$53,000 Raised

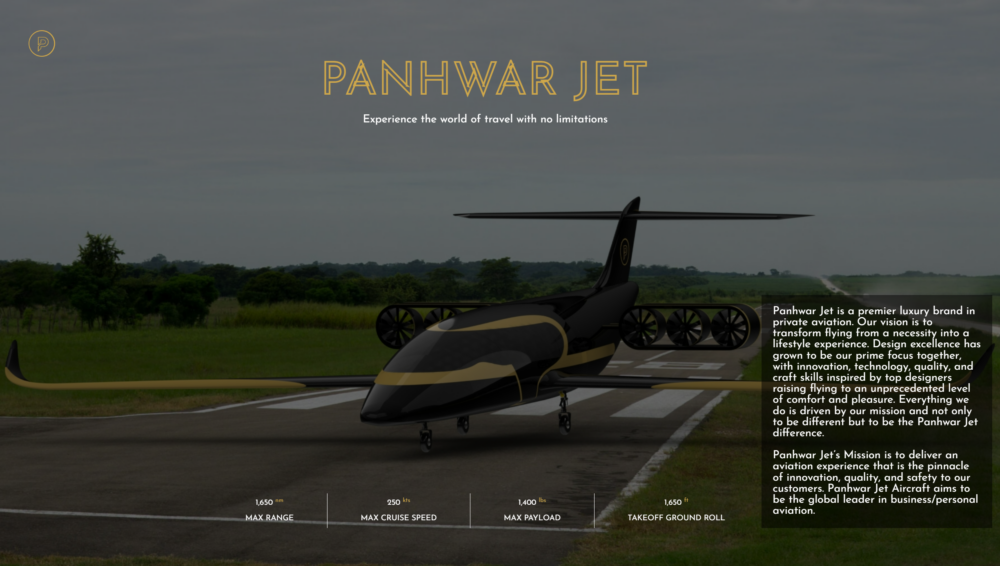

Panhwar Jet

Invest Now

Panhwar Jet

Invest Now

Raised

$53,000

Days Left

Closed

Business Description

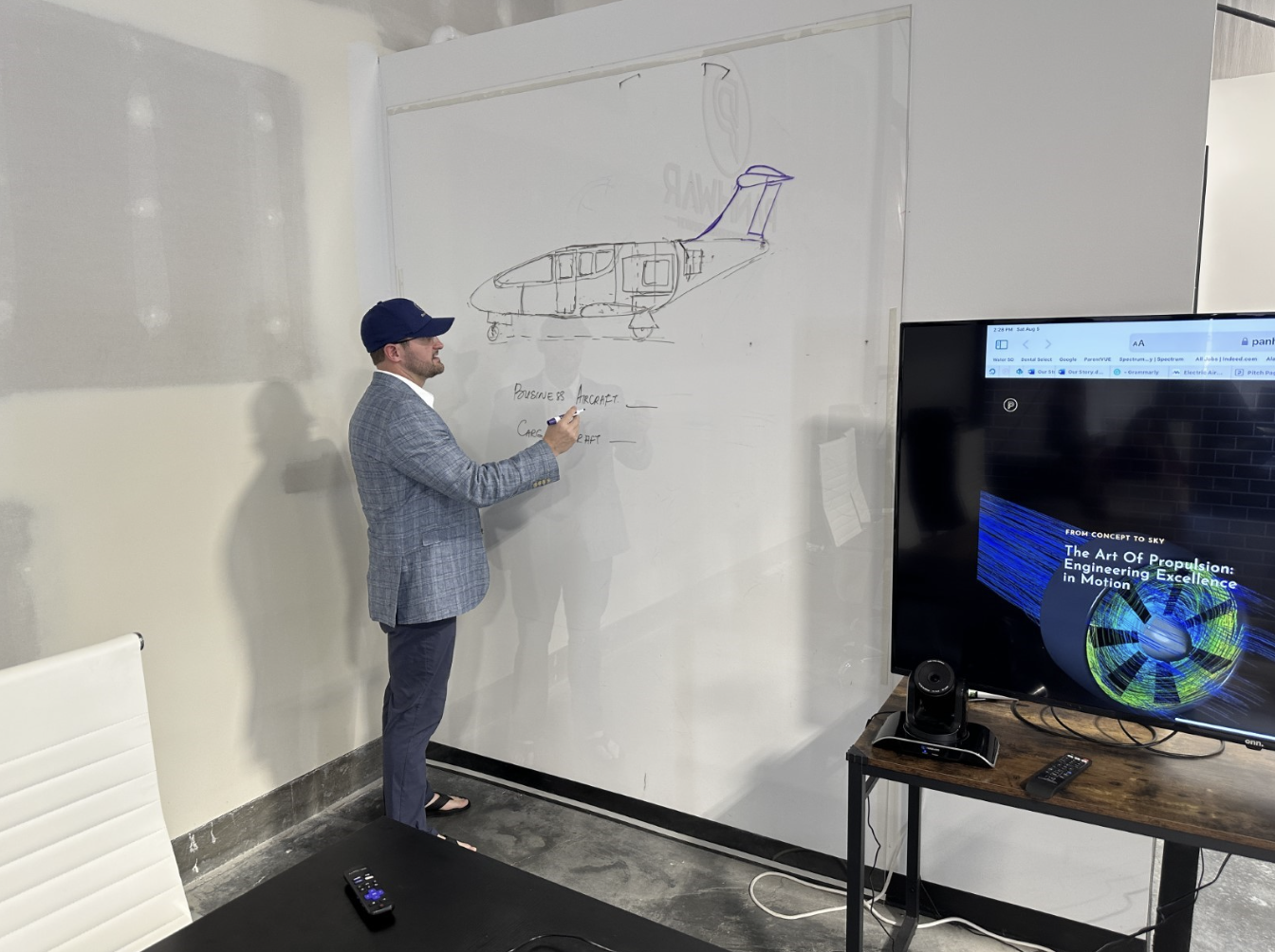

Panhwar Jet is the story of inventors who built successful technology businesses and refused to accept the status quo.

This time they are going bigger than ever to revolutionize the trillion-dollar aviation industry.

Panhwar Jet’s innovative approach to aircraft building reduces manufacturing costs by an impressive 70% compared to traditional methods.

We are preparing for our inaugural flight in the next 6 months, we are already making remarkable progress, almost 10 months ahead of our original schedule.

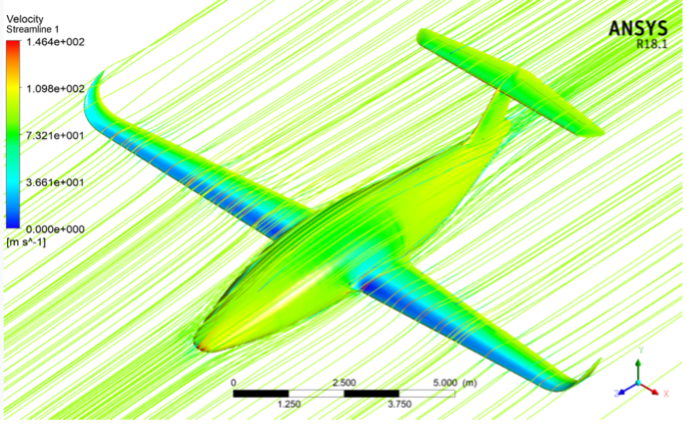

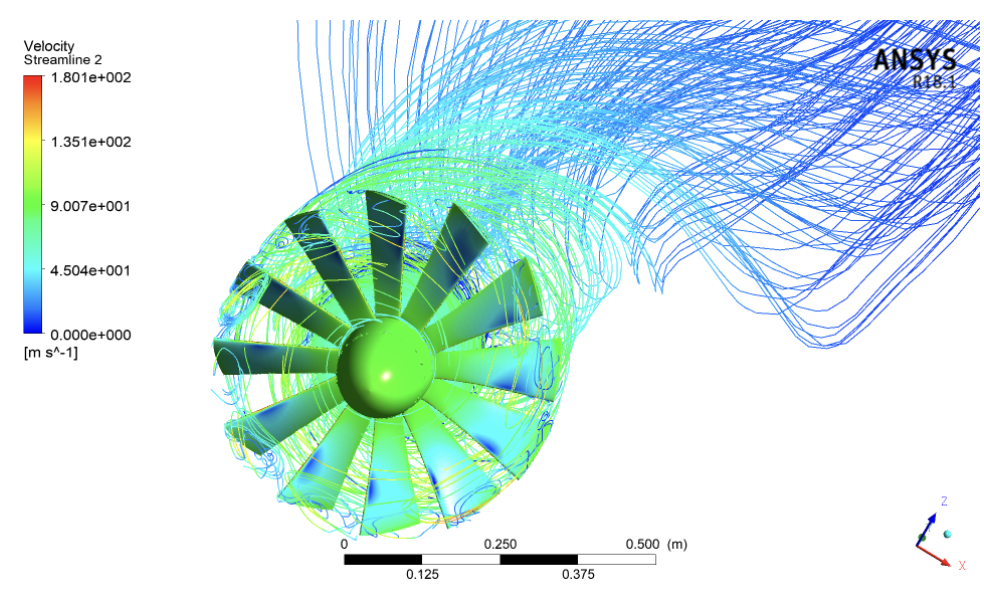

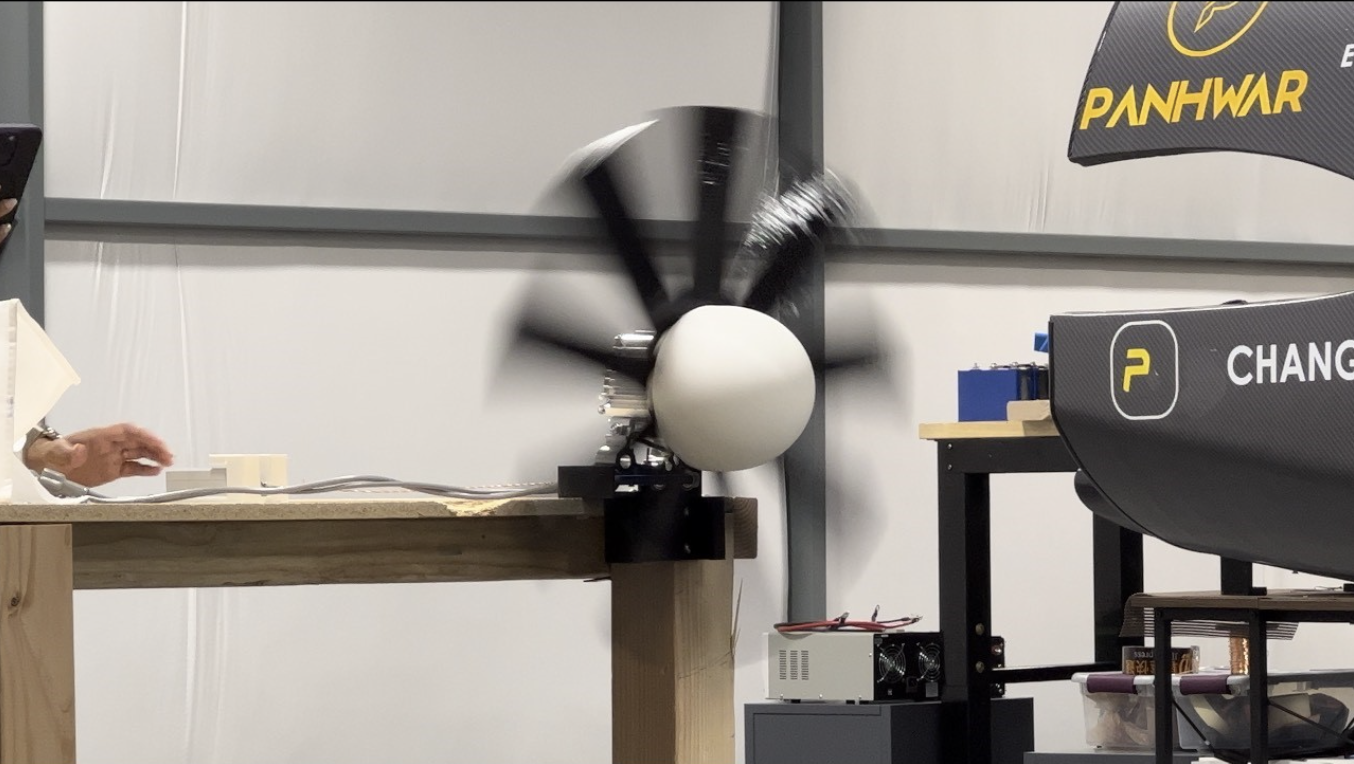

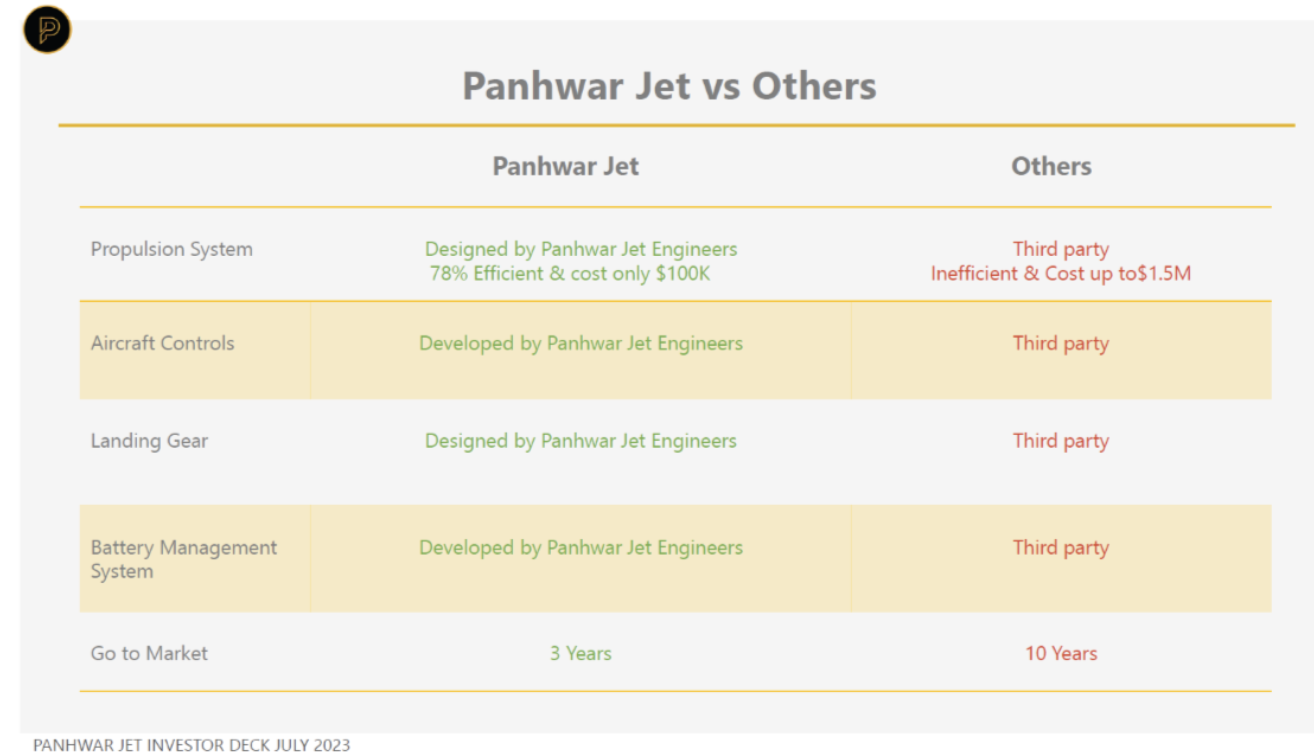

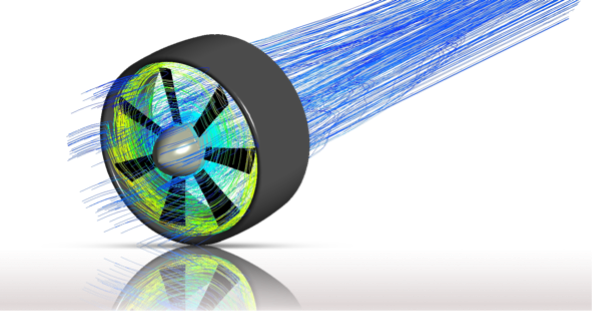

Designed and developed a complete propulsion system in-house, that will help our plane to fly longer and save millions of dollars.

Today we have an entire propulsion system, that is 78% efficient.

Projections indicate that the global business jet market will touch 41 billion by 2030, while the Cargo Air freight industry is anticipated to surpass $210 Billion by 2027.

Taking inspiration from electric cars, the early investment in electric cars proved to be a wise financial choice, Panhwar Jet is currently causing a stir in the aviation industry with their groundbreaking electric aircraft innovations.

Panhwar Jet innovative approach towards aircraft building and vertical integration is a game changer.

Our secret to success lies in their unorthodox and vertically integrated approach, allowing us to achieve milestones faster and more cost-effectively than our competitors.

Our team is dedicated to revolutionizing the trillion-dollar aerospace industry using Our accomplished business leaders and top-tier engineers are driving the development of this groundbreaking technology.

We anticipate breaking world records with our inaugural flight in just six months.

At Panhwar Jet, we aim to eliminate CO2 emissions in aviation through cutting-edge inventions.

We aim to make private business and cargo jets accessible to everyone at low cost, empowering a diverse range of business owners.

Our electric aircraft has 6,000 fewer components than our fossil fuel counterparts, ensuring cost-effective manufacturing and accelerated production.

Panhwar Jet represents innovation, efficiency, and environmental responsibility as we journey toward the future of flight.

Problem

1. Expensive to operate, maintain & manufacture

2. Polluting environment

3. Fewer Profit Margin (3.5% – 10%)

4. Zero Comfort and Noisy

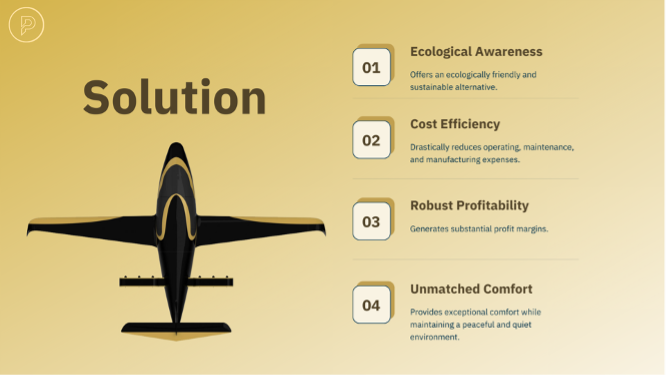

Solution

✓ ECO friendly and sustainable

✓ Lower Cost to operate, maintain & manufacture

✓ High Profit margin

✓ Extremely Comfortable & Quiet

What Sets Us Apart?

We acknowledge the challenges others face. We’re taking a different path toward innovation and practicality. We’ve harnessed cutting-edge proprietary propulsion systems to develop all-electric aircraft that significantly reduce noise and emissions, aligning with environmental concerns. Panhwar Jet’s innovative approach towards aircraft building reduced manufacturing costs by a staggering 70% compared to traditional approaches.

Benefits

Lower Cost of Operation:Through meticulous design and our vertically integrated approach, we’ve crafted an efficient and cost-effective solution that promises enhanced operational efficiency.

Decreased Time and Expenses with Maintenance: By embracing simplicity in design, our aircraft possess nearly 6,000 fewer components compared to their fossil fuel counterparts, translating to reduced maintenance requirements and costs.

Extended Range Coupled with Comfort: Our focus on long-range luxury travel caters to passengers’ preferences, ensuring both comfort and efficiency in each journey.

High Cruising Speed of 250 Miles per Hour: Panhwar Jet’s team approach has enabled us to develop aircraft capable of achieving this impressive speed, exemplifying our commitment to enhancing travel efficiency

Focus on Safety: The Panhwar Jet team is dedicated to upholding the highest safety standards, ensuring that our aircraft meet and exceed industry requirements.

As we align with these priorities, Panhwar Jet is poised to revolutionize the aviation industry by delivering innovative, sustainable, and customer-centric solutions.

Business Model

Business Jet: ElectroBird

Business Aircraft (B2B): Catering to the corporate sector’s demand for efficient and sustainable travel solutions.

– Market Size: $41B

Freight: EliteFlock

Freight Aircraft (B2B): Tapping into the growing cargo air freight industry projected to exceed $210 billion by 2027, addressing the need for cost-effective and environmentally conscious cargo transport.

Medical: MediHawk

Medical Supplies Aircraft (B2B): Meeting the critical demand for swift and reliable transportation of medical supplies.

– Market Size: $39.61 billion by 2030

Our inaugural flight is set to take place in 6 months. We are already making remarkable progress, almost ten months ahead of our original schedule!

Market Projection

In alignment with these demographics, it’s noteworthy that Precedence Research predicts the Global Electric Aircraft market size to reach US$ 39.61 billion by 2030. Projections indicate that the global business jet market will touch 41 billion by 2030, while the Cargo Air freight industry is anticipated to surpass $210 Billion by 2027. Panhwar Jet aspires to forge strategic partnerships to secure initial purchase orders exceeding $100 million. Panhwar Jet’s exceptional strategic vision, engineering expertise, and role as a frontrunner in the aviation sector are beyond doubt.

Revenue Projections:

Competition

While some current competition exists, Management believes that Panhwar Jet, Inc.’s products are demographically well-positioned, top-quality, and unique. The expertise of Management, combined with the innovative marketing approach set the Company apart from its competitors. However, there is the possibility that new competitors could seize upon Panhwar Jet, Inc.’s business model and produce competing products or services with a similar focus. Likewise, these new competitors could be better capitalized than Panhwar Jet, Inc, giving them a significant advantage. There is the possibility that the competitors could capture a significant market share of Panhwar Jet, Inc.’s intended market.

What common challenges are other aircraft facing?

Other Electric Aircraft companies first started building fancy aircraft with limitation to heavy batteries and secured significant funding at billion-dollar valuations. They have been operating in the field for 9-20 years, mainly focusing on incremental design enhancements. However, their aircraft struggle to achieve flight times exceeding 30 minutes due to the limitations of heavy batteries. The heavy batteries have imposed constraints on flight endurance and the overall practicality of the aircraft. The manufacturers’ ventures are valued at billions of dollars despite these challenges. They have managed to secure substantial orders from freight and business companies.

What Sets Us Apart?

We acknowledge the challenges others face. We’re taking a different path toward innovation and practicality. We’ve harnessed cutting-edge proprietary propulsion systems to develop all-electric aircraft that significantly reduce noise and emissions, aligning with environmental concerns. Panhwar Jet’s innovative approach towards aircraft building reduced manufacturing costs by a staggering 70% compared to traditional approaches.

Traction & Customers

Marketing Strategy

To bolster our sales efforts, the Company will employ the following promotional strategies:

Hire Marketing Agency: Engaging the expertise of a marketing agency to amplify our reach and enhance our brand visibility.

Brand Awareness Campaigns: Launching campaigns designed to create awareness and communicate the value proposition of our electric aircraft solutions.

Aircraft Conventions and Roadshows: Participating in industry events, conventions, and roadshows to showcase our innovative offerings and foster valuable connections within the aviation sector.

Through these strategic approaches, we aim to establish a strong market presence, foster partnerships, and propel the adoption of our cutting-edge electric aircraft across diverse sectors.

Pricing Strategy

The Company has completed a thorough analysis of its competitors’ pricing. Keeping in mind our competition’s pricing and the costs of customer acquisition, we have decided on the following pricing strategy:

Despite Fossil fuel aircraft having limited range and over $800 hourly operating cost, the Piper M600/SLS is priced at 3.5 million, and the TBM 940 by Daher at 4.3 million. Considering this, we propose an initial aircraft price of $4 million, coupled with a minimal $25/hr. operating cost.

Milestones Achieved

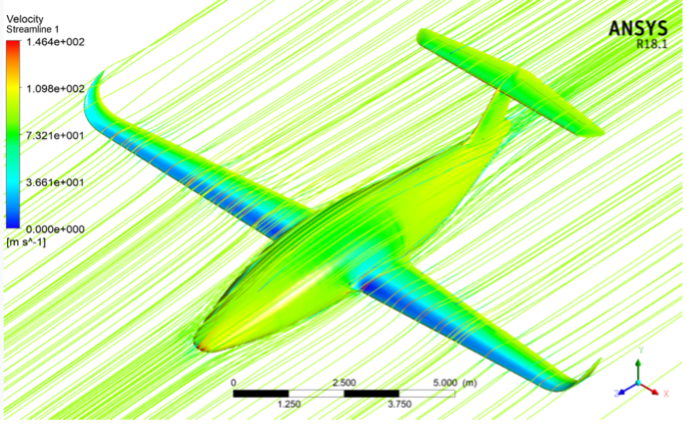

1. May 2022 Aircraft design completed

2. Dec 2022 Panhwar Proprietary Propulsion System Ready

3. March 2023 Finished CFD for Manufacturing

Investors

Panhwar Jet has a clean cap table, with the majority of shares firmly owned by the dedicated founding team. We’ve successfully raised $1.5 million in funds and have meticulously maintained audited reports that transparently detail our spending.

An exceptional aspect of our approach is that our founders have chosen to forgo taking salaries until the company generates revenue, demonstrating our commitment to the long-term success of the venture. As we set our sights on the future, we’re excited to announce our upcoming raise of $4 million. This substantial investment will play a pivotal role in propelling our aircraft project into the skies within the next six months.

Terms

Convertible note with $100,000,000.00 valuation cap; 5.00% discount; 6.0% interest.

Type of Security: Convertible Promissory Notes (“Notes”).

Maximum Amount: The maximum amount that can be raised is $4,000,000

Valuation Cap: $100,000,000.00

Discount Rate:95%

Maturity Date: 24 months from the Effective Date.

Interest Rate: 6.0%. Interest shall commence with the date of the convertible note and shall continue on the outstanding principal amount until paid in full or converted. Interest shall be computed on the basis of a year of 365 days for the actual number of days elapsed. All unpaid interest and principal shall be due and payable upon request of the Majority Holders on or after the Maturity Date.

Bonus: Investors that invest $25,000 or more will receive a discount rate of 90% in place of the 95% discount rate noted above.

Instead of issuing its securities directly to investors, the Company has decided to issue its securities to the Special Purpose Vehicle (SPV), which will then issue interests in the SPV to investors. The Company’s use of the SPV is intended to allow investors in the SPV to achieve the same economic exposure, voting power, and ability to assert State and Federal law rights, and receive the same disclosures, as if they had invested directly in the Company. The Company’s use of the SPV will not result in any additional fees being charged to investors.

The SPV has been organized and will be operated for the sole purpose of directly acquiring, holding and disposing of the Company’s securities, will not borrow money and will use all of the proceeds from the sale of its securities solely to purchase a single class of securities of the Company. As a result, an investor investing in the Company through the SPV will have the same relationship to the Company’s securities, in terms of number, denomination, type and rights, as if the investor invested directly in the Company.

Lead Investor

The lead investor is Chad Briggs. Chad has a Bachelors of Science in Accounting. He is a retired Chief Financial Officer at Bridge Investment Group. At Bridge Investment Group, Chad was the Chief Financial Officer from December 2010 to June of 2022. Prior to these positions, he was also VP & CFO of Digital Draw Network from December 2005 to June 2010. Lastly, he was a controller at Theratech Inc. from 1990 – 2000.

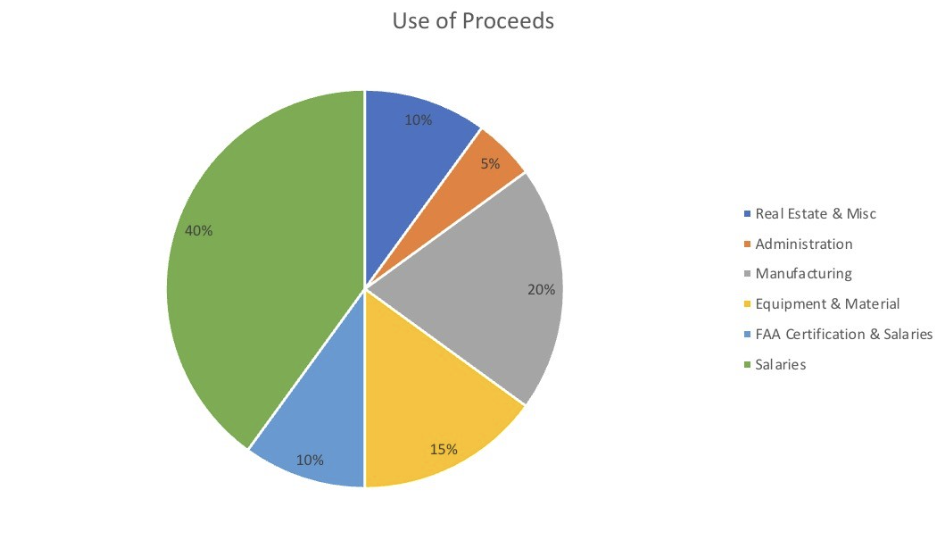

Use of Proceeds:

Risks

Please be sure to read and review the Offering Statement. A crowdfunding investment involves risk. You should not invest any funds in this offering unless you can afford to lose your entire investment.

In making an investment decision, investors must rely on their examination of the issuer and the terms of the offering, including the merits and risks involved. These securities have not been recommended or approved by any federal or state securities commission or regulatory authority. The U.S. Securities and Exchange Commission does not pass upon the merits of any securities offered or the terms of the offering, nor does it pass upon the accuracy or completeness of any offering document or literature.

These securities are offered under an exemption from registration; however, the U.S. Securities and Exchange Commission has not made an independent determination that these securities are exempt from registration.

Neither PicMii Crowdfunding nor any of its directors, officers, employees, representatives, affiliates, or agents shall have any liability whatsoever arising from any error or incompleteness of fact or opinion in, or lack of care in the preparation or publication of, the materials and communication herein or the terms or valuation of any securities offering.

The information contained herein includes forward-looking statements. These statements relate to future events or future financial performance and involve known and unknown risks, uncertainties, and other factors that may cause actual results to be materially different from any future results, levels of activity, performance, or achievements expressed or implied by these forward-looking statements. You should not place undue reliance on forward-looking statements since they involve known and unknown risks, uncertainties, and other factors, which are, in some cases, beyond the company’s control and which could, and likely will materially affect actual results, levels of activity, performance, or achievements. Any forward-looking statement reflects the current views with respect to future events and is subject to these and other risks, uncertainties, and assumptions relating to operations, results of operations, growth strategy, and liquidity. No obligation exists to publicly update or revise these forward-looking statements for any reason or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

Security Type:

Convertible Note

Valuation Cap

$100,000,000

Annual Interest Rate

6.00%

Discount Rate

95%

Post Money Valuation:

N/A

Investment Bonuses!

Investors that invest $25,000 or more receive a 90% discount rate in place of the 95% discount rate above.

Regulatory Exemption:

Regulation Crowdfunding – Section 4(a)(6)

Deadline:

April 1, 2024

Minimum Investment Amount:

$500

Target Offering Range:

$10,000-$4,000,000

*If the sum of the investment commitments does not equal or exceed the minimum offering amount at the offering deadline, no securities will be sold and investment commitments will be cancelled returned to investors.

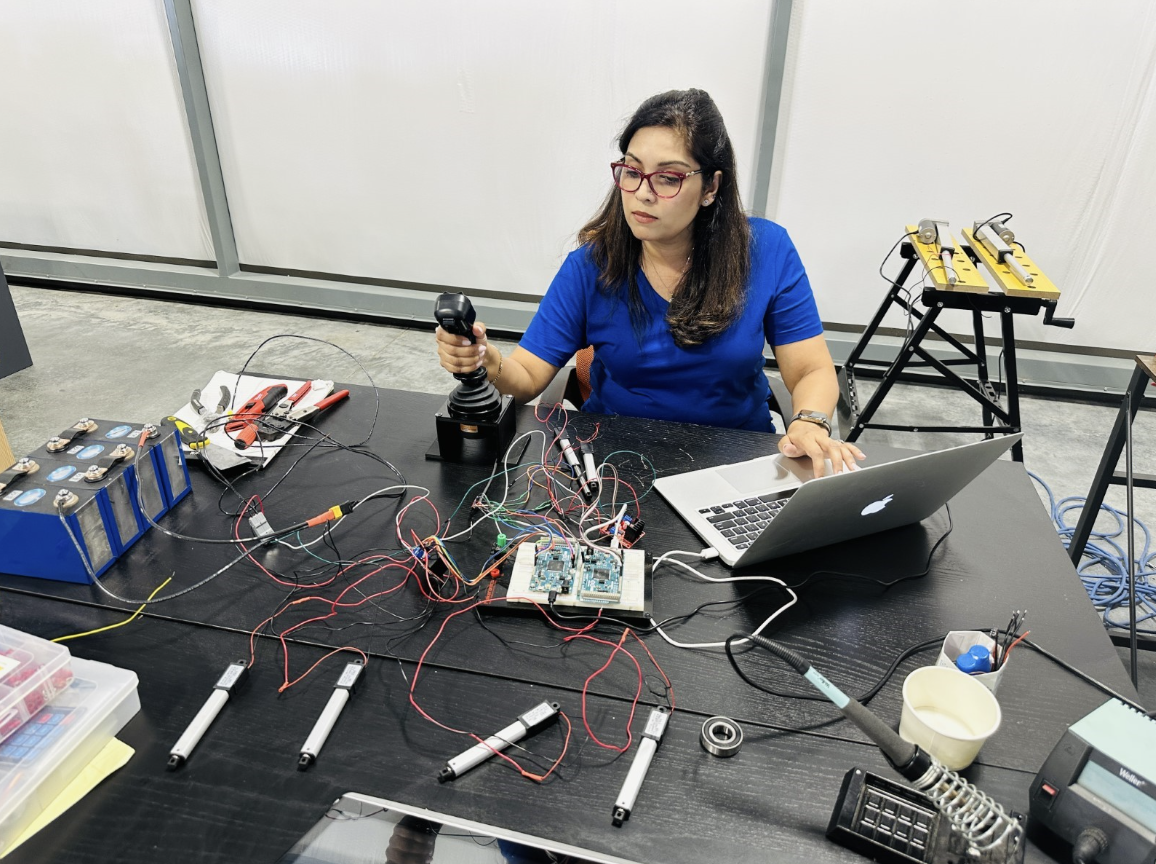

Ayisha Panhwar

CEO & Co-Founder

Background19 years of senior management experience in multinational company. Serial entrepreneur with successful exits. Has AI Software background experience.

Nick Panhwar

Chief Engineer & Co-Founder

BackgroundExperienced in power generation and propulsion system. 20 years of senior management experience. Serial entrepreneur with successful exits. Has Marine Engineering background experience.

Ryan Higgins

Investor & Strategy Advisor

BackgroundInstrumental in taking a Billion Dollar renewable energy company public on the NYSE by hitting critical milestones within 2 years, by increasing growth by 760%.

Steve Larson

Chief Operations Officer

BackgroundSteve has 30 years of extensive experience and knowledge in the aviation industry. He led all aviation capability development and sustainment efforts.

Jared Esselman

Aviation Advisor/ Panhwar Test Pilot

BackgroundJared was a board member of directors at NCSL & NASAO and passed aviation legislation in 25 states. He was a Director of Aeronautics and is presently Vice President of Aerial Innovation, Utah.

Chad Briggs

Lead Investor

BackgroundRetired Chief Financial Officer at Bridge Investment Group. Experienced Finance Officer taking company to IPO.

Legal Company Name

Panhwar Jet

Location

2511 S Redwood Rd test

Hangar #35

Woods Cross, Utah 84087

Number of Employees

19

Incorporation Type

C-Corp

State of Incorporation

Delware

Date Founded

February 11, 2021

Campaign Launch

Panhwar Jet has launched their equity crowdfunding campaign on August 11th, 2022.

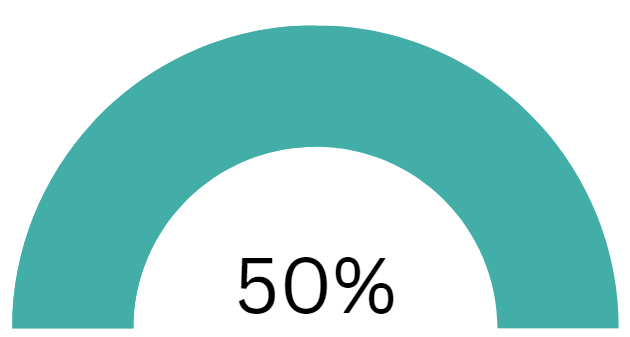

Raises half the minimum amount

Panhwar Jet has raised half of the target offering amount on October 27, 2023. $53,500 has been raised at this time.

Raises 100% of the minimum amount

Panhwar Jet has raised the target offering amount on October 27, 2023. $53,500 has been raised at this time.Investors should be aware that the Issuer can now conduct rolling closes if they wish. If the Issuer decides to do so, you will be notified and given time to cancel your investment.