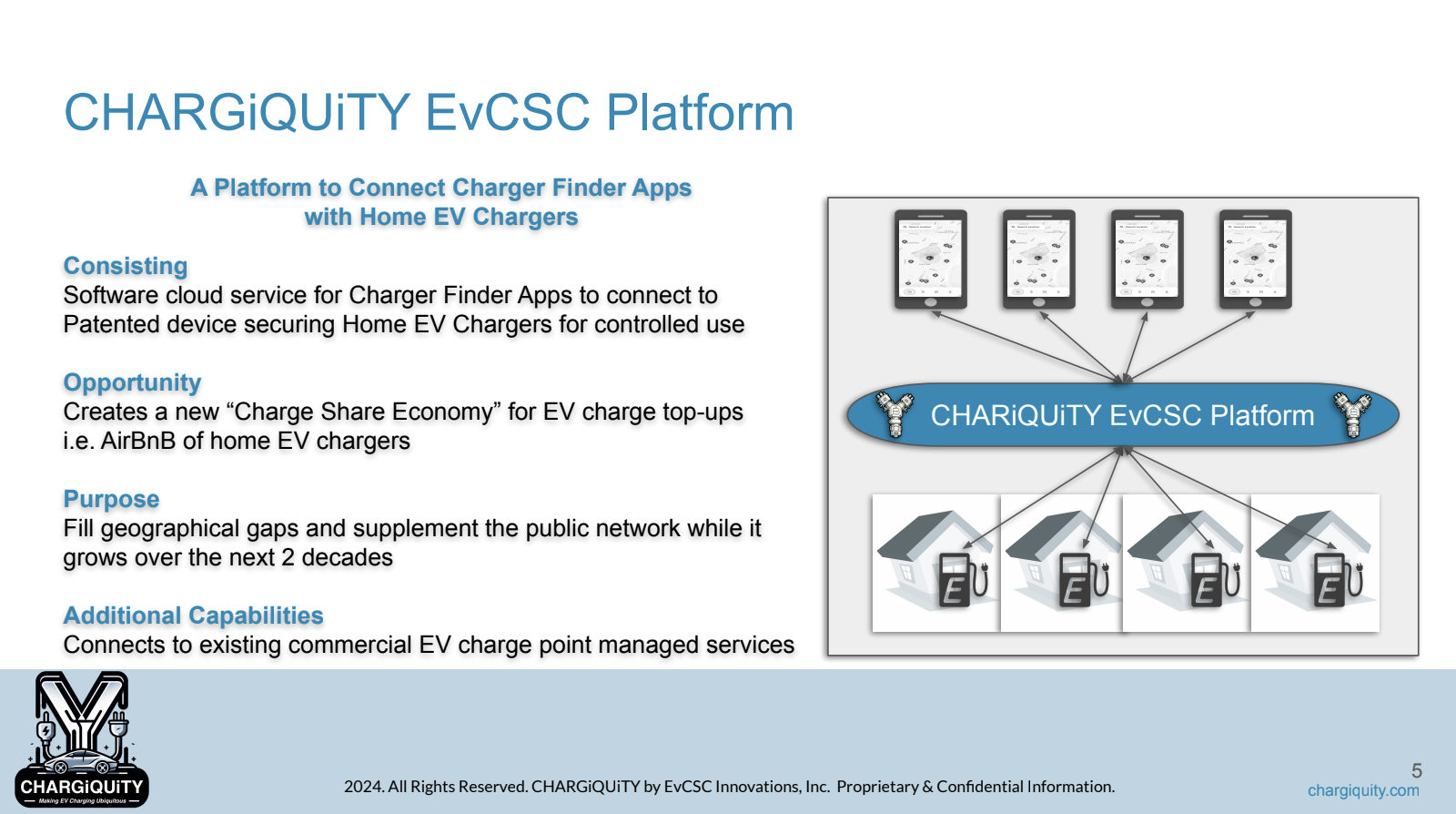

Problem

Range Anxiety and Charge Uncertainty!

CHARGiQUiTY is tackling two of the most significant barriers to widespread electric vehicle (EV) adoption: range anxiety and charge uncertainty. Range anxiety, the fear that an EV driver will run out of battery before reaching a charging station, is a common concern, especially as long road trips or unpredictable schedules can make charging seem like a constant challenge. Additionally, the scarcity and unpredictability of public charging stations exacerbate the problem—drivers are often left wondering when and where they will be able to charge, which can create unnecessary stress and reluctance to fully transition to electric vehicles.

Solution

Making EV Charging Ubiquitous.

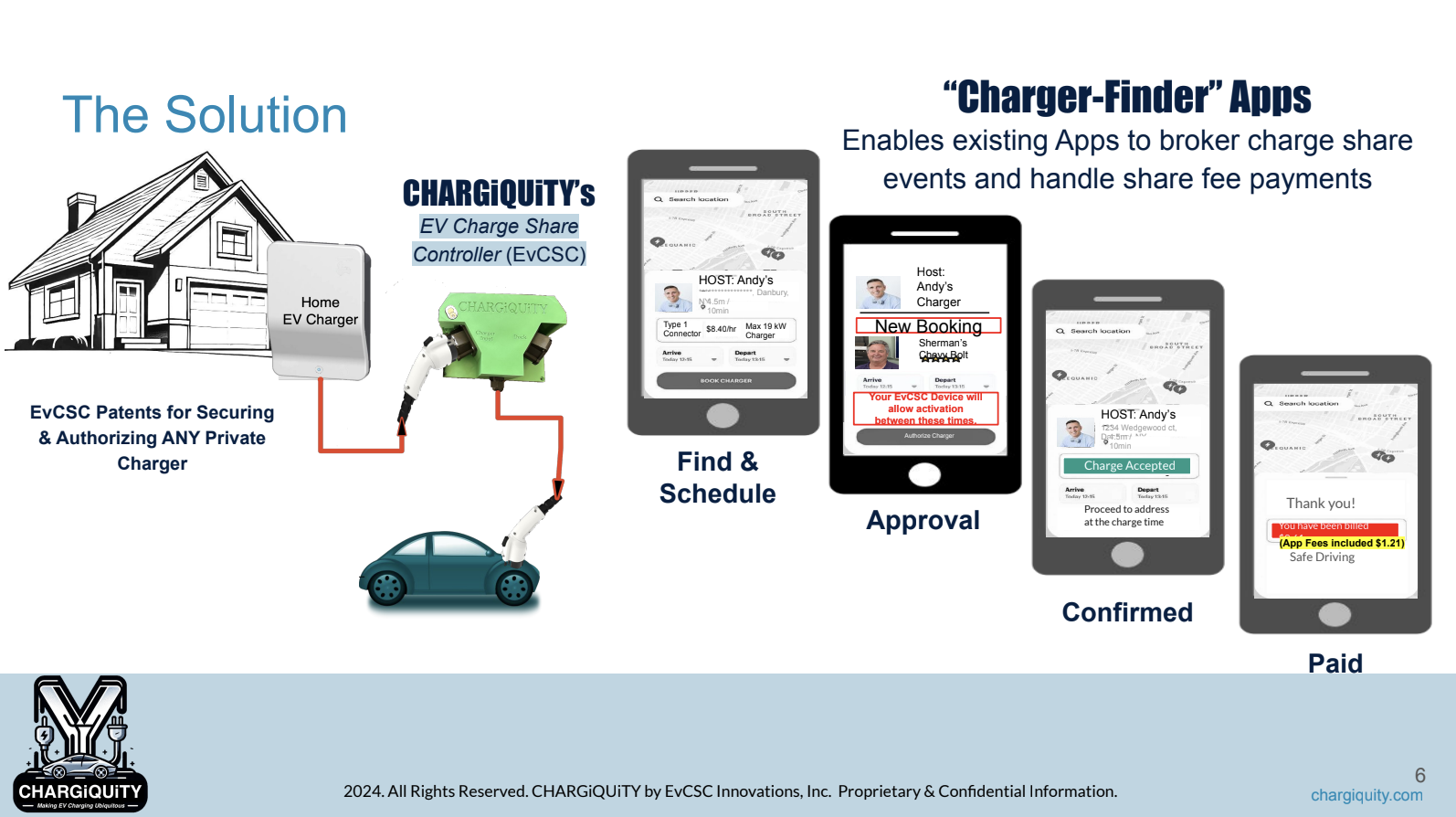

CHARGiQUiTY is a solution that addresses the “range anxiety” and “charge uncertainty” experienced by current and future electric vehicle (EV) owners due to the slow and costly expansion of public charging infrastructure. By enabling and incentivizing the public to share their home chargers, CHARGiQUiTY aims to supplement the public charging network and make EV charging widely accessible. This approach fosters greater confidence in EV adoption by alleviating concerns about running out of charge and finding available charging stations.

Business Model

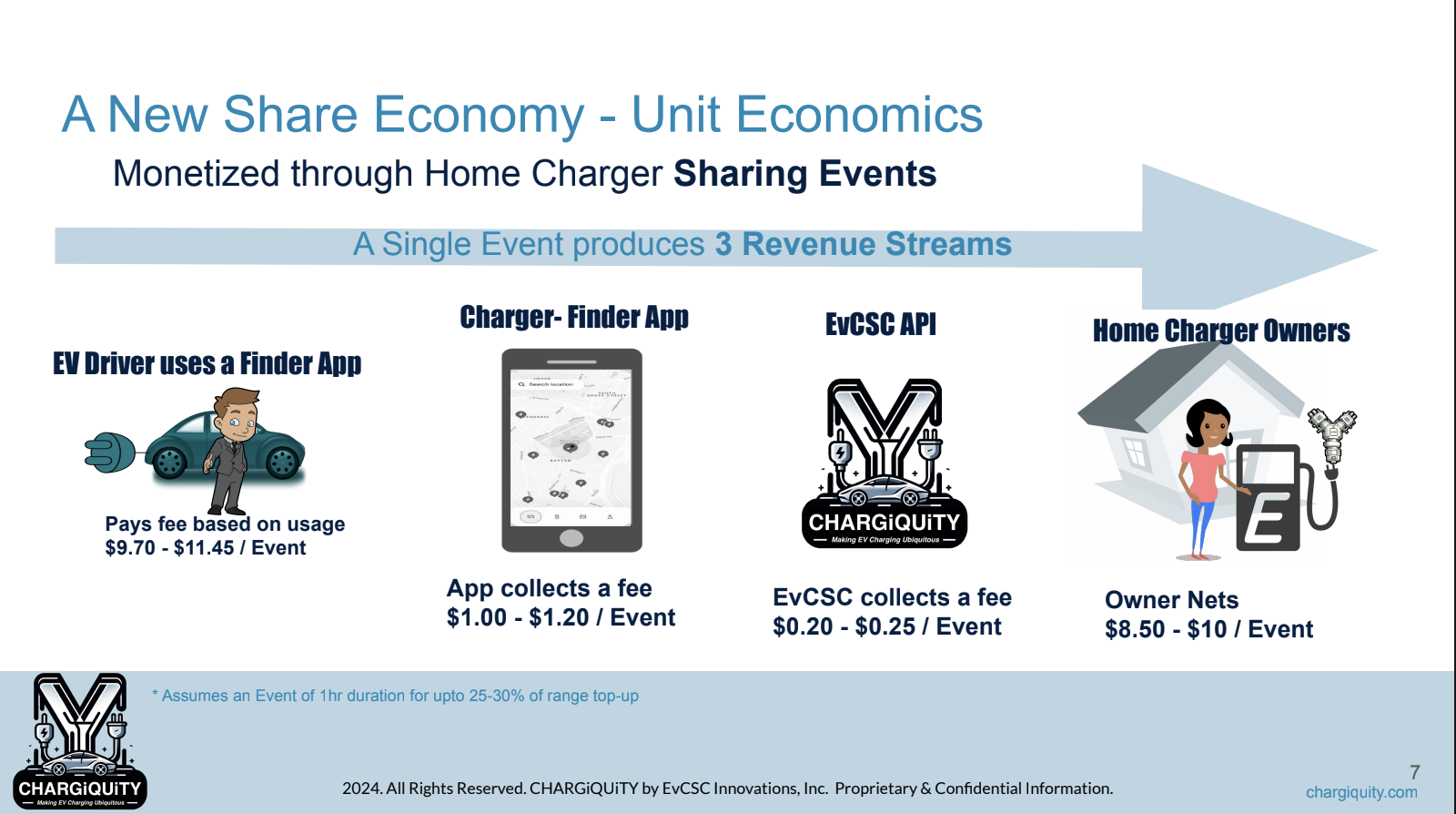

By offering our innovative EV Charge Share Controller devices to home charger owners, we enable them to monetize their existing charging infrastructure, turning underutilized home chargers into a valuable resource. This approach expands the charging network, reducing range anxiety and enhancing convenience for EV drivers, who can easily locate and use home chargers via existing charge-sharing apps, integrated through our API and adapter.

Our business model generates revenue by collecting a fee from charge-sharing apps based on the usage of our devices, creating a mutually beneficial ecosystem where drivers gain access to more charging options, and charger owners earn income from their equipment. By tapping into the growing demand for EV adoption and leveraging the shared economy, CHARGiQUiTY offers a scalable, cost-effective solution that addresses the limitations of current public charging infrastructure while empowering individuals to actively participate in and profit from the transition to electric mobility.

Market Projection

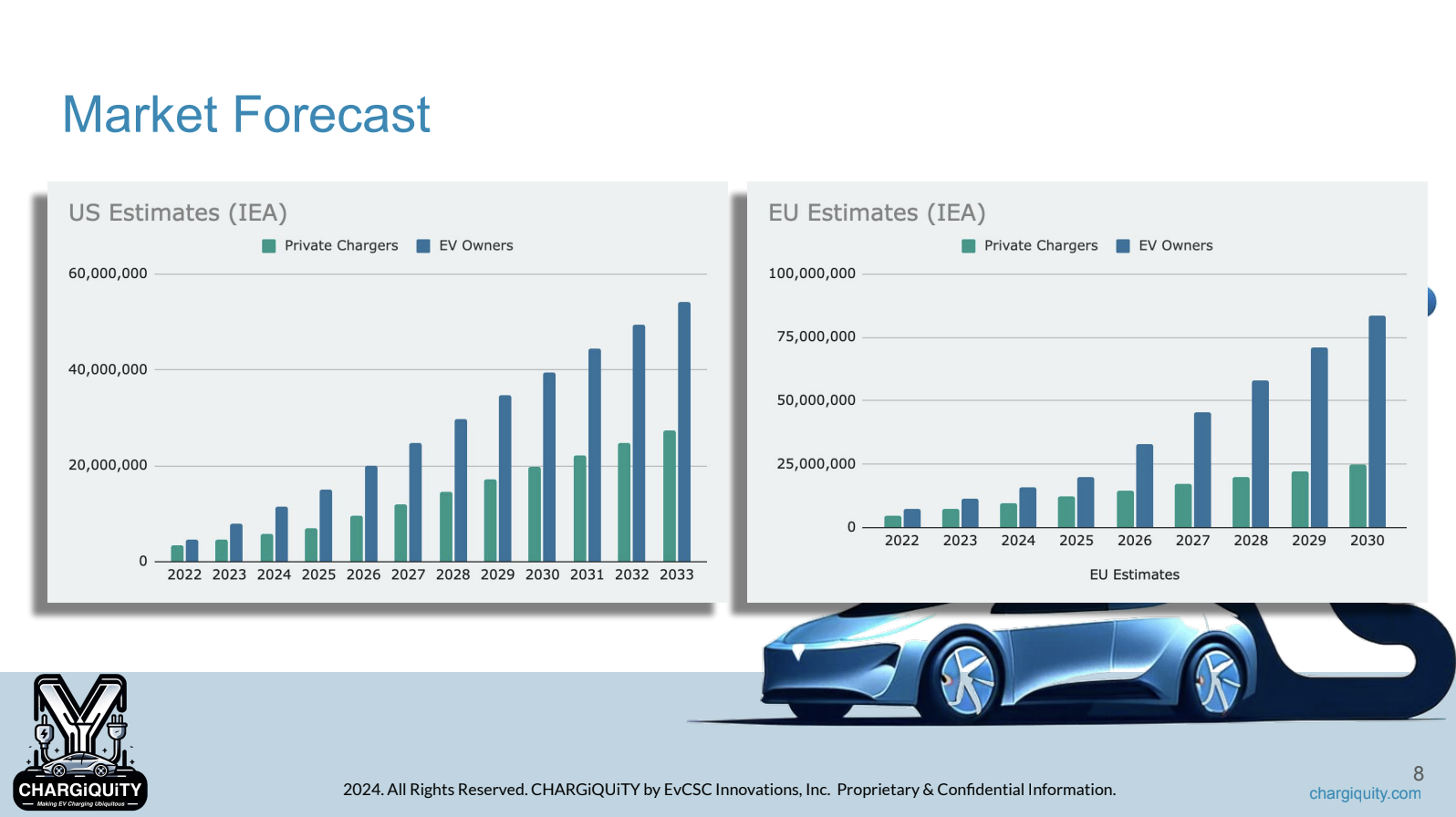

Market Forecast

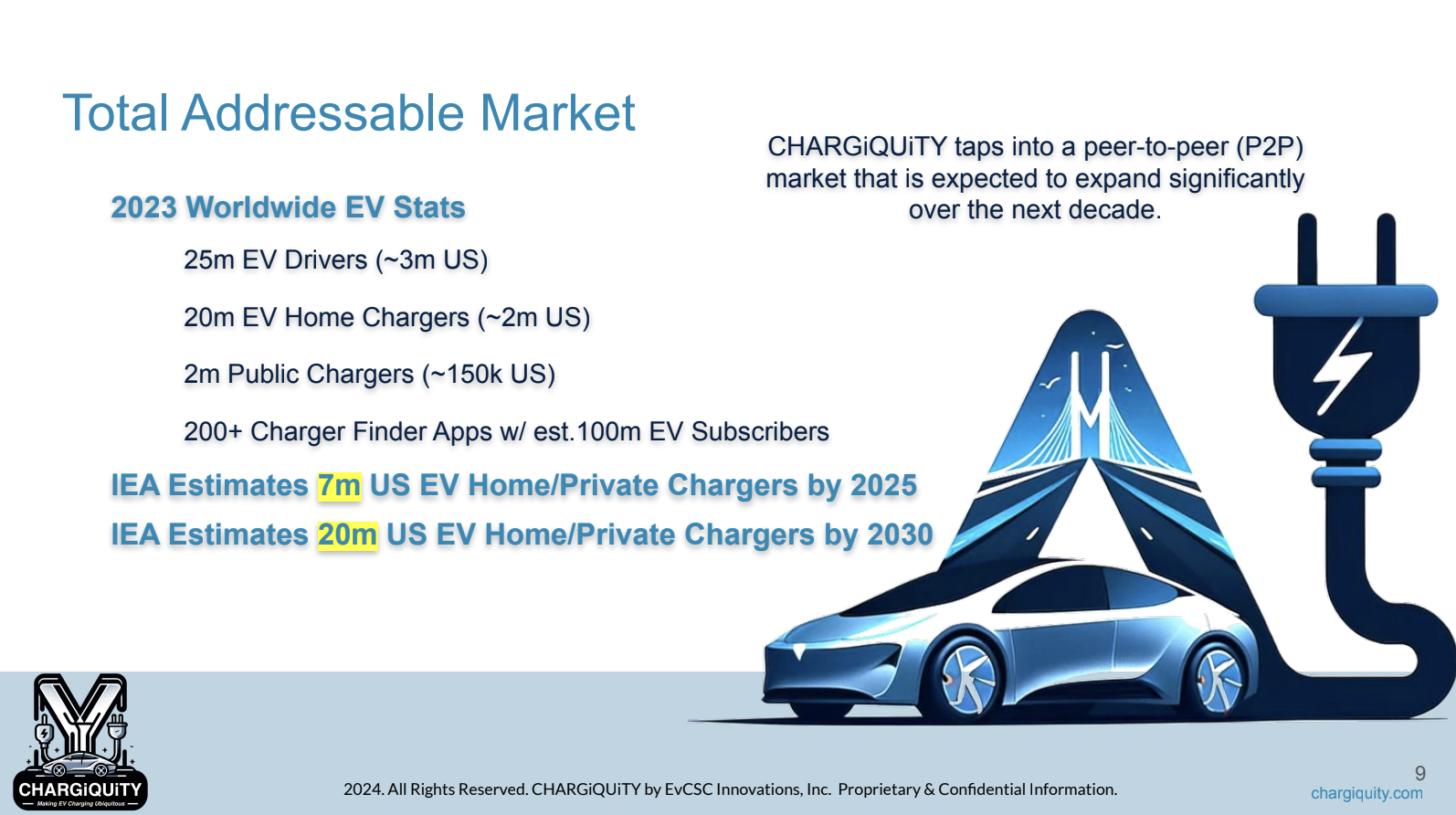

Total Addressable Market

The total addressable market (TAM) for CHARGiQUiTY is vast and rapidly growing, driven by the increasing adoption of electric vehicles and the rising number of home charging stations. As of 2023, there are approximately 3 million EV drivers in the U.S., with around 2 million of them having access to home chargers. This number is expected to more than triple, with the International Energy Agency (IEA) forecasting 7 million home chargers by 2025 and 20 million by 2030. CHARGiQUiTY taps into this expanding market by enabling a peer-to-peer (P2P) charging network, offering a scalable solution to the limitations of public charging infrastructure. As the number of EVs and home chargers grows, our platform has the potential to address a significant portion of the charging demand, positioning CHARGiQUiTY as a key player in the transition to electric mobility.

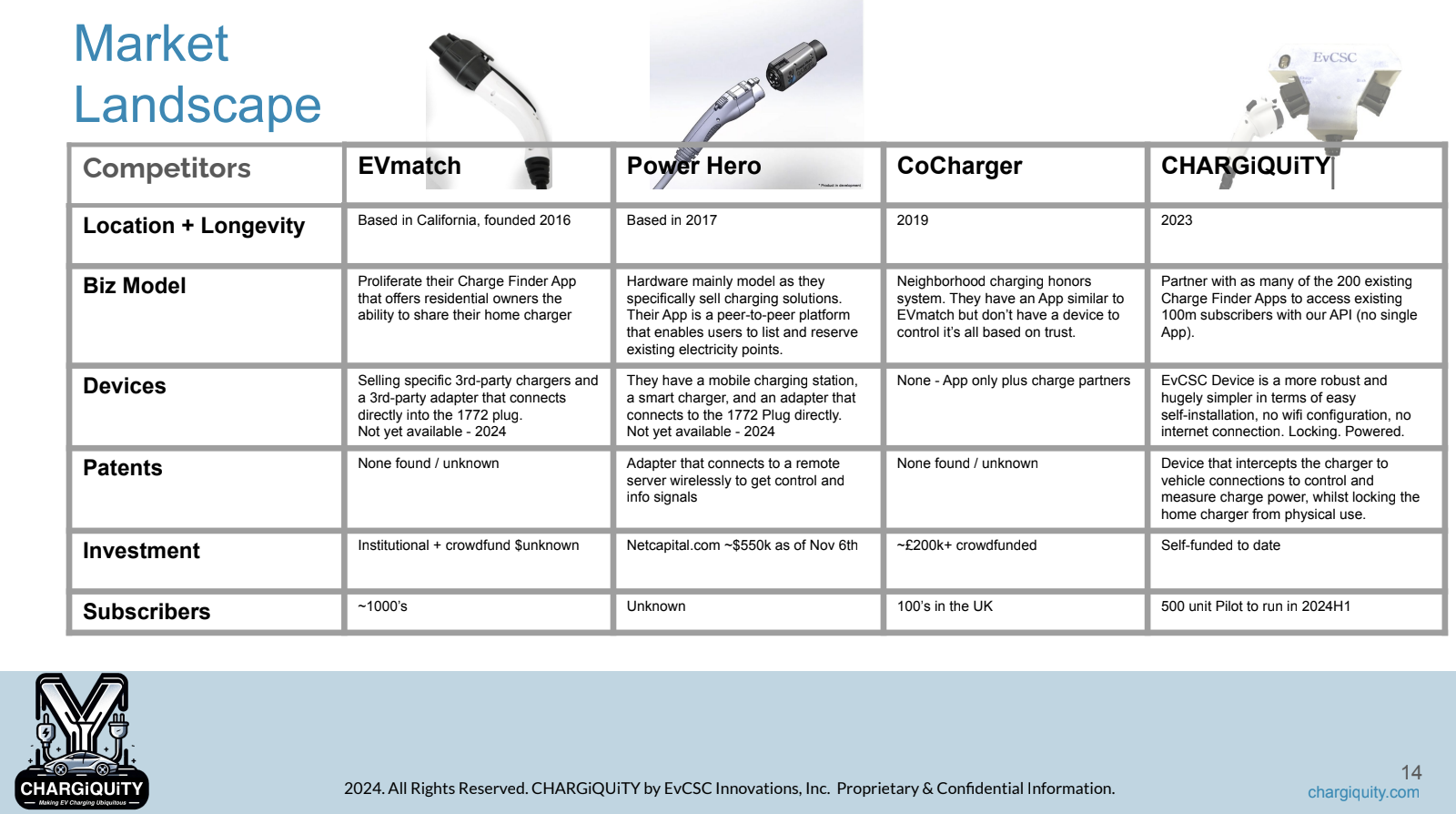

Competition

CHARGiQUiTY Potential Competition:

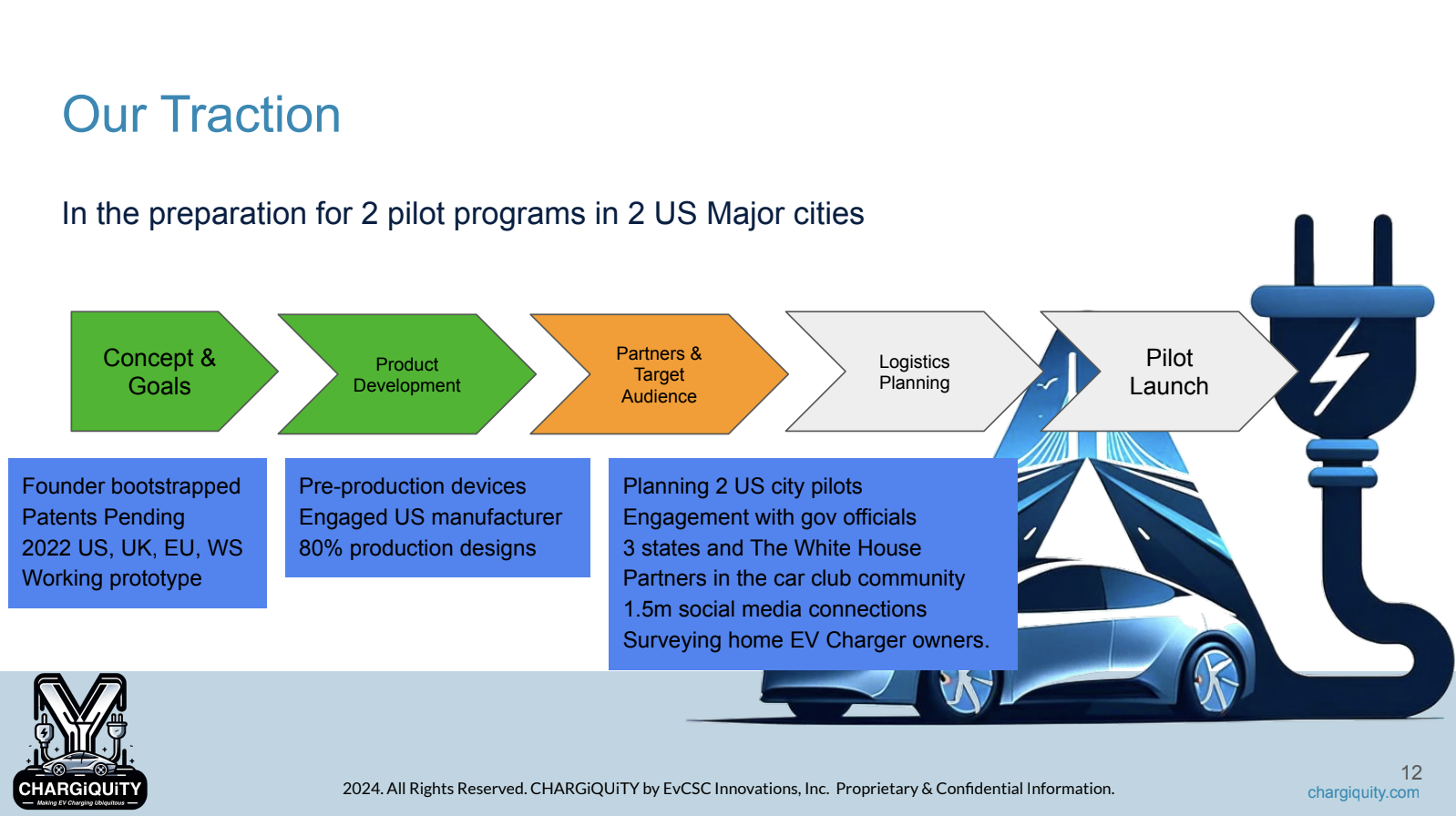

Traction & Customers

Current Traction Timeline

Proof of Concept

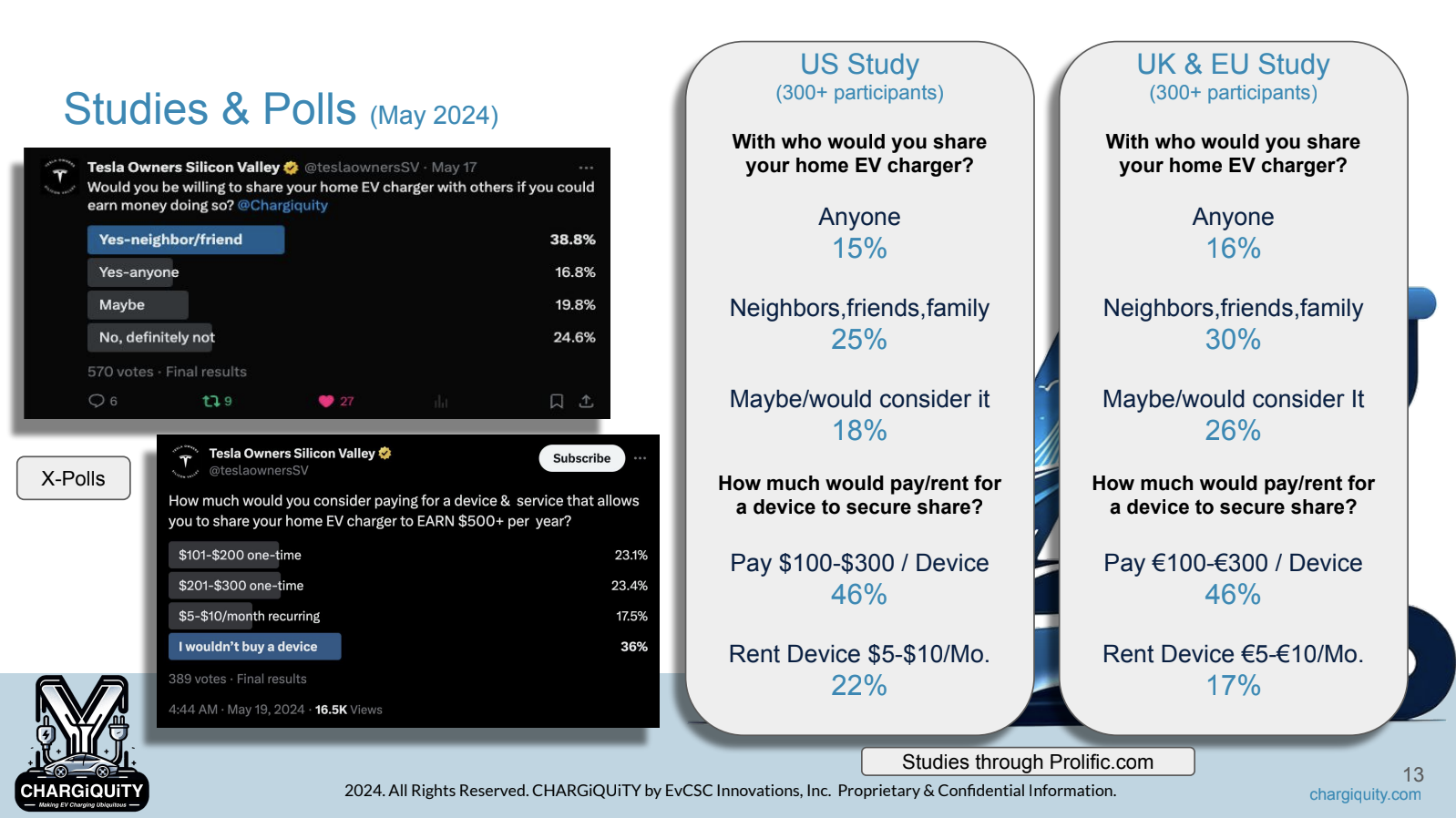

To gauge interest and validate the market potential, CHARGiQUiTY conducted a survey with over 300 participants, exploring both the willingness to share home chargers and the price sensitivity for a device that would enable charger sharing. The results were promising, with more than 16% of the respondents indicating they would be open to sharing their chargers with anyone, while an additional 38.8% expressed a preference for sharing with friends or family.

Furthermore, the survey revealed a strong willingness to invest in the solution, with 46.6% of participants stating they would be willing to pay between $101 and $300 for a device that would enable them to share their home charger. These insights demonstrate significant demand for a platform that facilitates home charger sharing, validating both the business model and the potential for widespread adoption as the market for electric vehicles continues to grow.

Investors

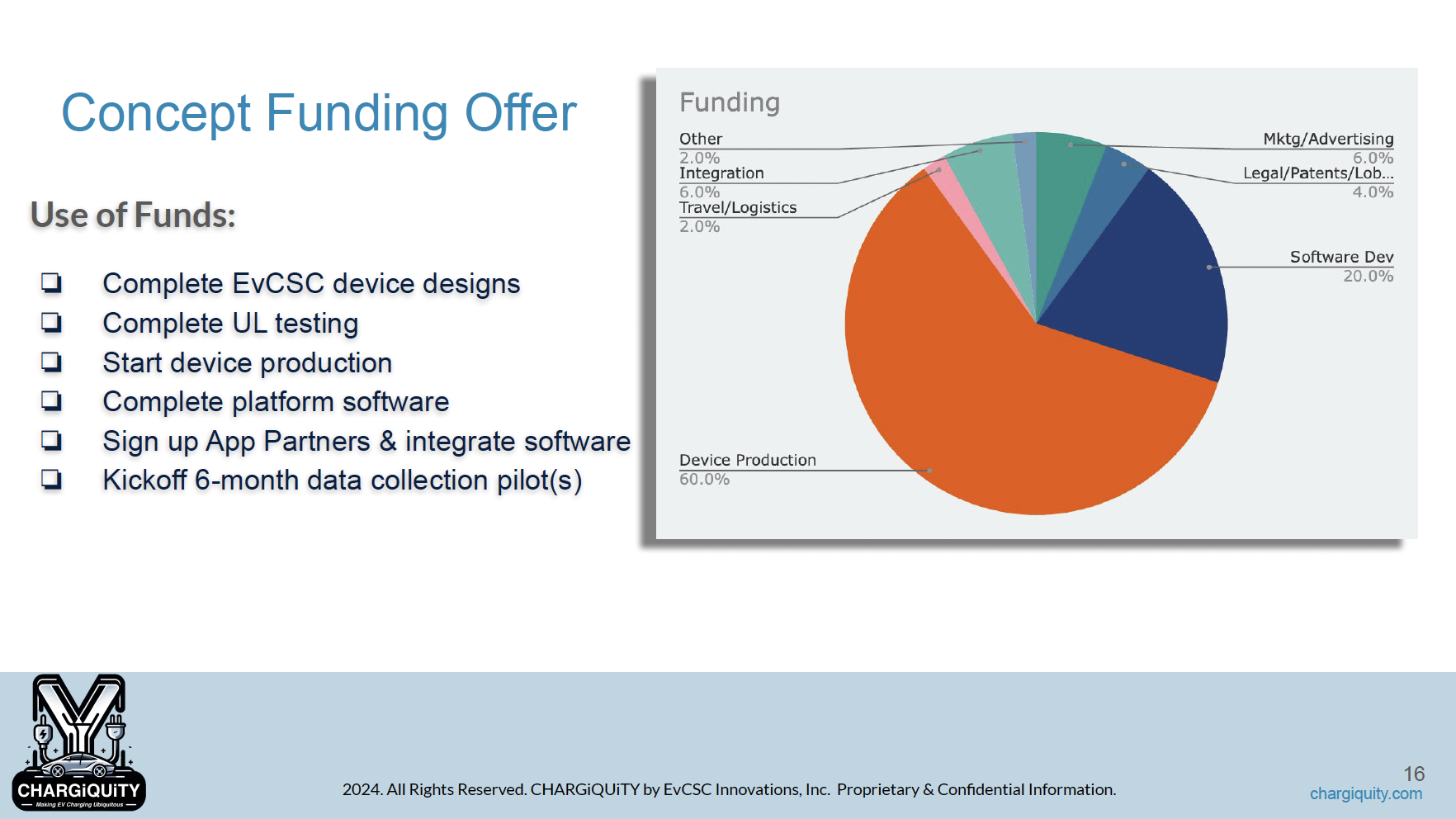

Intended Use of Raised Funds:

Terms

Up to $124,000 in Common Stock at $0.50 per Share, with a minimum target amount of $10,000.

Offering Minimum: $10,000 | 20,000 Securities

Offering Maximum: $124,000 | 248,000 Securities

Type of Security: Common Stock

Offering Deadline: July 31, 2025

Minimum Investment Amount (Per Investor): $500

The Minimum Individual Purchase Amount accepted under this Regulation CF Offering is $500. The Company must reach its Target Offering Amount of $10,000 by July 31, 2025 (the “Offering Deadline”). Unless the Company raises at least the Target Offering Amount of $10,000 under the Regulation CF offering by the Offering Deadline, no securities will be sold in this Offering, investment commitments will be cancelled, and committed funds will be returned.

NOTE TO INVESTORS ABOUT THE SPV

Regulation Crowdfunding allows an issuer to use a special purpose vehicle, or SPV. The technical legal term is a “crowdfunding vehicle.”

In this case, while the name of the Company itself is EvCSC Innovations, Inc., the name of the SPV is EvCSC Innovations SPV, LLC. You and all the other Regulation Crowdfunding investors will invest in EvCSC Innovations SPV, LLC and EvCSC Innovations SPV, LLC will, in turn, use your money to invest in EvCSC Innovations, Inc. Hence, EvCSC Innovations SPV, LLC will be reflected as one investor in EvCSC Innovations, Inc.

EvCSC Innovations, Inc. believes this structure – with one investor rather than many – will make it easier to raise additional capital in the future because the Offering will leave the Company with only one investor on its capitalization table.

EvCSC Innovations SPV, LLC will conduct no business other than to invest in EvCSC Innovations, Inc. The SPV has been organized and will be operated for the sole purpose of directly acquiring, holding and disposing of the Company’s securities, will not borrow money and will use all the proceeds from the sale of its securities solely to purchase a single class of securities of the Company. EvCSC Innovations SPV, LLC will be managed by the Company itself. The Company’s use of the SPV is intended to allow investors in the SPV to achieve the same economic exposure, voting power, and ability to assert State and Federal law rights, and receive the same disclosures, as if they had invested directly in the Company. The Company’s use of the SPV will not result in any additional fees being charged to investors.

Although EvCSC Innovations, Inc. is a corporation, you will be an owner of EvCSC Innovations SPV, LLC, which is a limited liability company. Hence, you will receive IRS Form K-1 for tax reporting purposes.

All the information about “the Company” in this Form C refers to EvCSC Innovations, Inc., not to EvCSC Innovations SPV, LLC unless otherwise indicated.

NOTE TO INVESTORS: As explained above, you will invest in EvCSC Innovations SPV, LLC, not in the Company directly. You will receive an interest in EvCSC Innovations SPV, LLC called “Investor Shares” while EvCSC Innovations SPV, LLC will receive shares of Common Stock issued by the Company. The governing documents of EvCSC Innovations SPV, LLC, being its Certificate of Formation and Limited Liability Company Agreement (EXHIBIT E and EXHIBIT G), and the Investor Shares to be issued to you from EvCSC Innovations SPV, LLC, are intended to put you in the same position as if you had purchased shares of Common Stock directly from the Company.

Voting Proxy to the Manager

The SPV investor shares do not have voting rights. With respect to those voting rights, the investor and his, her, or its transferees or assignees (collectively, the “Investor”), through a voting proxy granted by Investor in the subscription agreement (Exhibit C), has appointed or will appoint the Manager, EvCSC Innovations, Inc., as the Investor’s true and lawful proxy (the “Proxy”) with the power to act alone and with full power of substitution, on behalf of the Investor to: (i) vote all securities related to the Company purchased in an offering hosted by PicMii Crowdfunding, LLC, and (ii) execute, in connection with such voting power any instrument or document that the Manager determines is necessary and appropriate in the exercise of his or her authority. The Investor Shares shall have one hundred percent (100%) of the economic rights and no management rights other than to replace the Manager upon a majority vote at a duly called meeting. The Manager Shares shall be held only by EvCSC Innovations, Inc., or its affiliates or assigns. The Manager Shares will confer no economic rights but shall confer one hundred percent (100%) of the management authority to the holders of the Manager Shares. The holders of Manager Shares shall have all rights necessary to manage the business affairs of the Company, including but not limited to, the authority to direct the acquisition, holding, and disposition of the Company’s assets, and to make all decisions regarding the Company’s operations without requiring the consent of the holders of the Investor Shares, subject to limitations in Delaware state law, participation in tender offers, mergers, acquisitions, or any other matters requiring shareholder approval.

Risks

Please be sure to read and review the Offering Statement. A crowdfunding investment involves risk. You should not invest any funds in this offering unless you can afford to lose your entire investment.

In making an investment decision, investors must rely on their examination of the issuer and the terms of the offering, including the merits and risks involved. These securities have not been recommended or approved by any federal or state securities commission or regulatory authority. The U.S. Securities and Exchange Commission does not pass upon the merits of any securities offered or the terms of the offering, nor does it pass upon the accuracy or completeness of any offering document or literature.

These securities are offered under an exemption from registration; however, the U.S. Securities and Exchange Commission has not made an independent determination that these securities are exempt from registration.

Neither PicMii Crowdfunding nor any of its directors, officers, employees, representatives, affiliates, or agents shall have any liability whatsoever arising from any error or incompleteness of fact or opinion in, or lack of care in the preparation or publication of, the materials and communication herein or the terms or valuation of any securities offering.

The information contained herein includes forward-looking statements. These statements relate to future events or future financial performance and involve known and unknown risks, uncertainties, and other factors that may cause actual results to be materially different from any future results, levels of activity, performance, or achievements expressed or implied by these forward-looking statements. You should not place undue reliance on forward-looking statements since they involve known and unknown risks, uncertainties, and other factors, which are, in some cases, beyond the company’s control and which could, and likely will materially affect actual results, levels of activity, performance, or achievements. Any forward-looking statement reflects the current views with respect to future events and is subject to these and other risks, uncertainties, and assumptions relating to operations, results of operations, growth strategy, and liquidity. No obligation exists to publicly update or revise these forward-looking statements for any reason or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

Security Type:

Equity Security

Price Per Share

$0.50

Shares For Sale

248,000

Post Money Valuation:

$4,592,500

Investment Bonuses!

Regulatory Exemption:

Regulation Crowdfunding – Section 4(a)(6)

Deadline:

July 31, 2025

Minimum Investment Amount:

$500

Target Offering Range:

$10,000-$124,000

*If the sum of the investment commitments does not equal or exceed the minimum offering amount at the offering deadline, no securities will be sold and investment commitments will be cancelled returned to investors.

Andy Kemal

CEO

BackgroundA seasoned technology executive and entrepreneur, with a two-decade tenure at Qualcomm leading multinational technology groups during the fast-paced mobile tech boom of the 90s and 00s. As a key engineer for the Binary Runtime Environment for Wireless (BREW), he played a pivotal role in shaping the mobile App Store experience, a precursor to the Android and iPhone App Stores. His career began in defense technologies, earning him an award-winning apprenticeship in the mid-80s, and in 2016 he founded INFIX, a business tech consulting firm.

Sherman

CTO

BackgroundA highly accomplished technology executive with a three-decade career at Qualcomm, where he played a pivotal role in the commercialization of CDMA and the development of 2nd and 3rd generation mobile cellular technologies. He retired in 2016 as VP of technology, holding numerous patents in digital communications. His expertise is complemented by a master’s degree in electrical engineering and a lifelong passion for automobiles and car collecting.

Company Name

CHARGiQUiTY

Location

6176 Charing St

San Diego, California 92117

Number of Employees

2

Incorporation Type

C-Corp

State of Incorporation

Delaware

Date Founded

August 30, 2023

Raises half the minimum amount

CHARGiQUiTY has raised half of the target offering amount on February 28, 2025. $20,800 has been raised at this time.

Raises 100% of the minimum amount

CHARGiQUiTY has raised the target offering amount on February 28, 2025. $20,800 has been raised at this time.Investors should be aware that the Issuer can now conduct rolling closes if they wish. If the Issuer decides to do so, you will be notified and given time to cancel your investment.