IdentifySensors Biologics

Invest Now

Raised

$99,173

Days Left

Closed

Business Description

Check4® by IdentifySensors® Biologics is a digital diagnostic platform intended to rapidly detect and differentiate multiple pathogens simultaneously at the molecular gene level.

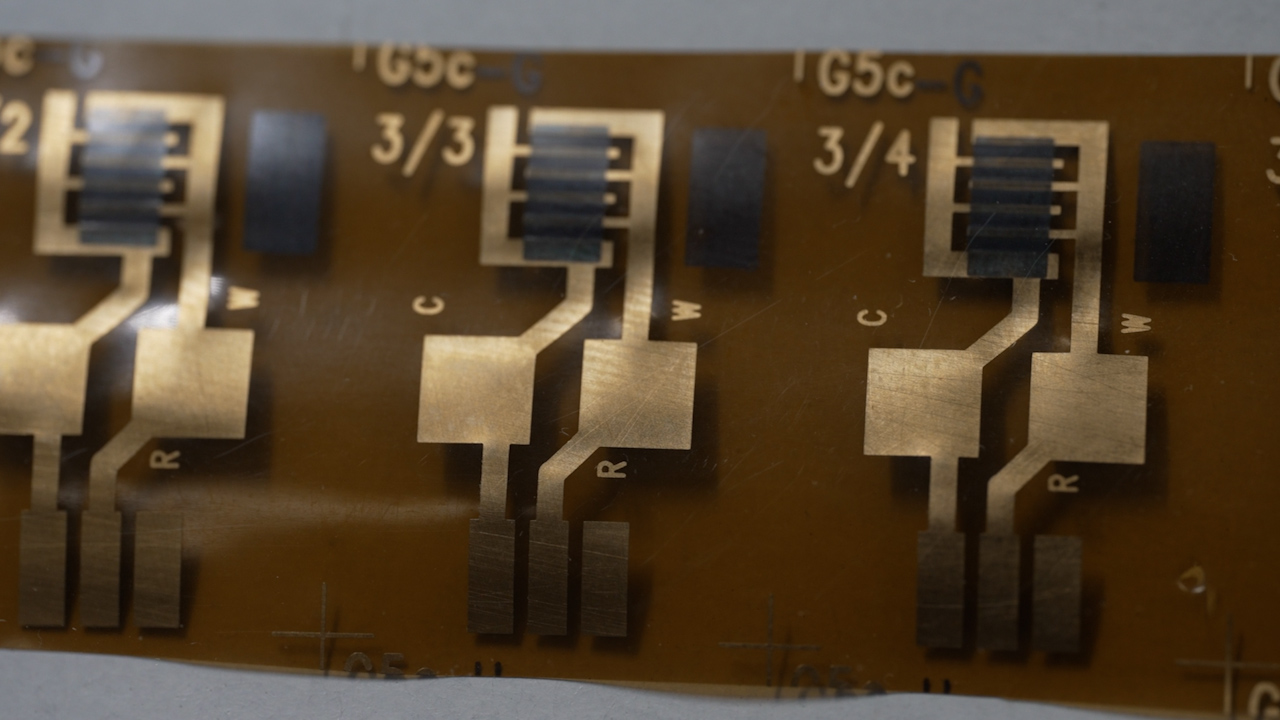

New patented technology eliminates enzymatic amplification and reagents. Graphene-based inks are printed into solid-state electronic biosensors. The technology is intended to move diagnostics away from chemical testing and into a rapid multiplex platform, with a lower limit of detection than the most accurate PCR tests on the market today.

In extensive preliminary studies, printed sensors on thin-film substrates pinpointed target DNA and RNA in saliva in minutes. These new sensors serve as the core to a new Bluetooth portable device intended for point-of-care and over-the-counter use. The company plans to expand the platform to rapidly detect genetic material from dozens of infectious diseases, including respiratory illnesses, diarrheal pathogens and sexually transmitted diseases.

With a target price lower than current molecular tests, Check4® is intended to significantly disrupt the PCR market. This technology has not yet been approved for sale in the United States.

Problem

For the past 50 years, medical science has relied on slow chemical reactions to test for infections from viruses and bacteria. During the pandemic, the public witnessed firsthand how slow and cumbersome the process really is. After samples are taken from patients, most PCR tests required trained clinicians to process the chemical reactions in laboratories.

The method is slow, expensive and time-consuming. What’s more, most patients prefer testing themselves at home, without driving to a clinic and waiting for results. This is particularly true for diseases such as HIV and other STDs. Home antigen tests have taken market share with COVID, but the accuracy of antigen results are often unreliable and not suitable for medical professionals dealing with a host of other problems.

Solution

IdentifySensors® Biologics has developed a small and simple Bluetooth device intended to detect most viruses and bacteria from saliva with a high level of accuracy. The device uses interchangeable cartridges that rapidly detect and differentiate groups of multiple infections simultaneously – anywhere, any time.

Each cartridge is intended to detect as many as three different infections. Results are sent to patients by text message or email in minutes. Tests can be taken at home or through medical professionals. At the heart of this product are cutting-edge electronic biosensors that transmit digital signals through DNA and RNA. When an exact molecular sequence is a match, and analyzed through an algorithm, the test is positive. Using no chemicals, these rapid results are intended to be as accurate as a hospital PCR test.

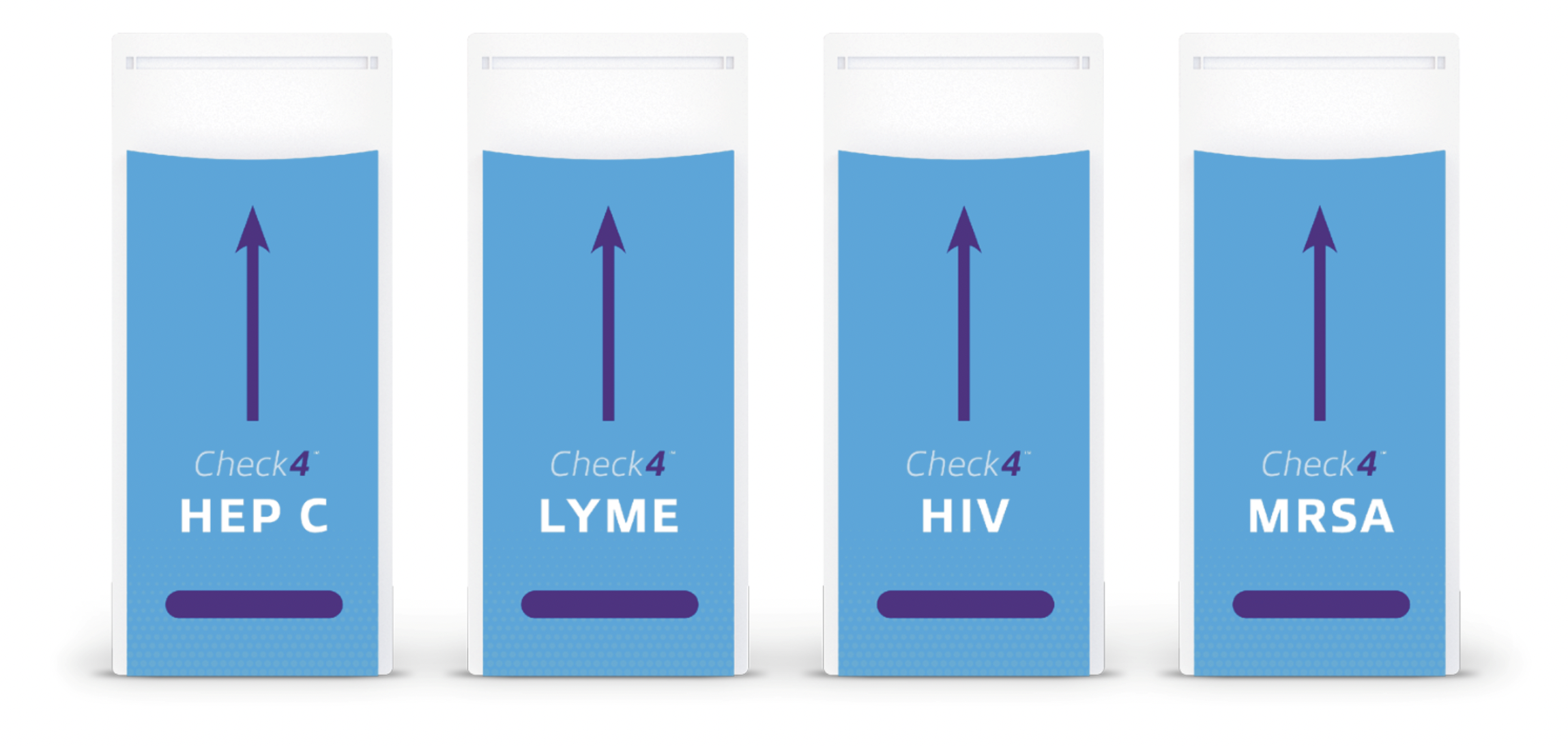

By shifting infectious-disease diagnostics to a digital platform, testing can become significantly faster, less expensive and more accessible to many more people whose lives depend on it. IdentifySensors plans to market this technology first in Africa, where an Ebola infection is a death sentence to those who encounter it. The Check4 device will then be manufactured for a wide range of other infections, such as strep, flu, COVID, Hepatitis C, RSV, HIV and Lyme.

Business Model

Razor-Razorblade Model

IdentifySensors is developing a razor-razorblade model to sales and marketing. Consumers and health organizations purchase a reusable Bluetooth reader for about $99. Customers then buy an ongoing supply of disposable test cartridges, which are operated by the reader. The single-use cartridges – each of which test for different infections – will range in price between $29 to $199, depending on the number of sensors they hold and the pathogens for which they test.

Following FDA approval – the first approval is expected in mid-2024 – IdentifySensors will begin marketing to health-care organizations, doctors’ offices and hospital systems. Soon after, the company plans to market its products direct to consumers for common infections, such as influenza, COVID, RSV, Lyme and sexually transmitted diseases.

One of the benefits to this technology is the biosensors can be programmed to detect any form of RNA or DNA. This means that that the devices and infrastructure to manufactured them remains the same regardless of the targeted disease. The goal is to significantly disrupt the PCR market for dozens and infections.

Market Projection

The molecular testing market for infectious diseases is roughly $16 billion worldwide. This is for highly accurate molecular tests only, including PCR tests for a wide range of pathogens. This does not include low-quality antigen tests commonly associated with COVID. These products are considered point-of-care, which are generally used in medical settings for accurate and definitive results.

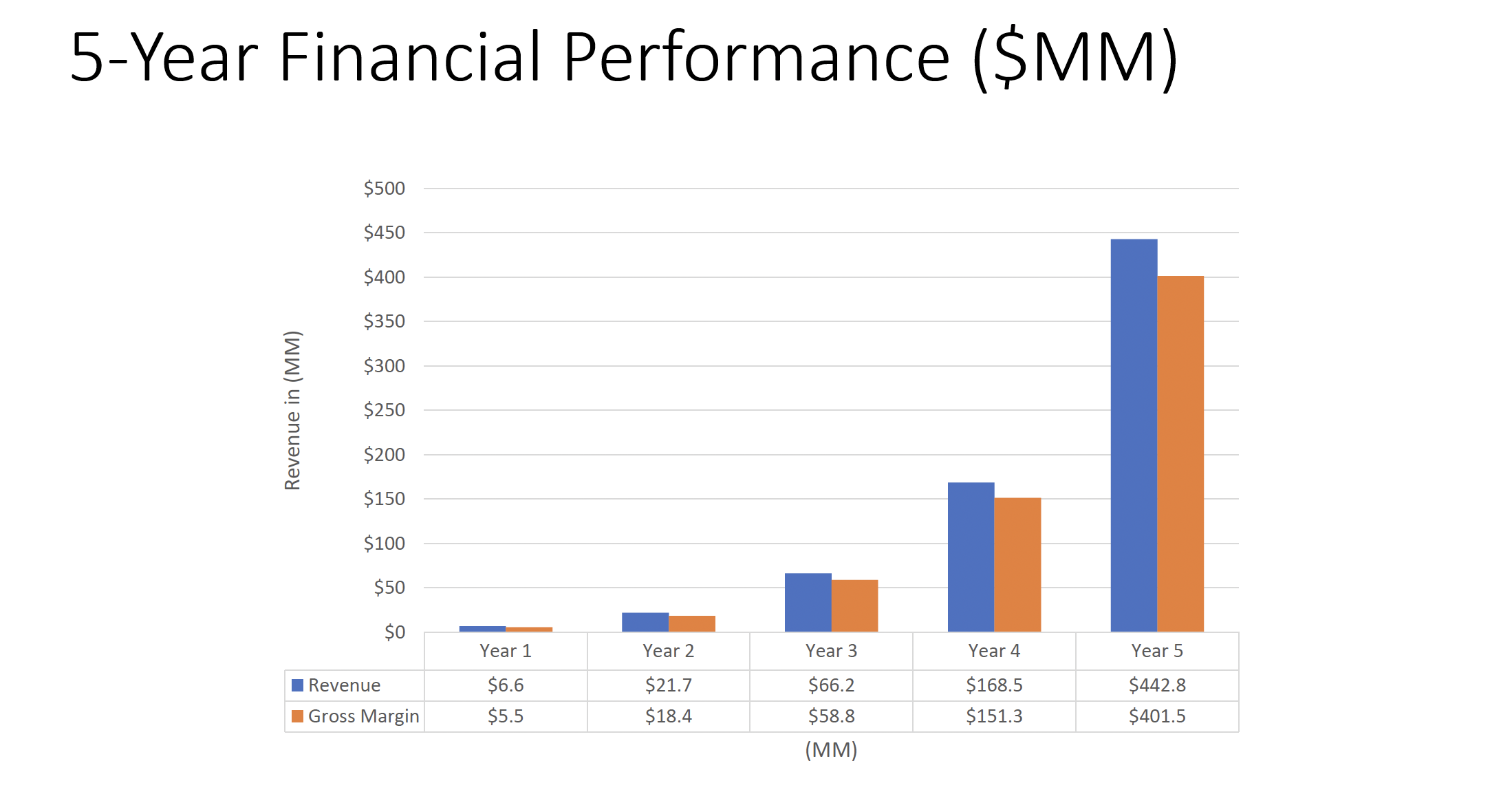

IdentifySensors has run an extensive analysis of this market through planned products, using industry best data and a conservative planning model of only 3 percent market share over five years. Through this model, we project revenues of $36 million in the first full year, ramping up to $440 million dollars by year five.

With a projected EBITDA of 69 percent – and a conservative annual growth rate of 154 percent – the company anticipates a five-year valuation of $2.6 billion, based on a 6X multiple.

Competition

IdentifySensors plans to significantly disrupt the PCR testing market. This includes a wide range of infection in both clinical setting for point-of-care and over-the-counter to consumers. The company also plans to launch new home testing products that currently do not exist on the market today. These include over-the-counter tests for STDs, HIV and Lyme, among other pathogens.

Traction & Customers

IdentifySensors has begun large-scale manufacturing and is about to submit its first application to the FDA. In the meantime, the company is conversations with several large health care and pharmaceutical companies about partnerships, marketing and sales.

Investors

In the past two years, the company has raised nearly $15 million from Regulation A+ and Regulation D investors. The company is fully audited and is now opening its doors to smaller investors, as we begin the expensive task of clinical trials.

Terms

IdentifySensors Biologics Corp is offering securities in the form of Equity which provides investors the right to Common Stock in the Company.

Target Offering: $9,999.00 | 2,222 Securities

Maximum Offering Amount: $4,999,999.50 | 1,111,111 Securities

Share Price: $4.50

Type of Offering: Equity

Type of Security: Common Stock

Offering Deadline: October 25, 2024

Minimum Investment: $990.00

The Minimum Individual Purchase Amount accepted under this Regulation CF Offering is $990.00. The Company must reach its Target Offering Amount of $9,999 by October 25, 2024 (the “Offering Deadline”). Unless the Company raises at least the Target Offering Amount of $9,999 under the Regulation CF offering by the Offering Deadline, no securities will be sold in this Offering, investment commitments will be cancelled, and committed funds will be returned.

Risks

Please be sure to read and review the Offering Statement. A crowdfunding investment involves risk. You should not invest any funds in this offering unless you can afford to lose your entire investment.

In making an investment decision, investors must rely on their examination of the issuer and the terms of the offering, including the merits and risks involved. These securities have not been recommended or approved by any federal or state securities commission or regulatory authority. The U.S. Securities and Exchange Commission does not pass upon the merits of any securities offered or the terms of the offering, nor does it pass upon the accuracy or completeness of any offering document or literature.

These securities are offered under an exemption from registration; however, the U.S. Securities and Exchange Commission has not made an independent determination that these securities are exempt from registration.

Neither PicMii Crowdfunding nor any of its directors, officers, employees, representatives, affiliates, or agents shall have any liability whatsoever arising from any error or incompleteness of fact or opinion in, or lack of care in the preparation or publication of, the materials and communication herein or the terms or valuation of any securities offering.

The information contained herein includes forward-looking statements. These statements relate to future events or future financial performance and involve known and unknown risks, uncertainties, and other factors that may cause actual results to be materially different from any future results, levels of activity, performance, or achievements expressed or implied by these forward-looking statements. You should not place undue reliance on forward-looking statements since they involve known and unknown risks, uncertainties, and other factors, which are, in some cases, beyond the company’s control and which could, and likely will materially affect actual results, levels of activity, performance, or achievements. Any forward-looking statement reflects the current views with respect to future events and is subject to these and other risks, uncertainties, and assumptions relating to operations, results of operations, growth strategy, and liquidity. No obligation exists to publicly update or revise these forward-looking statements for any reason or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

Security Type:

Equity Security

Price Per Share

$4.50

Shares For Sale

1,111,111

Post Money Valuation:

217,561,914

Investment Bonuses!

N/A

Regulatory Exemption:

Regulation Crowdfunding – Section 4(a)(6)

Deadline:

October 25, 2024

Minimum Investment Amount:

$990

Target Offering Range:

$9,999-$4,999,999.5

*If the sum of the investment commitments does not equal or exceed the minimum offering amount at the offering deadline, no securities will be sold and investment commitments will be cancelled returned to investors.

Greg Hummer MD

CEO

BackgroundTrained as a trauma surgeon at the Cleveland Clinic, Dr. Hummer served as a medical consultant to NASA and founded two successful healthcare technology companies. He earned his medical degree from The Ohio State University and a bachelor’s in chemistry and computer science from the University of Notre Dame. Dr. Hummer has deep expertise in clinical diagnosis of infectious diseases with the ability to leverage bioinformatics and nanotechnologies.

Matt Hummer

Co-Founder

Backgroundserved as a medical consultant to NASA and founded two successful healthcare technology companies. He earned his medical degree from The Ohio State University and a bachelor’s in chemistry and computer science from the University of Notre Dame. Dr. Hummer has deep expertise in clinical diagnosis of infectious diseases with the ability to leverage bioinformatics and nanotechnologies. Matthew Hummer CO-FOUNDER Mr. Hummer is a specialist in data science and analytics with applications in diagnostics, supply chain and infrastructure sustainability and security. He held senior management positions at two data technology startups, including Govini and Bloomberg Government. Mr. Hummer has extensive experience building platforms that generate, process and analyze data for improved decision making. He has held senior analyst roles at the U.S. Department of State, BlackRock Financial Management and Merrill Lynch. Mr. Hummer earned degrees in public policy and data science from Georgetown University and finance and economics degrees from Fordham University.

Bruce Raben

President

BackgroundMr. Raben is the founding partner of Hudson Capital Advisors. Starting in 1979 at Drexel Burnham Lambert, he worked on many leveraged buyouts and recapitalizations, including Mattel Toys, SFN, Magma Copper, Warnaco, Mellon Bank and John Fairfax. Mr. Raben went on to co- found the corporate finance department at Jefferies & Co. in 1990. There, he led Jeffries entering the energy and gaming industries. At CIBC World Markets, Mr. Raben led the bank’s founding investment and financing of Global Crossing.

Ghazi Kashmolah

Operations

BackgroundMr. Kashmolah has more than 30 years of experience in quality, operations and regulatory work leading. Most recently, he was EVP Regulatory Affairs and chief quality officer at Lucira Health, where he was responsible for FDA approval. While at Lucira, Mr. Kashmolah achieved the first multiplex COVID/FLU diagnostic test for consumers. Prior to Lucira, Mr. Kashmolah led quality and regulatory affairs as chief quality assurance, Regulatory Affairs for Orchid Orthopedic Solutions, senior vice president for DJO Global, vice president at OSI Systems and vice president at Life Technologies. Mr. Kashmolah holds bachelor’s and master’s degrees in electrical engineering, as well as an executive MBA.

William Shatner

Senior Advisor

BackgroundWilliam Shatner has an unparalleled 70-plus years in entertainment, displaying broad talent throughout the industry and being instantly recognizable to generations of television fans as Captain James T. Kirk, commander of the starship U.S.S. Enterprise. In recent years, Shatner has taken an interest in advanced medicine and technologies that offer the potential for significant impact on population health and wellbeing.

Company Name

IdentifySensors Biologics

Location

20600 Chagrin Blvd.

405

Shaker Heights, Ohio 44122

Number of Employees

23

Incorporation Type

C-Corp

State of Incorporation

Ohio

Date Founded

June 12, 2020

Raises half the minimum amount

IdentifySensors Biologics has raised half of the target offering amount on February 28, 2025. $99,173 has been raised at this time.

Raises 100% of the minimum amount

IdentifySensors Biologics has raised the target offering amount on February 28, 2025. $99,173 has been raised at this time.Investors should be aware that the Issuer can now conduct rolling closes if they wish. If the Issuer decides to do so, you will be notified and given time to cancel your investment.