PopCom

Invest Now

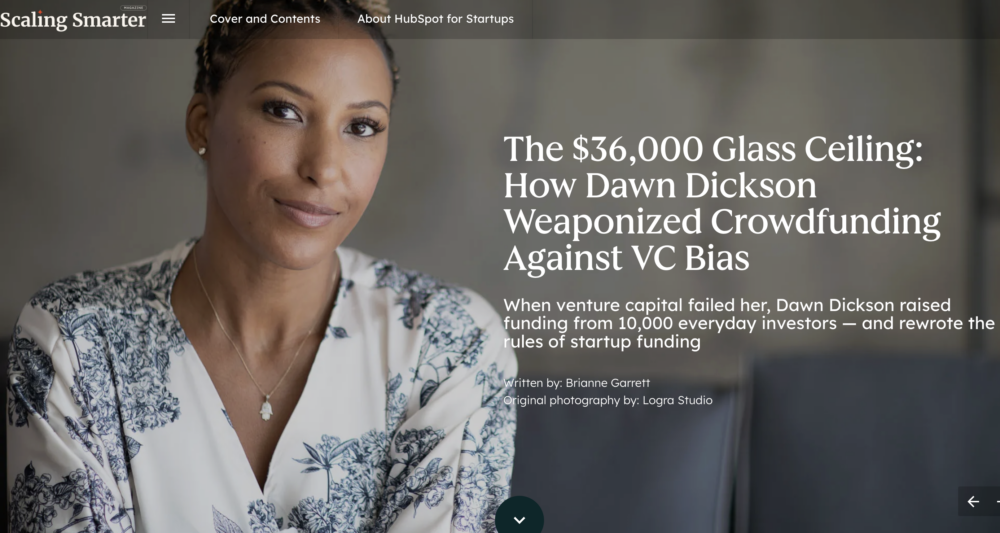

Raised

$36,661

Days Left

54

Business Description

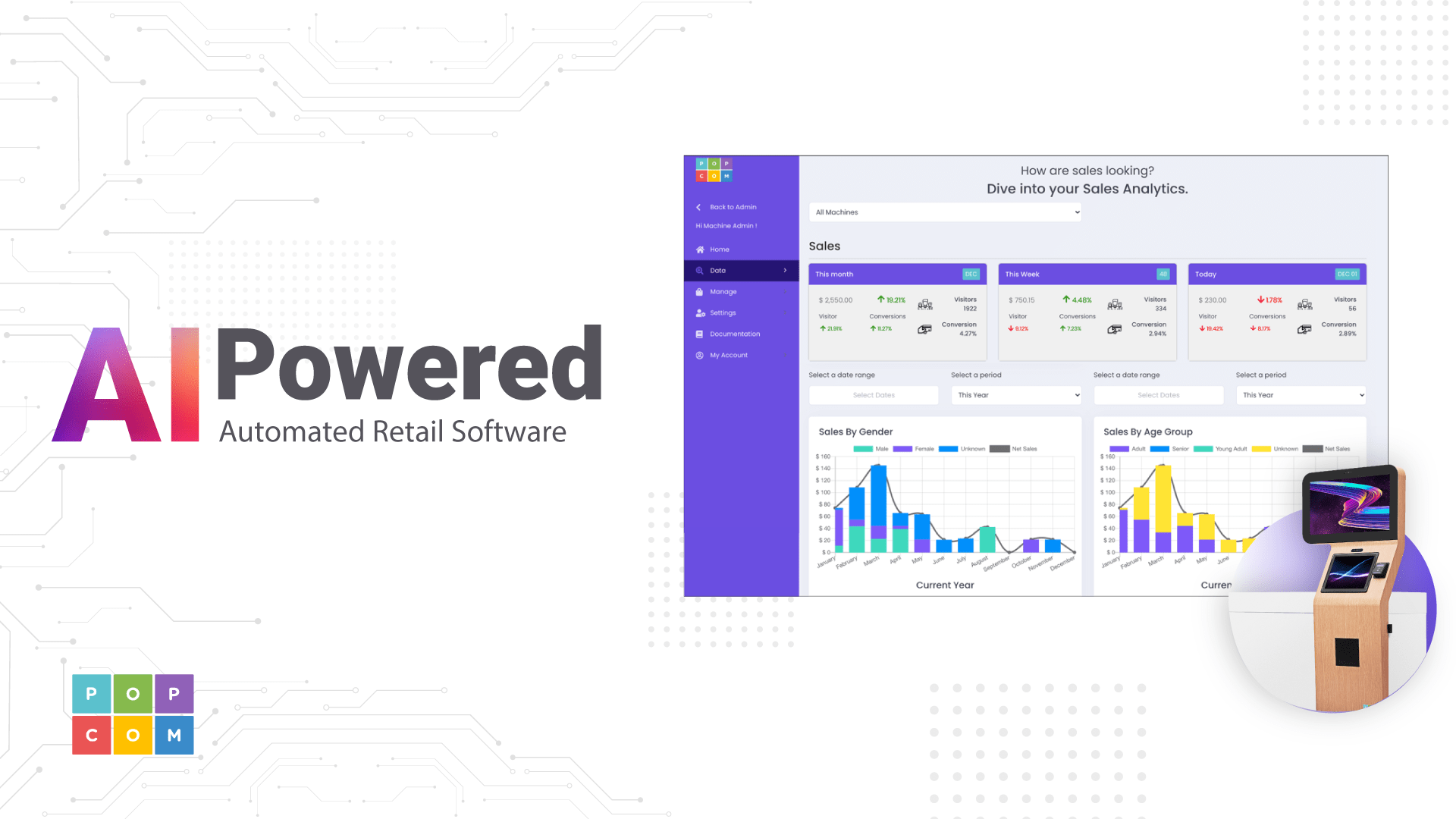

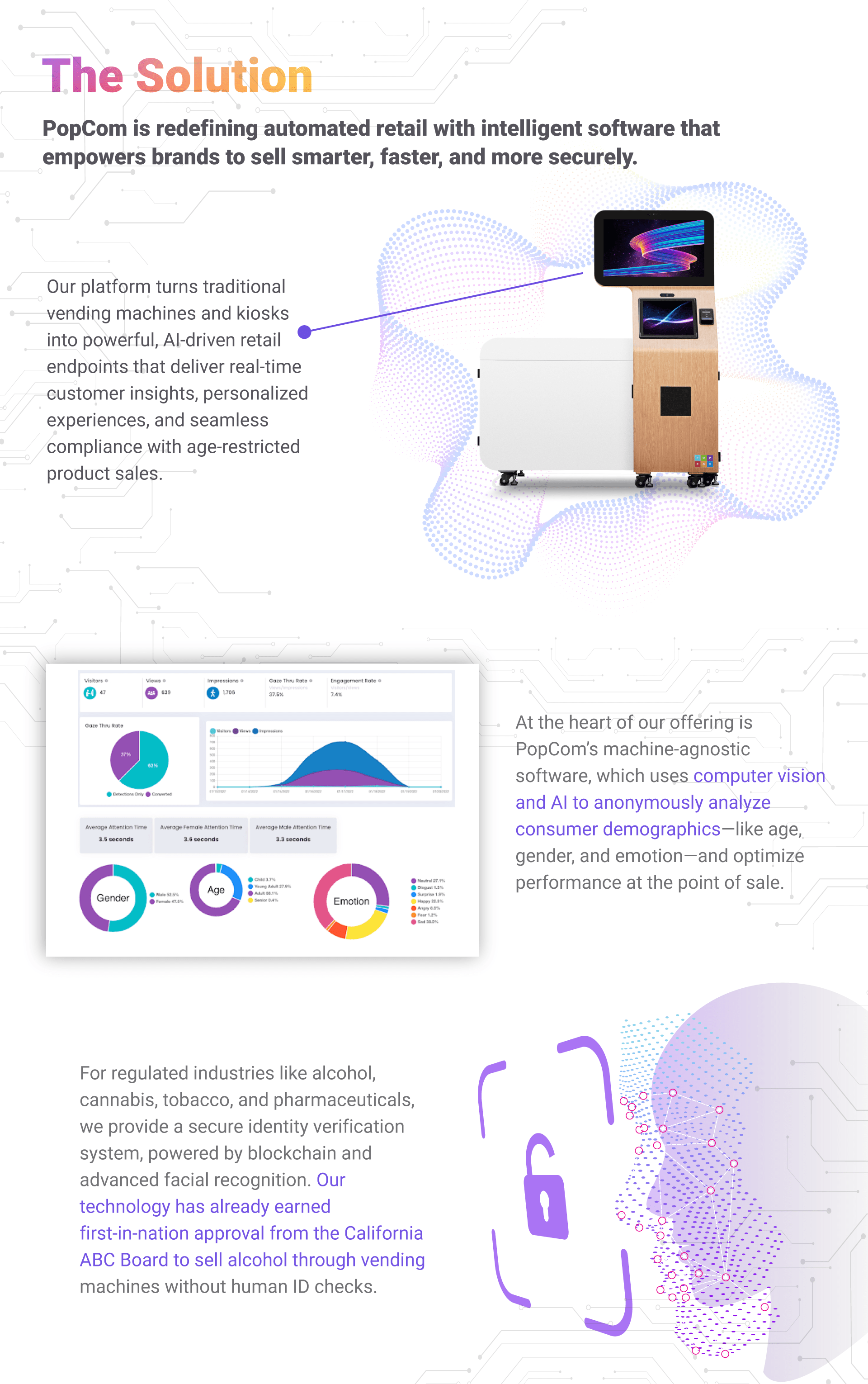

PopCom is a software company transforming automated retail for the age of AI, data, and compliance.

Our patented technology empowers brands to sell products in physical spaces—without the high costs of traditional retail—while unlocking powerful customer insights in real time. At the core of our platform is machine-agnostic software that uses computer vision and AI to collect anonymous demographic data (age, gender, emotion), optimize product performance, and support secure, compliant sales of regulated goods.

Following years of R&D and field validation, PopCom is now laser-focused on scaling a lean, software-first business model. With a refined strategy, recurring SaaS revenue, and proven demand from enterprise partners, PopCom is leading the next evolution in retail: one that is intelligent, automated, and built for the future of commerce.

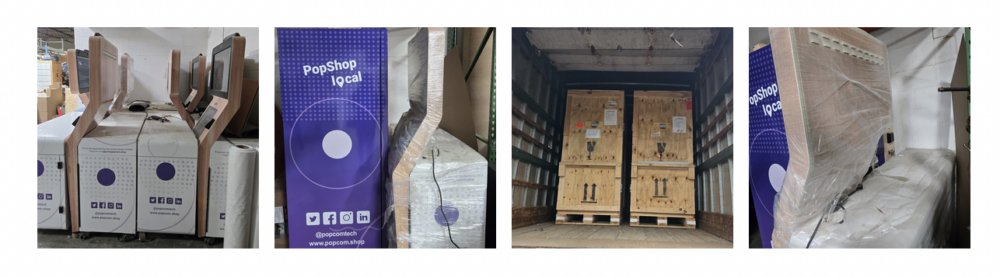

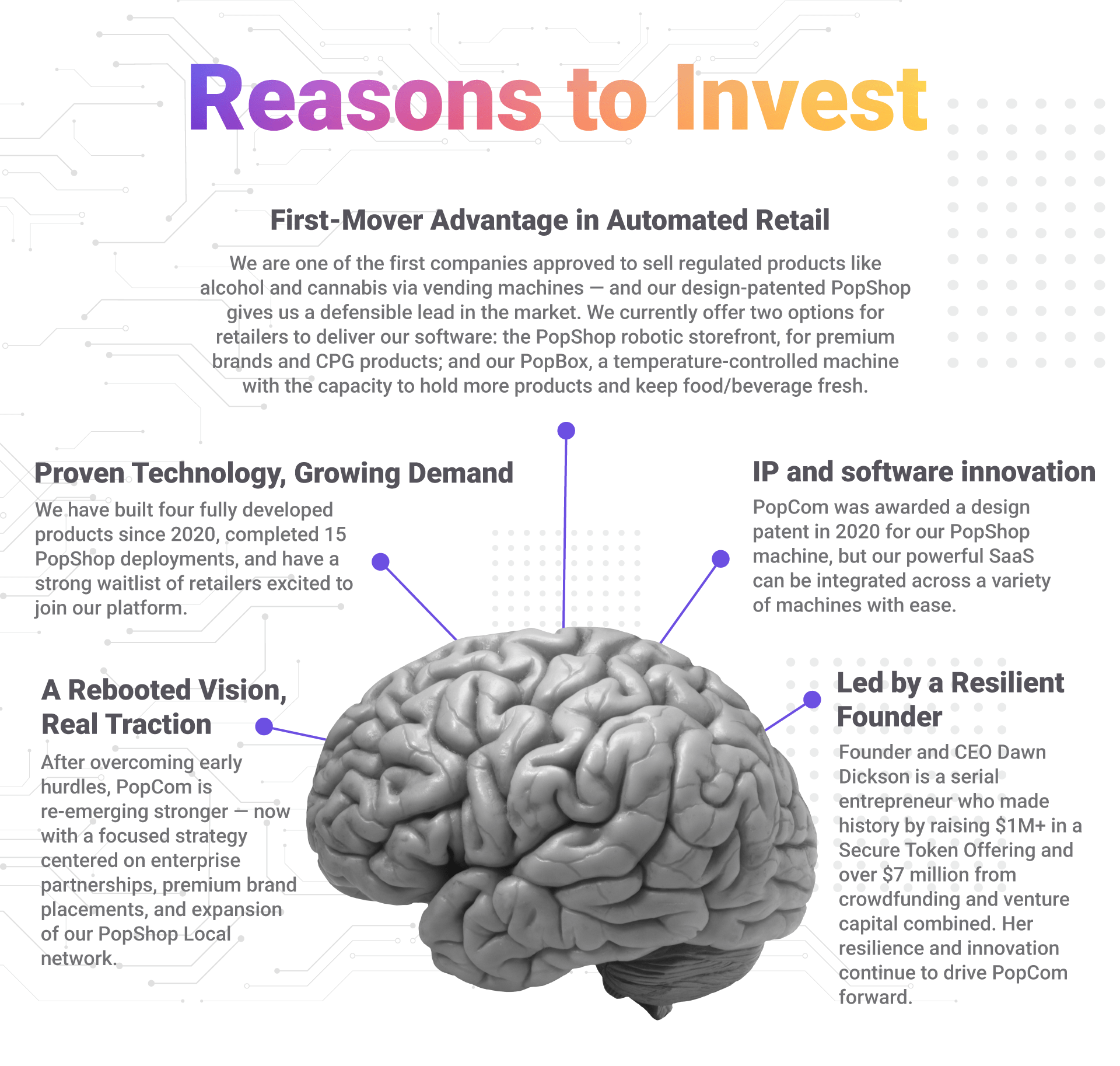

PopCom has an operating history that includes multiple successful crowdfunding campaigns in 2019, 2020, and 2021, during which we raised over $7 million from thousands of investors. These early rounds allowed us to develop and launch three core products, validate the market demand for automated retail software, and test our PopShop kiosks in live environments and scale to $35,000 MRR from our pilot program, PopShop Local.

Problem

In a world driven by personalization, speed, and data, retail must evolve — fast.

Solution

PopCom solves this by delivering an AI-powered software platform that turns any vending machine into a smart, secure, data-rich sales channel. We provide brands, distributors, and operators with the tools to grow, learn, and sell 24/7 — with lower risk, higher margins, and enhanced customer insights. PopCom doesn’t just automate retail — we elevate it with intelligence, security, and scalability.

Business Model

The PopCom Comeback

In 2023, the company paused operations after a planned Series A investment round fell through when the lead investor was unable to close their fund. While this presented a temporary setback, it also provided the opportunity to critically evaluate our business model. The experience revealed that our previous strategy—centered on hardware and the PopShop Local program—was too capital-intensive to scale profitably.

By relaunching with a focus on machine leasing, growing software subscriptions, and expanding into hardware-agnostic licensing, PopCom is poised not just to return, but to scale faster and more sustainably than ever before. We believe the challenges we faced made us stronger, sharper, and more prepared to build lasting value for our customers, partners, and investors.

In 2025, we’ve made significant operational changes to reduce our burn rate and increase financial sustainability:

- • Business Model Shift: We shifted focus to a SaaS-first model that prioritizes software licensing, data monetization, and recurring revenue over hardware deployments.

- • Cost Reduction Strategy: We’ve reduced overhead by outsourcing key responsibilities—such as maintenance, software development, and logistics—to trusted vendors with deep product knowledge.

- • Lean Staffing Model: We exclusively engage 1099 contractors and fractional teams, reducing long-term tax liabilities and fixed employee costs.

- • AI-Driven Efficiency: By integrating AI tools across customer service, analytics, and operations, we’ve streamlined internal workflows and improved speed to market.

Path to Profitability

PopCom’s go-to-market strategy is built for sustainable revenue growth, not rapid capital burn. We’re focused on validating demand, maximizing recurring income, and laying the foundation for a liquidity event by Year 3.

Year 1: Deploy, Monetize, Refine

- • Lease and activate current inventory

- • Grow monthly SaaS subscriptions with a targeted group of enterprise and regulated retail clients

- • Rebuild our sales pipeline with a lean team focused on conversion and customer success

- • Prioritize MRR, onboarding revenue, and capital efficiency, not headcount or hardware expansion

Year 2: Scale Strategically

- • Add 50 new SaaS clients through targeted sales and channel partnerships

- • Expand enterprise licensing and compliance-based sales, earning recurring revenue and setup fees

- • With a controlled cost structure and lean operations, we project over $1,000,000 in net profit by Year 2

Year 3: Accelerate Toward Liquidity

With proven product-market fit, scalable SaaS infrastructure, and consistent revenue, PopCom will be well-positioned to pursue strategic options — including acquisition, venture funding, or a security token offering — to unlock shareholder value.

Market Projection

PopCom is positioned at the convergence of AI, data analytics, and automated retail — where demand is growing rapidly, but innovation still lags.

While e-commerce continues to expand, over 70% of global retail sales still happen offline, and there is a growing push to digitize physical retail experiences with smarter, data-driven solutions. PopCom fills this gap by transforming traditional vending into intelligent, connected points of sale that generate real-time customer insights and unlock new revenue opportunities.

- • The global retail analytics market is projected to grow to $31.7 billion by 2030, driven by demand for AI-powered insights, automation, and personalization at the point of sale.

- • The global smart vending machine market is expected to reach $21.2 billion by 2032, as businesses adopt intelligent kiosks and frictionless checkout solutions.

- • AI in retail is projected to hit $85 billion by 2030, with applications in demand forecasting, customer segmentation, and personalized product recommendations.

- • Studies show impulse buying accounts for up to 60–80% of retail purchases, and the likelihood of purchase increases when consumers can receive products instantly, making smart vending a high-conversion channel.

PopCom stands apart in this landscape by not just delivering products — but capturing and monetizing the data behind every interaction. While legacy hardware companies remain product-focused, we’re building a scalable data and AI platform that enables brands to sell smarter, not just faster.

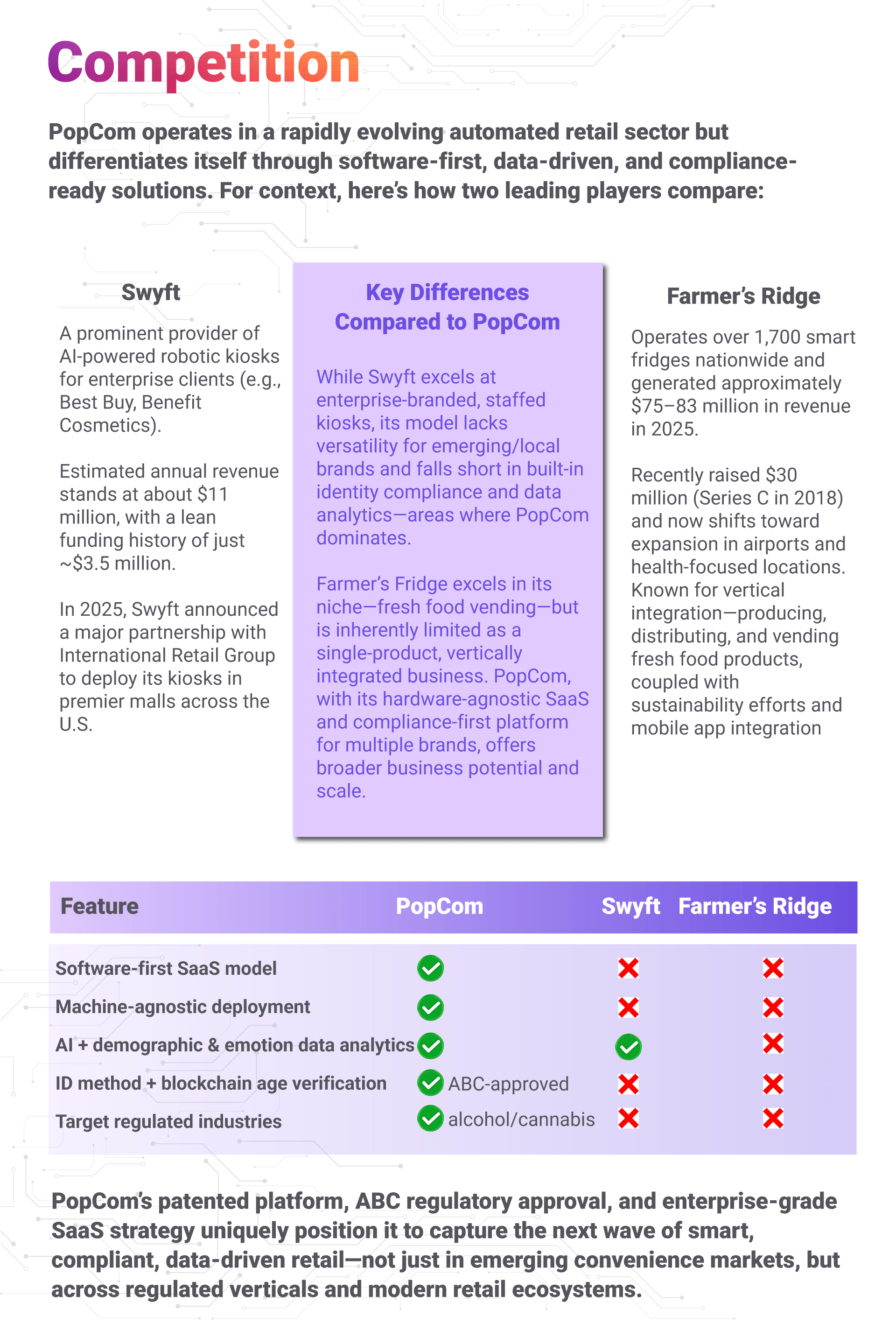

Competition

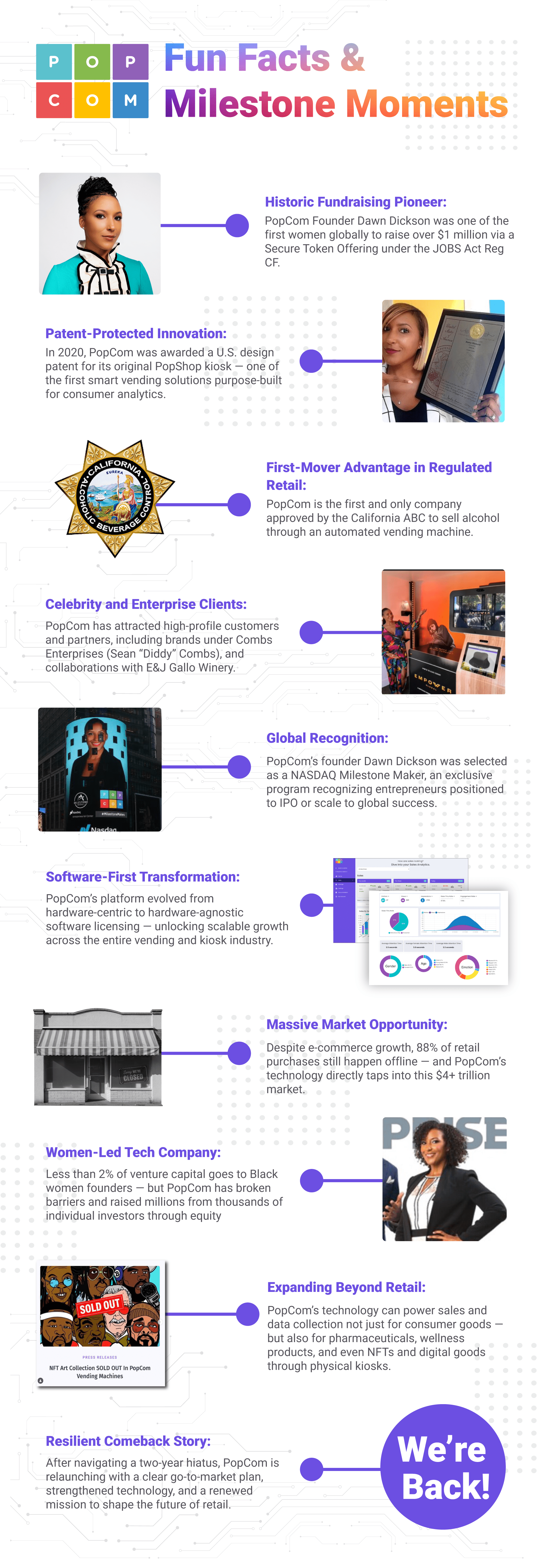

Fun Facts & Milestone Moments for PopCom

Traction & Customers

With a proven product, patent protection, and strong early traction, PopCom is positioned to lead the next generation of automated, data-powered retail.

Investors

How We Will Use Your Investment

We are raising $600,000 to fund PopCom’s next phase of growth with a focus on product development, operational strength, and strategic market expansion. Here’s how the funds will be used:

- $50,000 – Software Updates and Development

To enhance our core SaaS platform, complete integrations for hardware-agnostic deployments, and expand features for data analytics and compliance. - $300,000 – Operations and Payroll (2 Years)

To support a lean, highly skilled team focused on engineering, customer success, and business development, ensuring consistent execution as we scale. - $100,000 – Sales, Marketing, and Trade Shows (2 Years)

To drive customer acquisition, increase brand visibility, and attend key industry events that position PopCom as a leader in the smart retail and vending sectors. - $150,000 – Cash Flow Reserves

To maintain financial flexibility, absorb unexpected costs, and ensure the company can execute its strategic plan without disruption.

Every dollar raised will directly support the successful deployment of our machines, expansion of our SaaS business, and growth into new regulated retail markets

Join Our Community of Over 10,000 Investors

PopCom has learned from its early growth stage and is now positioned to scale a lean, software-driven business in one of the fastest-growing segments of retail. Join us as we lead the future of automated, data-powered commerce—invest now and be part of the next retail revolution.

Terms

Up to $600,000.07 in Class A Common Stock at $0.222 per share with a minimum target amount of $9,999.99.

Offering Minimum: $9,999.99 | 45,045 shares of Class A Common Stock

Offering Target: $600,000.07 | 2,702,703 shares of Class A Common Stock

Type of Security Offered: Class A Common Stock

Purchase Price of Security Offered: $0.222 per Share

Minimum Investment Amount (per investor): $250.19

The Minimum Individual Purchase Amount accepted under this Regulation CF Offering is $250.19. The Company must reach its Target Offering Amount of $9,999.99 by April 20, 2026 (the “Offering Deadline”). Unless the Company raises at least the Target Offering Amount of $9,999.99 under the Regulation CF offering by the Offering Deadline, no securities will be sold in this Offering, investment commitments will be cancelled, and committed funds will be returned.

NOTE TO INVESTORS ABOUT THE SPV

Regulation Crowdfunding allows an issuer to use a special purpose vehicle, or SPV. The technical legal term is a “crowdfunding vehicle.”

In this case, while the name of the Company itself is Solutions Vending International, Inc., the name of the SPV is Solutions Vending International SPV, LLC. You and all the other Regulation Crowdfunding investors will invest in Solutions Vending International SPV, LLC and Solutions Vending International SPV, LLC will, in turn, use your money to invest in Solutions Vending International, Inc. Hence, Solutions Vending International SPV, LLC will be reflected as one investor in Solutions Vending International, Inc.

Solutions Vending International, Inc. believes this structure – with one investor rather than many – will make it easier to raise additional capital in the future because the Offering will leave the Company with only one investor on its capitalization table.

Solutions Vending International SPV, LLC will conduct no business other than to invest in Solutions Vending International, Inc. The SPV has been organized and will be operated for the sole purpose of directly acquiring, holding and disposing of the Company’s securities, will not borrow money and will use all the proceeds from the sale of its securities solely to purchase a single class of securities of the Company. Solutions Vending International SPV, LLC will be managed by the Company itself. The Company’s use of the SPV is intended to allow investors in the SPV to achieve the same economic exposure, voting power, and ability to assert State and Federal law rights, and receive the same disclosures, as if they had invested directly in the Company. The Company’s use of the SPV will not result in any additional fees being charged to investors.

Although Solutions Vending International, Inc. is a corporation, you will be an owner of Solutions Vending International SPV, LLC, which is a limited liability company. Hence, you will receive IRS Form K-1 for tax reporting purposes.

All the information about “the Company” in this Form C refers to Solutions Vending International, Inc., not to Solutions Vending International SPV, LLC unless otherwise indicated.

NOTE TO INVESTORS: As explained above, you will invest in Solutions Vending International SPV, LLC, not in the Company directly. You will receive an interest in Solutions Vending International SPV, LLC called “Investor Units” while Solutions Vending International SPV, LLC will receive shares of Class C Common Stock issued by the Company. The governing documents of Solutions Vending International SPV, LLC, being its Certificate of Formation and Limited Liability Company Agreement (EXHIBIT E and EXHIBIT G), and the Investor Units to be issued to you from Solutions Vending International SPV, LLC, are intended to put you in the same position as if you had purchased shares of Class C Common Stock directly from the Company.

Voting Proxy to the Manager

The SPV investor units do not have voting rights. With respect to those voting rights, the investor and his, her, or its transferees or assignees (collectively, the “Investor”), through a voting proxy granted by Investor in the subscription agreement (Exhibit C), has appointed or will appoint the Manager, Solutions Vending International, Inc., as the Investor’s true and lawful proxy (the “Proxy”) with the power to act alone and with full power of substitution, on behalf of the Investor to: (i) vote all securities related to the Company purchased in an offering hosted by PicMii Crowdfunding, LLC, and (ii) execute, in connection with such voting power any instrument or document that the Manager determines is necessary and appropriate in the exercise of his or her authority. The Investor Units shall have one hundred percent (100%) of the economic rights and no management rights other than to replace the Manager upon a majority vote at a duly called meeting. The Manager Units shall be held only by Solutions Vending International, Inc., or its affiliates or assigns. The Manager Units will confer no economic rights but shall confer one hundred percent (100%) of the management authority to the holders of the Manager Units. The holders of Manager Units shall have all rights necessary to manage the business affairs of the Company, including but not limited to, the authority to direct the acquisition, holding, and disposition of the Company’s assets, and to make all decisions regarding the Company’s operations without requiring the consent of the holders of the Investor Units, subject to limitations in Delaware state law, participation in tender offers, mergers, acquisitions, or any other matters requiring shareholder approval.

Risks

Please be sure to read and review the Offering Statement. A crowdfunding investment involves risk. You should not invest any funds in this offering unless you can afford to lose your entire investment.

In making an investment decision, investors must rely on their examination of the issuer and the terms of the offering, including the merits and risks involved. These securities have not been recommended or approved by any federal or state securities commission or regulatory authority.

The U.S. Securities and Exchange Commission does not pass upon the merits of any securities offered or the terms of the offering, nor does it pass upon the accuracy or completeness of any offering document or literature.These securities are offered under an exemption from registration; however, the U.S. Securities and Exchange Commission has not made an independent determination that these securities are exempt from registration.

Neither PicMii Crowdfunding nor any of its directors, officers, employees, representatives, affiliates, or agents shall have any liability whatsoever arising from any error or incompleteness of fact or opinion in, or lack of care in the preparation or publication of, the materials and communication herein or the terms or valuation of any securities offering.

The information contained herein includes forward-looking statements. These statements relate to future events or future financial performance and involve known and unknown risks, uncertainties, and other factors that may cause actual results to be materially different from any future results, levels of activity, performance, or achievements expressed or implied by these forward-looking statements. You should not place undue reliance on forward-looking statements since they involve known and unknown risks, uncertainties, and other factors, which are, in some cases, beyond the company’s control and which could, and likely will materially affect actual results, levels of activity, performance, or achievements. Any forward-looking statement reflects the current views with respect to future events and is subject to these and other risks, uncertainties, and assumptions relating to operations, results of operations, growth strategy, and liquidity. No obligation exists to publicly update or revise these forward-looking statements for any reason or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

Security Type:

Equity Security

Price Per Share

$0.222

Shares For Sale

2,702,703

Post Money Valuation:

$12,577,647.87

Investment Bonuses!

TBD

Regulatory Exemption:

Regulation Crowdfunding – Section 4(a)(6)

Deadline:

April 20, 2026

Minimum Investment Amount:

$250.19

Target Offering Range:

$9,999.99-$600,000.07

*If the sum of the investment commitments does not equal or exceed the minimum offering amount at the offering deadline, no securities will be sold and investment commitments will be cancelled returned to investors.

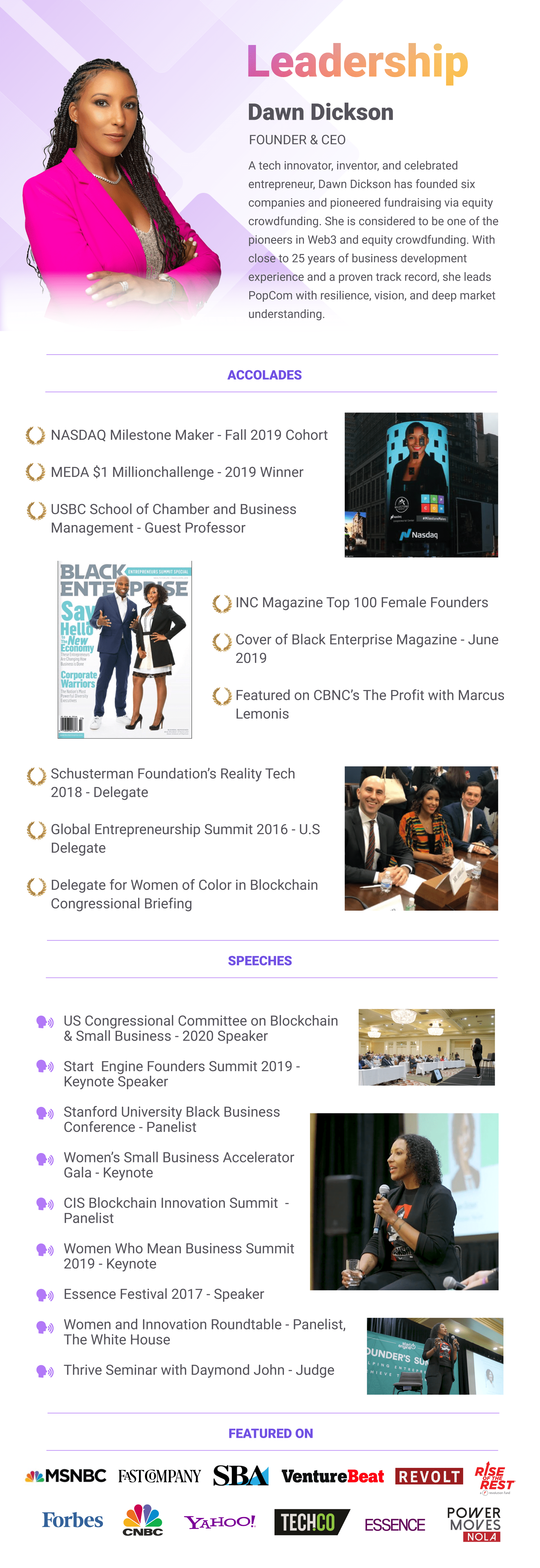

Dawn Dickson

Founder, CEO, and Director

BackgroundDawn Dickson is a seasoned entrepreneur, inventor, and fundraising pioneer with over 20 years of experience at the intersection of technology, retail, and marketing. As the Founder and CEO of PopCom, Dawn leads the development of an automated retail platform revolutionizing how brands sell products and collect customer insights through vending machines and kiosks. Under her leadership, PopCom has raised over $7 million from more than 10,000 investors worldwide—making Dawn the first woman globally to raise over $1 million through a Secure Token Offering (STO) via equity crowdfunding. Her innovative approach to capital raising and product development has earned her widespread recognition in both the tech and investment communities. Dawn has been featured in Forbes, Fast Company, Fortune, Essence, Black Enterprise (cover), INC Magazine’s Top 100 Female Founders, and more. In 2020, she was named OBWS Black Entrepreneur of the Year presented by Snapchat. A passionate advocate for emerging technologies, Dawn was invited to testify before the U.S. House of Representatives on the benefits of blockchain for small businesses. With a proven track record of building companies, raising capital, and bringing cutting-edge products to market, Dawn continues to be a force in retail innovation and a leader to watch in the tech industry. Through PopCom, she’s not just transforming vending—she’s democratizing retail.

Company Name

PopCom

Location

997 N Fourth Street

Columbus, Ohio 43201

Number of Employees

4

Incorporation Type

C-Corp

State of Incorporation

Delaware

Date Founded

October 1, 2012

Raises half the minimum amount

PopCom has raised half of the target offering amount on August 21, 2025. $5,209 has been raised at this time.

Raises 100% of the minimum amount

PopCom has raised the target offering amount on September 25, 2025. $11,753 has been raised at this time.Investors should be aware that the Issuer can now conduct rolling closes if they wish. If the Issuer decides to do so, you will be notified and given time to cancel your investment.