The Virtual Commonwealth

Invest Now

Raised

$13,650

Days Left

77

Business Description

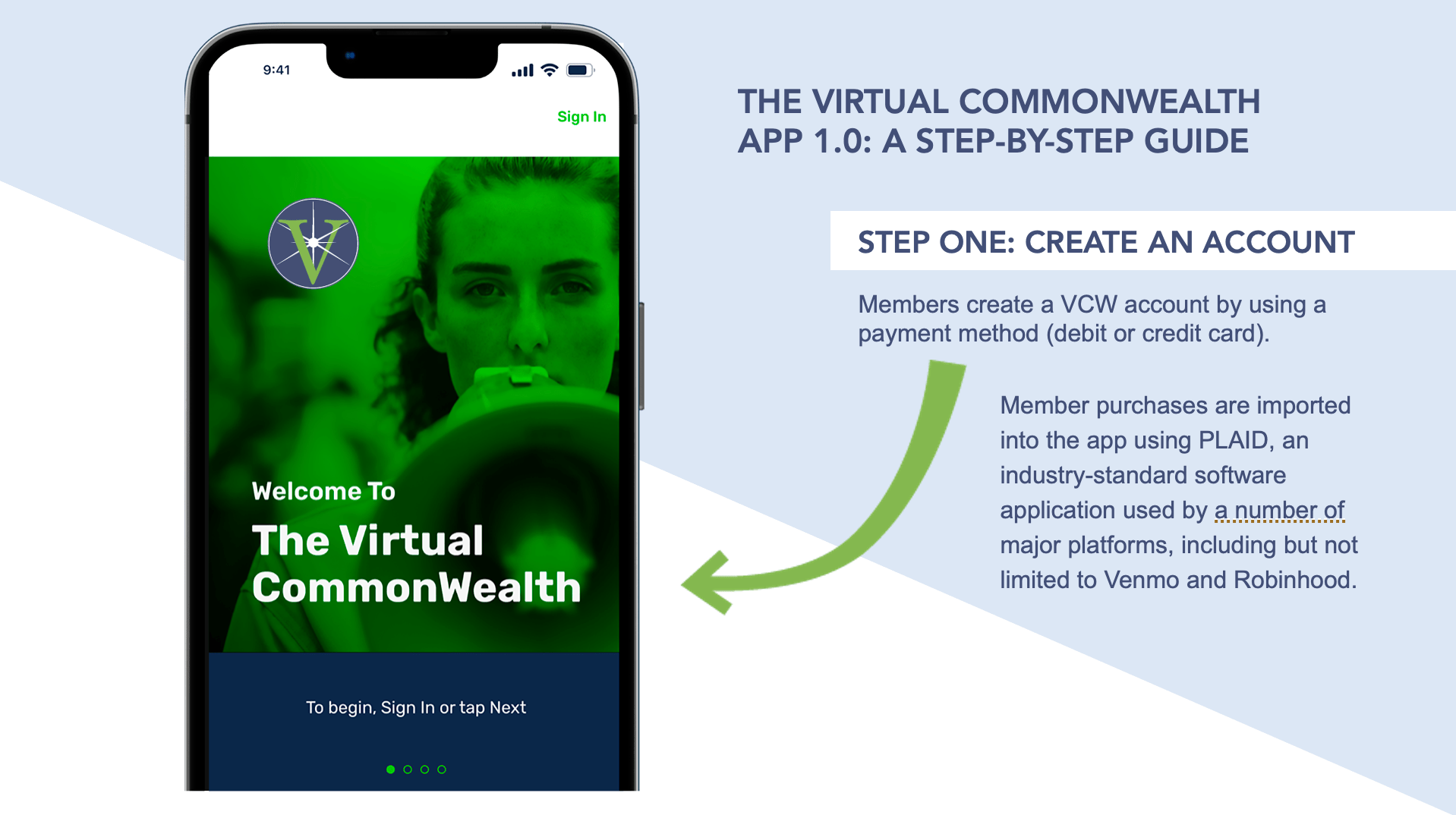

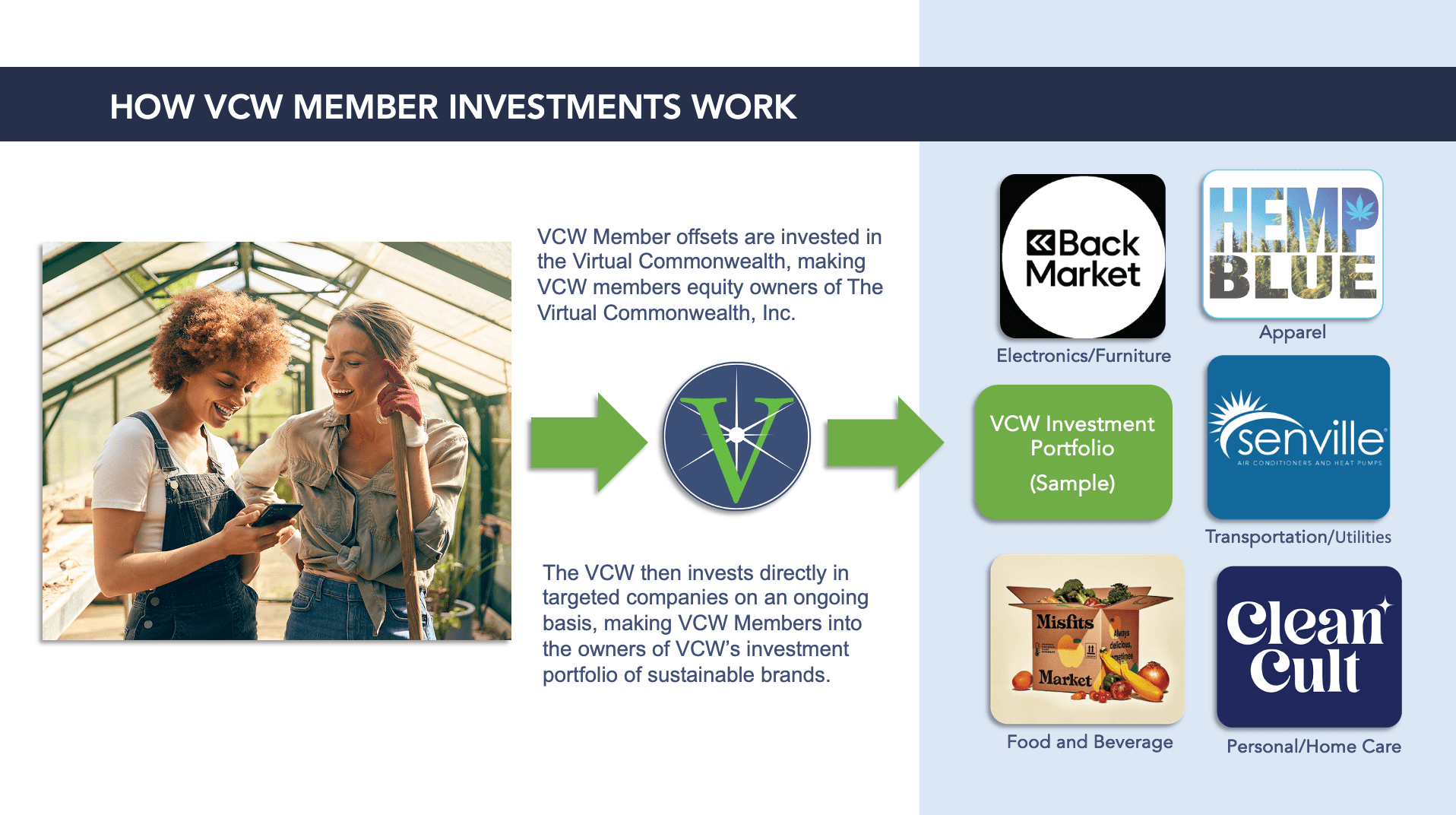

The Virtual Commonwealth is a sustainability and social equity investment platform. Members join The Virtual Commonwealth using a payment method (either debit or credit card), and their transactions are imported into the VCW platform using PLAID, an industry-standard software application used by a number of major platforms, including but not limited to Venmo and Robinhood.

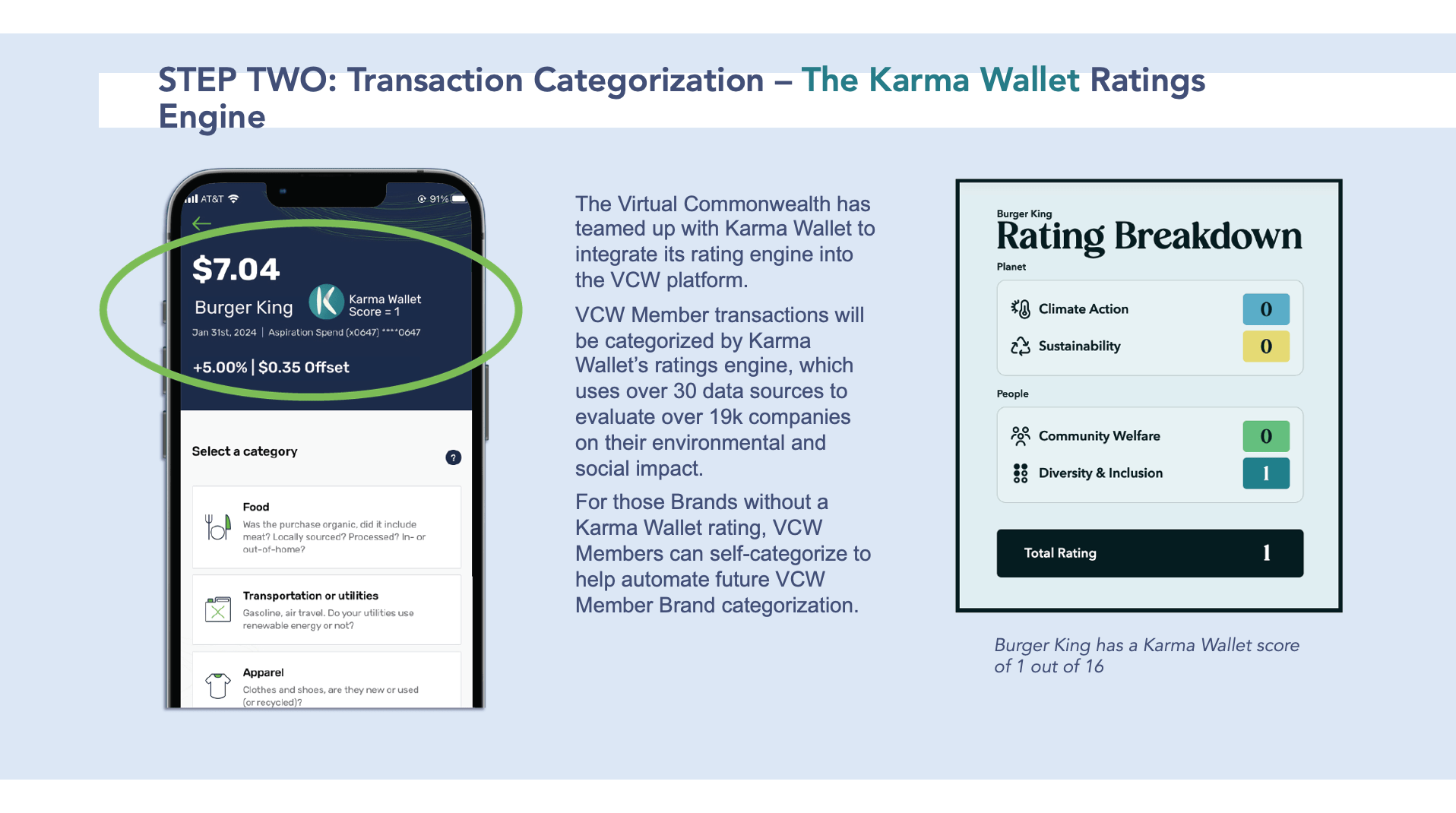

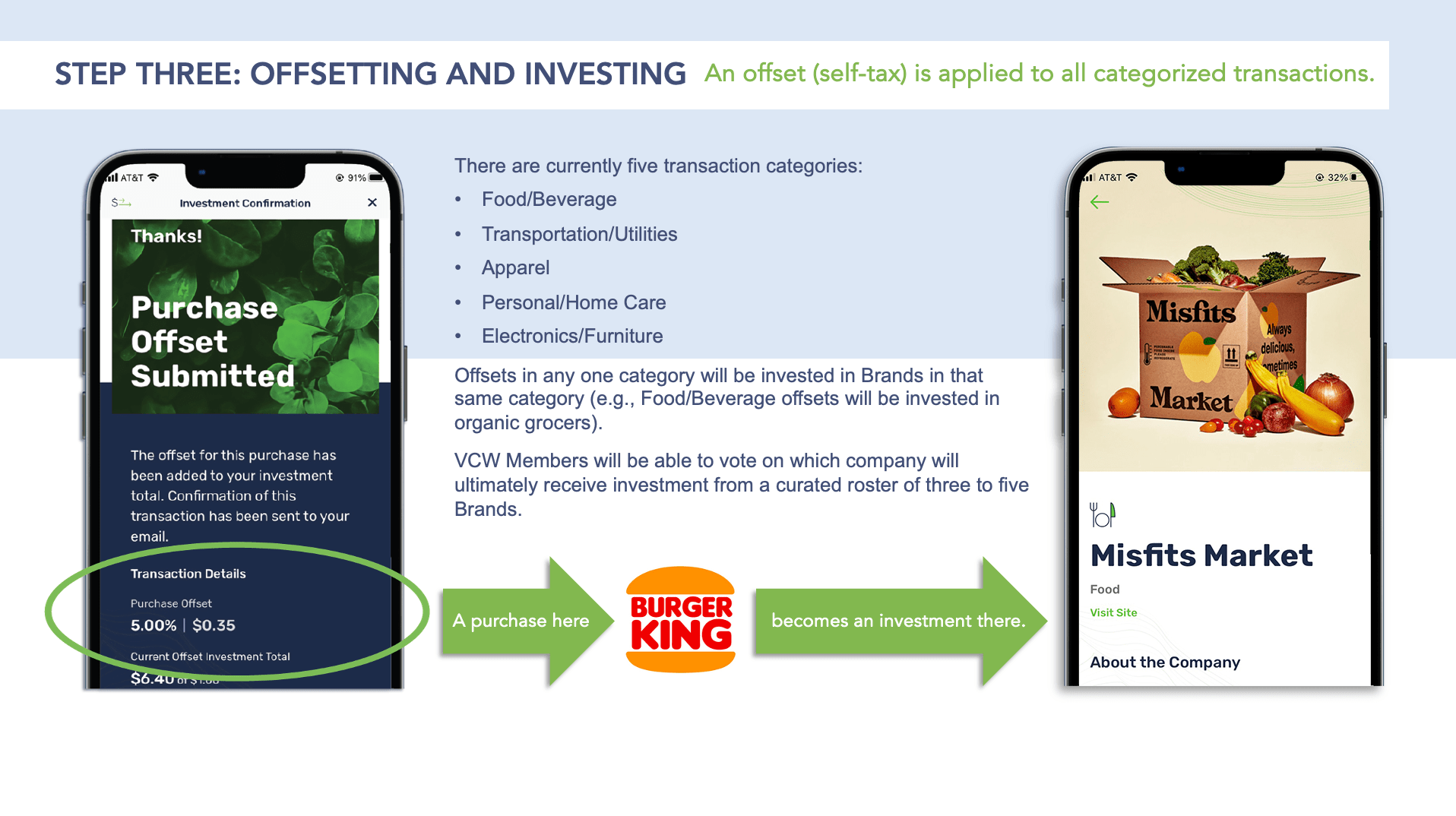

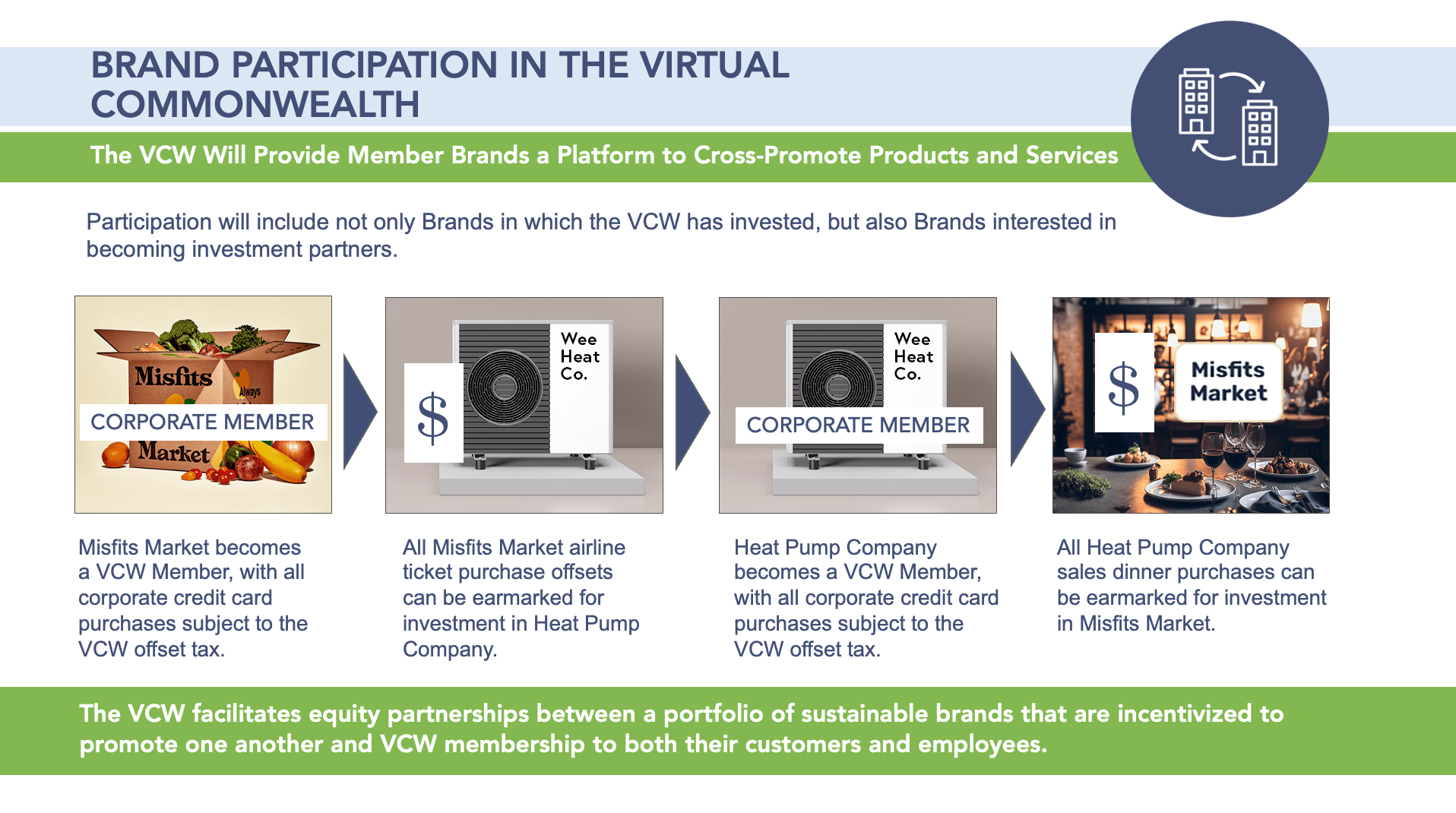

VCW Member transactions are then categorized using a proprietary ratings engine that uses over 30 data sources to rate 19k+ Brands on Planet and People – that ratings is in turn used to calculate the self-tax/offset. Offsets in any one category will be invested in Brands in that same category (e.g., Food/Beverage offsets will be invested in organic grocers). VCW Members will be able to vote on which company will ultimately receive investment from a curated roster of three to five Brands.

Once a Member’s total offsets reach $50-$100, the Member is then prompted to make their investment – upon approval their payment method is charged and (due to securities regulations) they purchase equity in The Virtual Commonwealth. The Virtual Commonwealth then aggregates Member investments and takes equity positions in Brands with strong sustainability and social equity profiles, making VCW Members equity partners in these Brands via the VCW.

The VCW will reserve a portion of Member offsets for cash rebates for Members who purchase products from VCW Investment Portfolio Brands. With each VCW Member purchase, the overall value of the VCW equity position – and by extension VCW Member’s equity position in the VCW – increases.

While in the long-term the value of the VCW will come primarily from the appreciated value of its investment portfolio, VCW revenue will come from charging its members a “minimum monthly investment” (e.g., subscription fee) of ~$10. VCW Members will in effect be contributing to the revenue of a company of which they are part owners, incrementally increasing the value of their own investment.

Problem

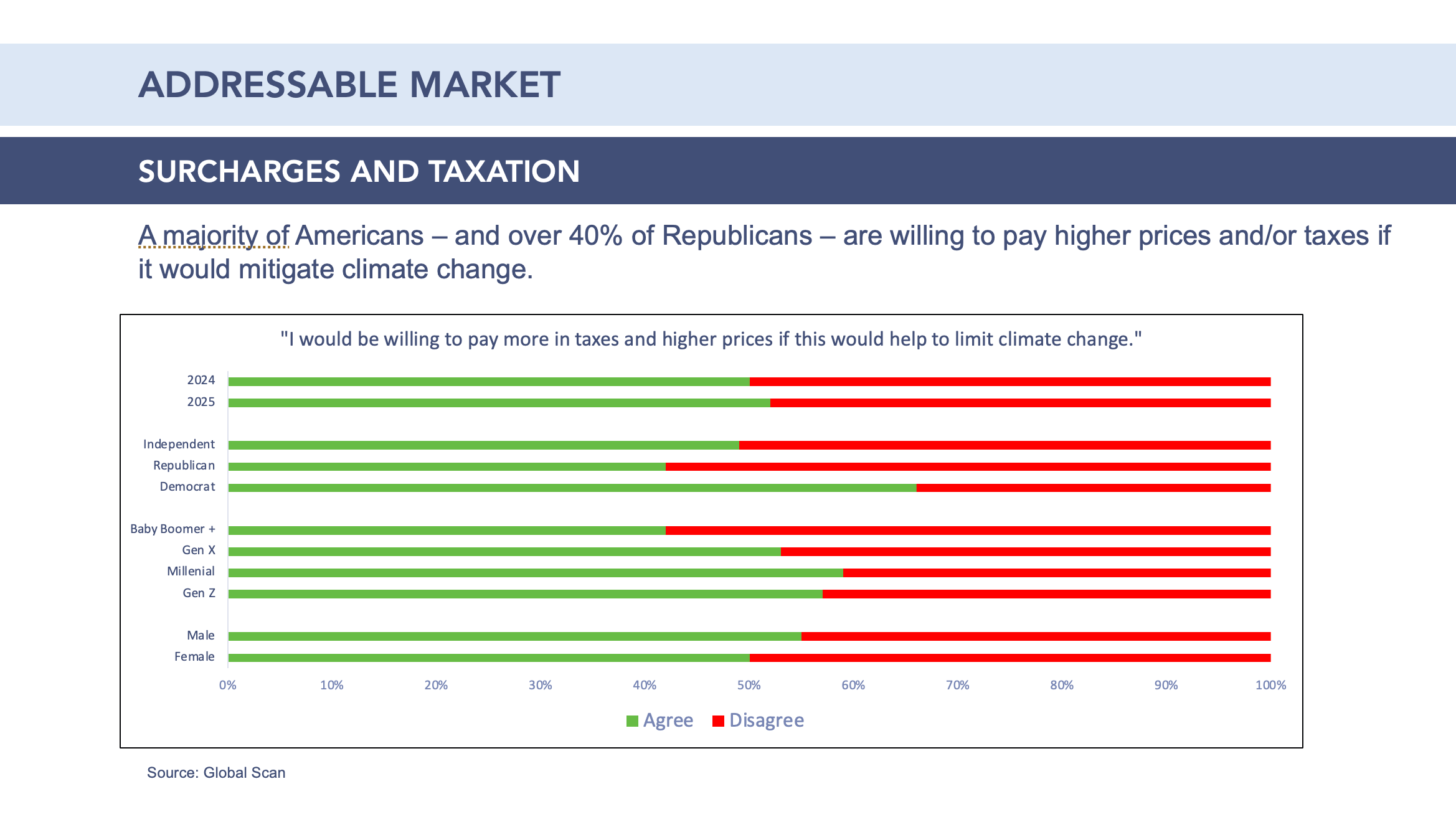

Saving the planet is actually fairly straightforward: tax bad things so that they’re much more expensive, then use that money to subsidize good things so they’re much cheaper.

Then you can pretty much let people live their lives.

As fewer people buy gasoline and fast food cheeseburgers and more people buy heat pumps and locally grown organic carrots, the more environmental health improves, the more human health improves, we all save a ton of money and live happily ever after.

The problem is that there is no chance….zero…that this policy will ever be implemented as a function of government policy.

Solution

Those of us interested in living in establishing an equitable and environmentally sustainable society are a majority of the population, and an even bigger majority financially – we don’t need anyone’s permission to do anything.

The Virtual Commonwealth is a for-profit platform that uses the private sector’s purchasing and investment power and influence to achieve our sustainability and social equity goals. VCW Members agree to self-tax (offset) their unsustainable purchases, and that money is then used to invest in Brands with strong sustainability and social equity profiles in which VCW Members then become equity partners.

The Virtual Commonwealth – doing what the public sector won’t do for us.

Business Model

While in the long-term the value of the VCW will come primarily from the appreciated value of its investment portfolio, VCW revenue will come from charging its members a “minimum monthly investment” (e.g., subscription fee) of ~$10. VCW Members will in effect be contributing to the revenue of a company of which they are part owners, incrementally increasing the value of their own investment.

For details, see Market Projection.

Market Projection

In addition to the 10k+ Karma Wallet member emails +80k Done Good emails, The Virtual Commonwealth will leverage the 4MM non-personally identifiable Karma Wallet transactions to help refine it’s media audience development and targeting.

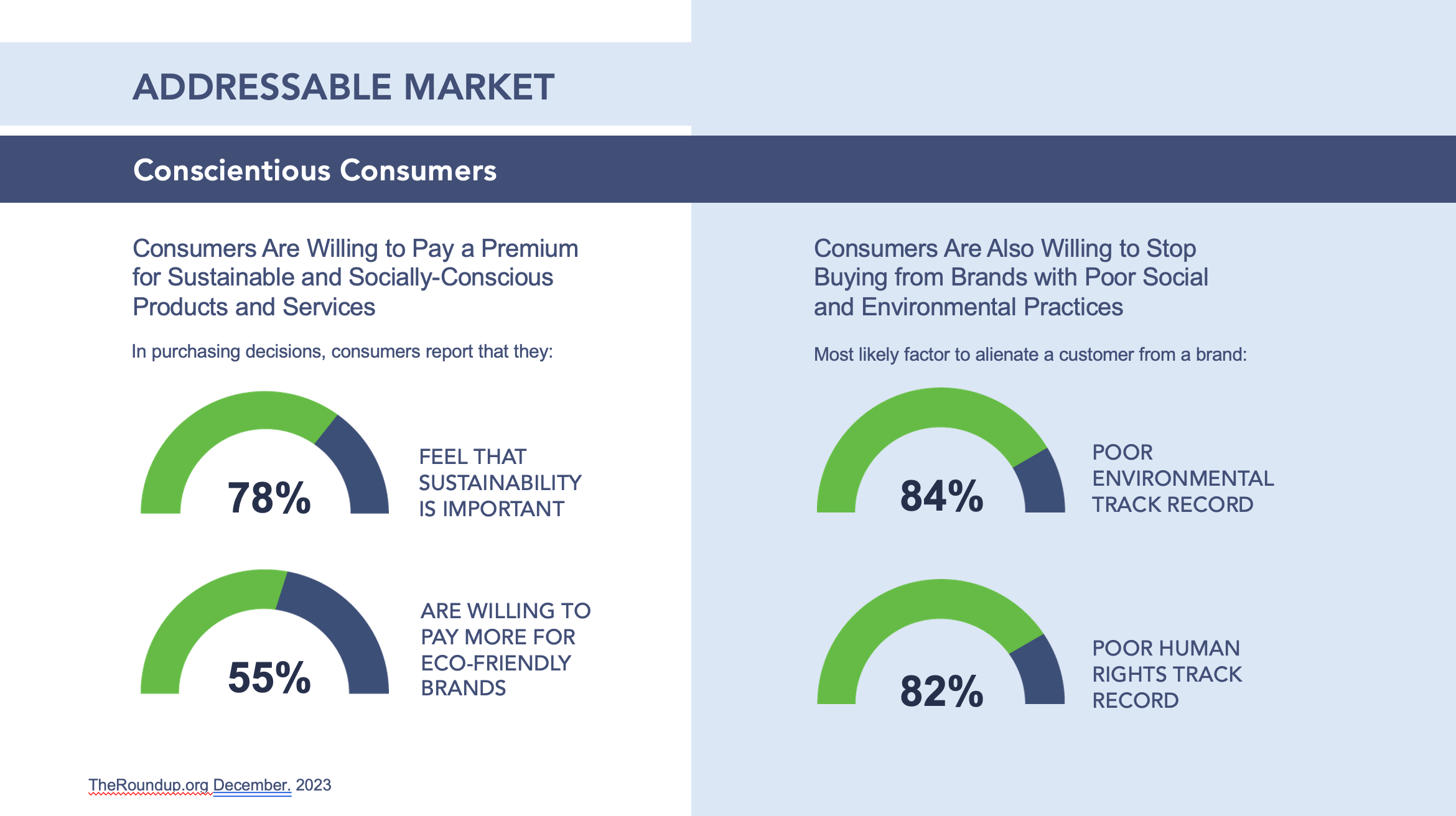

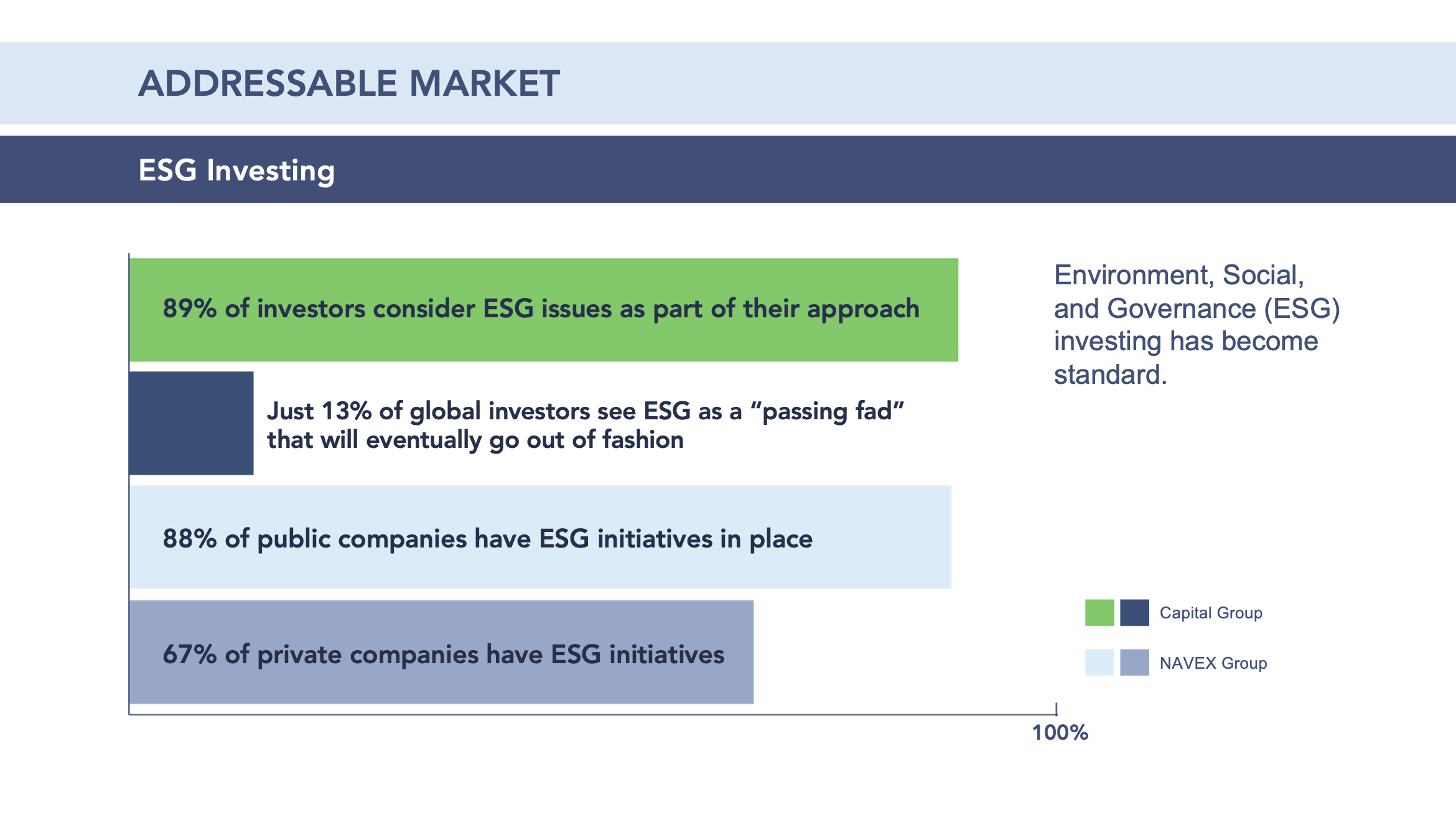

Following are the higher-level market dynamics proving The Virtual Commonwealth’s business model.

Competition

No other platform combines sustainability, self-taxation/offsets, and equity crowdfunding.

While platforms like OpenInvest, Aspiration, and Ethic offer impact investing or carbon offset features, none combine automated self-taxation, transaction-based sustainability ratings, collective decision-making, and equity ownership in a single ecosystem. The Virtual Commonwealth’s model—turning everyday spending into investment capital for sustainable and equitable brands—has no direct competitor. Its unique approach positions it not just within, but beyond, traditional ESG or fintech offerings, effectively creating a new category rather than entering an existing one.

Traction & Customers

The Virtual Commonwealth will leverage its strategic partnership with Karma Wallet/Done Good to achieve Proof of Concept (POC) prior to commercial introduction.

Karma Wallet featured a web app whose functionality mirrored that of The Virtual Commonwealth mobile app – users entered their payment method, and Karma Wallet’s ratings engine ranked their purchases on Planet and People. The Karma Wallet web app was commercially live for 3+ years – during that time over 3k+ users received “Karma Scores” on their purchases, and an additional 7k+ users signed on to receive emails and other updates from Karma Wallet.

As the result of a recently-completed Memorandum of Understanding (not yet reflected on the respective balance sheets), in exchange for a 7.5% ownership stake, The Virtual Commonwealth has purchased the Karma Wallet web app, effectively moving up the VCW’s commercial introduction to 2-3 months after the current Reg CF offering closes.

As part of that same agreement, The Virtual Commonwealth will license the Karma Wallet ratings engine (30+ data sources ranking 19k+ Brands on Planet and People), as well as Karma Wallet user data, which includes 10k email addresses, as well as over 4MM non-personally identifiable transactions to be used for audience development.

Additionally, Karma Wallet and Done Good have agreed to promote The Virtual Commonwealth to Done Good’s 80k+ users and 125+ sustainable brands.

Since The Virtual Commonwealth’s business model is predicated on converting VCW Member offsets into a purchase of VCW equity (the proceeds of which are then used to invest in sustainable brands), driving Karma Wallet and Done Good users to invest directly in The Virtual Commonwealth via a Reg CF offering will prove the VCW’s business case, and position it for further investment via both Reg CF, Reg D, and ultimately Reg A/A+.

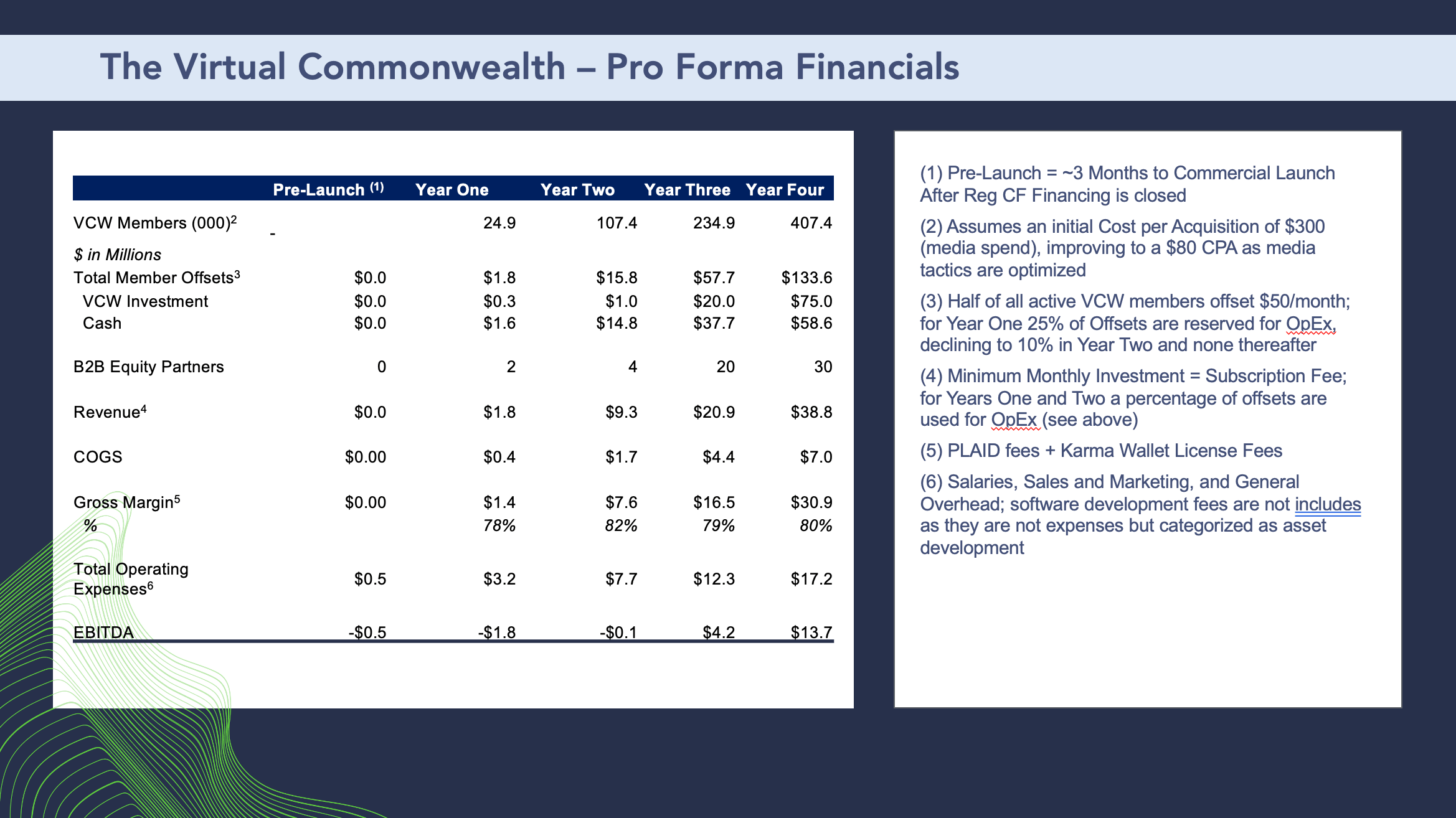

Following are the VCW Pro Forma Financials proving The Virtual Commonwealth’s business model.

Investors

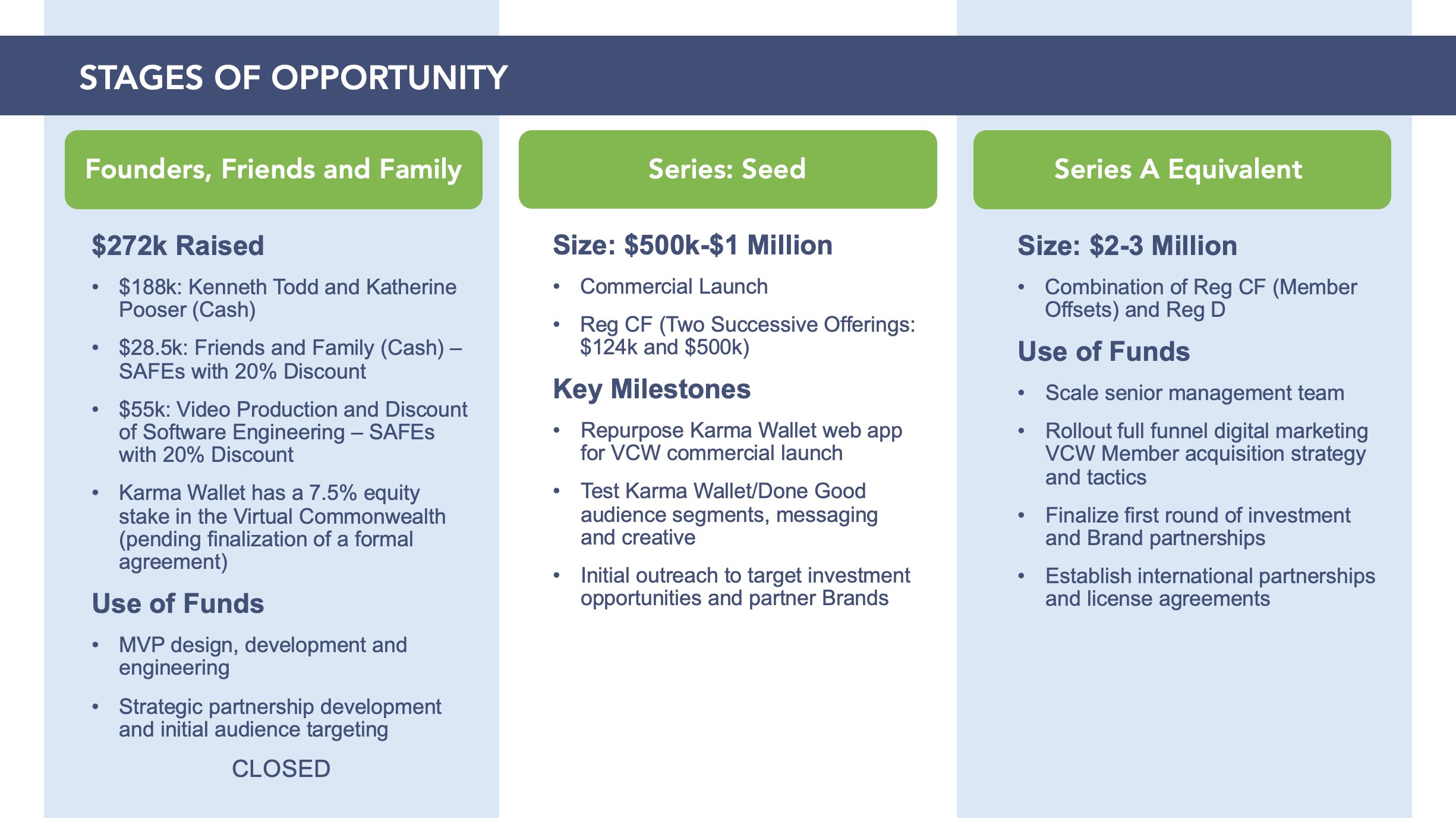

Following are the investor details of The Virtual Commonwealth as of the end of 2Q 2025:

- Kenneth Todd Pooser and Katherine Ann Pooser: $188k

- Terrence Lennox: $10k cash (via SAFE)

- Brian McTigue: $10k cash (via SAFE)

- Gregg Mason: $6.5k cash (via SAFE)

- John Bellassai: $2k cash (via SAFE)

- Joe Duva: $5k in video production services (via SAFE)

- Tony Borden: $5k in video production services (via SAFE)

- Ricky Panzer/Future Foundry: $44k in software development services (via SAFE)

Additionally, as detailed in the Traction/Customers section, The Virtual Commonwealth and Karma Wallet/Done Good have signed a Memorandum of Understanding (MOU), whereby in exchange for a 7.5% equity position (preferred stock) in The Virtual Commonwealth will purchase the Karma Wallet web app, and license the Karma Wallet ratings engine and user data. The entire Karma Wallet tech stack and data is valued at $1.5MM.

The issuance of stock and formal reflection of equity on the respective balance sheets will occur upon conclusion of the formal agreement.

Terms

Up to $124,000 in a Simple Agreements for Future Equity (SAFE) with a minimum target amount of $10,000.

SAFE with a 80% Discount Rate

Offering Minimum: $10,000 | 10,000 Securities

Offering Maximum: $124,000 | 124,000 Securities

Type of Security: Simple Agreement for Future Equity (Crowd SAFE)

Offering Deadline: November 30, 2025

Minimum Investment Amount (Per Investor): $250

Please see specific terms of the SAFE by referencing the Subscription Agreement in Exhibit C.

The Minimum Individual Purchase Amount accepted under this Regulation CF Offering is $250. The Company must reach its Target Offering Amount of $10,000 by November 30, 2025 (the “Offering Deadline”). Unless the Company raises at least the Target Offering Amount of $10,000 under the Regulation CF offering by the Offering Deadline, no securities will be sold in this Offering, investment commitments will be cancelled, and committed funds will be returned.

Risks

Please be sure to read and review the Offering Statement. A crowdfunding investment involves risk. You should not invest any funds in this offering unless you can afford to lose your entire investment.

In making an investment decision, investors must rely on their examination of the issuer and the terms of the offering, including the merits and risks involved. These securities have not been recommended or approved by any federal or state securities commission or regulatory authority.

The U.S. Securities and Exchange Commission does not pass upon the merits of any securities offered or the terms of the offering, nor does it pass upon the accuracy or completeness of any offering document or literature.These securities are offered under an exemption from registration; however, the U.S. Securities and Exchange Commission has not made an independent determination that these securities are exempt from registration.

Neither PicMii Crowdfunding nor any of its directors, officers, employees, representatives, affiliates, or agents shall have any liability whatsoever arising from any error or incompleteness of fact or opinion in, or lack of care in the preparation or publication of, the materials and communication herein or the terms or valuation of any securities offering.

The information contained herein includes forward-looking statements. These statements relate to future events or future financial performance and involve known and unknown risks, uncertainties, and other factors that may cause actual results to be materially different from any future results, levels of activity, performance, or achievements expressed or implied by these forward-looking statements. You should not place undue reliance on forward-looking statements since they involve known and unknown risks, uncertainties, and other factors, which are, in some cases, beyond the company’s control and which could, and likely will materially affect actual results, levels of activity, performance, or achievements. Any forward-looking statement reflects the current views with respect to future events and is subject to these and other risks, uncertainties, and assumptions relating to operations, results of operations, growth strategy, and liquidity. No obligation exists to publicly update or revise these forward-looking statements for any reason or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

Security Type:

SAFE

Discount Rate

80%

Post Money Valuation:

N/A

Investment Bonuses!

N/A

Regulatory Exemption:

Regulation Crowdfunding – Section 4(a)(6)

Deadline:

November 30, 2025

Minimum Investment Amount:

$250

Target Offering Range:

$10,000-$124,000

*If the sum of the investment commitments does not equal or exceed the minimum offering amount at the offering deadline, no securities will be sold and investment commitments will be cancelled returned to investors.

Todd Pooser

Founder and CEO

BackgroundTodd Pooser is the founder and CEO of the Virtual Commonwealth. Todd’s book, “A Systems Approach to Public Administration and Social Equity,” uses cross-disciplinary science to formulate “The Plan” – a series of social policies that if enacted, will enable humanity to live in the best possible world given the conditions of our existence. The Virtual Commonwealth is the commercial application of the concepts advanced in the book, which has been published by Information Age Publishing as part of a series on sustainability and social equity. As COO of an Ad Tech startup, Todd has raised $9M from both public companies and high net worth individuals. Todd speaks about sustainability, social equity and the social impact of artificial intelligence.

Jeffrey Hollender

Advisor/Investor

BackgroundJeffrey Hollender is co-founder and former CEO of Seventh Generation, which he built into a leading natural product brand known for its authenticity, transparency, and progressive business practices. Seventh Generation was sold to Unilever in 2016, Hollender remains on the Board of Directors. Hollender is also the founder and former CEO of Sustain Natural, that develops and markets sustainable feminine care products for women. In addition, he is an Adjunct Professor of sustainability and social entrepreneurship at the Stern Business School, New York University. Hollender is also strategic advisor and former Board Chair of Greenpeace US; and the co-founder and former CEO and Board Chair of the American Sustainable Business Network, a coalition of 200,000 business leaders committed to progressive public policy. He is also the author of his seven books, including most recently, “The Responsibility Revolution: How the Next Generation of Businesses Will Win” and “Planet Home.”

Bob Gatewood

Technical Advisor/Investor

BackgroundBob Gatewood is the Founding CTO of athenahealth, a provider of network-enabled services for healthcare and point-of-care mobile apps, and specializes in disruptive technologies that have a positive impact on the world. He’s been the CTO/VP for several different companies in the health care, energy, and workplace solutions verticals.

Chris Perine

Sustainability Advisor

BackgroundChris Perine was the Managing Director at the Washington DC-based Chemonics International, an international development company that provides consulting services across a number of fields, including agriculture and food security, environment and natural resources, and water, energy and sustainable cities. Chris brings 30 years of environmental science expertise to The Virtual Commonwealth.

Jayant Khadilkar

Co-Founder, Karma Waller/Done Good

BackgroundKarma Wallet/Done Good’s, story began in 2020 with one simple question:“How can you use your money to change the world?” Together father-son founders Jayant Khadilkar and Kedar Karkare built Karma Wallet/Done Good – a financial ecosystem that leverages cutting-edge technology and data to give consumers the power to create change in the world with every single purchase. Karma Wallet and The Virtual Commonwealth’s strategic partnership includes the purchase of the Karma Wallet web app, a license for the Karma Wallet “ratings engine” to help categorize VCW Member transactions, as well as the use of Karma Wallet’s first party data to promote the Virtual Commonwealth membership and develop the VCW’s paid and organic media playbook.

Ricky Panzer

Founder Future Foundry, Acting CTO

Background, Future Foundry is a New York City-based company with an extensive portfolio of web-based and mobile app development projects. Featuring a network of 15 engineers and designers, Future Foundry clients include Boston Consulting Group, Warner Brothers, and Radar Pictures.

Company Name

The Virtual Commonwealth

Location

220 Manhattan Avenue

6L

New York, New York 10025

Number of Employees

4

Incorporation Type

C-Corp

State of Incorporation

New York

Date Founded

February 14, 2022

Raises half the minimum amount

The Virtual Commonwealth has raised half of the target offering amount on July 17, 2025. $7,350 has been raised at this time.

Raises 100% of the minimum amount

The Virtual Commonwealth has raised the target offering amount on July 29, 2025. $10,050 has been raised at this time.Investors should be aware that the Issuer can now conduct rolling closes if they wish. If the Issuer decides to do so, you will be notified and given time to cancel your investment.