Perimtec is a distributor of unique, high-end modern fence solutions with incredible growth and plans to change the way customers buy premium fence products. With a relentless commitment to exceptional customer service, a diverse range of fencing options, and a steadfast focus on delivering high-quality products, Perimtec is poised to revolutionize the way customers buy premium fence products.

Raised 4 % of minimum

Funding Raised

$996

Funding Goal

$19,998.00-$1,234,998

Days Left to Invest

Closed

Perimtec

Perimtec is a distributor of unique, high-end modern fence solutions with incredible growth and plans to change the way customers buy premium fence products. With a relentless commitment to exceptional customer service, a diverse range of fencing options, and a steadfast focus on delivering high-quality products, Perimtec is poised to revolutionize the way customers buy premium fence products.

Raised 4 % of minimum

Funding Raised

$996

Funding Goal

$19,998.00-$1,234,998

Days Remaining

Closed

Business Description

Highlights:

– Durable, low-maintenance fencing with 25-years warranty.

– Premium product made with quality material.

– Direct-to-consumer services.– Fence Trac Master distributors.

– Low Market Value; 2.5X 2022 Sales.

– Three Month Run Rate of $3.1M.

– LTV to CAC of 4.1.

– 205,833 Class B Equity Units at a $7.1M post-money valuation.

– Fence Trac Master distributor.

– Countless possibilities in fencing with varying materials and additional options

– Easy process, white glove service

– Not one returned.

About:

Fencing Reimagined

Perimtec, a leader in the fencing industry, offers high-end, modern fence solutions that combine beauty with durability. Driven by a vision to redefine premium fencing, our designs appeal to architects, homeowners, and construction professionals alike. We don’t just source product; we meticulously select the finest from around the globe, ensuring top-tier quality for our customers.

Based in Tulsa, Oklahoma, our strategic location allows us to serve a broad North American clientele and occasionally beyond. With a steadfast commitment to customer service every Perimtec interaction is tailored, providing a seamless experience. For investors, partnering with Perimtec means aligning with a brand poised for significant growth and innovation in the fencing realm.

Perimtec Product Features and Specifications

– Metal frame fence kits and gate kits. 25-year warranty.

– Ranch rail fencing for a more rustic appeal.

– Vast array of infill options.

Durability

Built to last a 25-year warranty, ensuring peace of mind and long-term value.

Quality Assurance

Premium craftsmanship that stands out in the industry.

Versatility in Design

Compatible with a wide range of infill options:

– Traditional choices like wood and vinyl.

– Designer metals for a modern touch.

– Eco-friendly options like bamboo with a Class A Fire Rating

– Innovative materials such as custom metal, hemp, and composite.

Enhanced Features

Fencing accessories to elevate the overall look and functionality:

– Stain and steel to protect and enhance the fence’s appearance.

– Fence-mounted planters for a touch of greenery.

– Handy fence hooks for added utility.

With Perimtec, you’re not just choosing a fence; you’re opting for quality, versatility, and a product that compliments your spaces aesthetics.

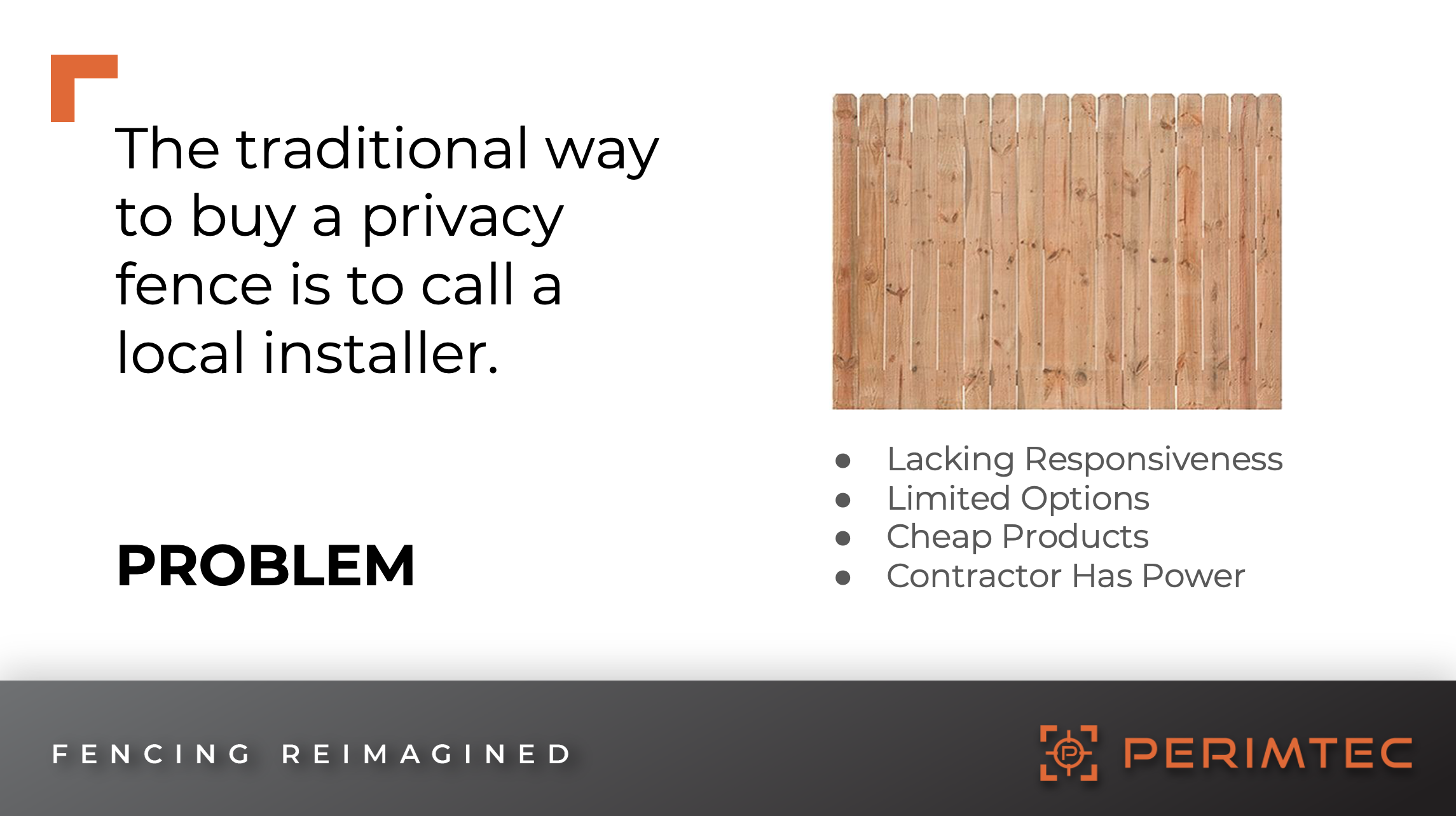

Problem

Addressing the Fencing Industry’s Challenges:

Traditional Fencing Shortcomings:

1. Responsiveness Issues: The industry is plagued by delayed responses, ambiguous timelines, and poor communication.

2. Limited Choices: Traditional installers often offer a restricted array of options, stifling creativity and customization.

3. Compromised Quality: A focus on cost-cutting often results in subpar products that lack durability.

4. Decision Discrepancy: Contractors dominate decision-making, often sidelining client preferences.

Solution

We’re revolutionizing the fencing industry:

1. Direct Engagement Across the Spectrum: We seamlessly collaborate with a diverse range of clients, from individual homeowners to commercial entities and professional installers, ensuring tailored solutions for every need.

2. Guaranteed Longevity: Our solutions come with a 25-year warranty, often lasting up to 30 years, ensuring a sustainable ROI.

3. Innovative and Adaptable Designs: We’re redefining fencing aesthetics, offering designs that can be customized to any architectural or landscape requirement, supplemented by a range of spoke accessories.

Business Model

Consistent Performance

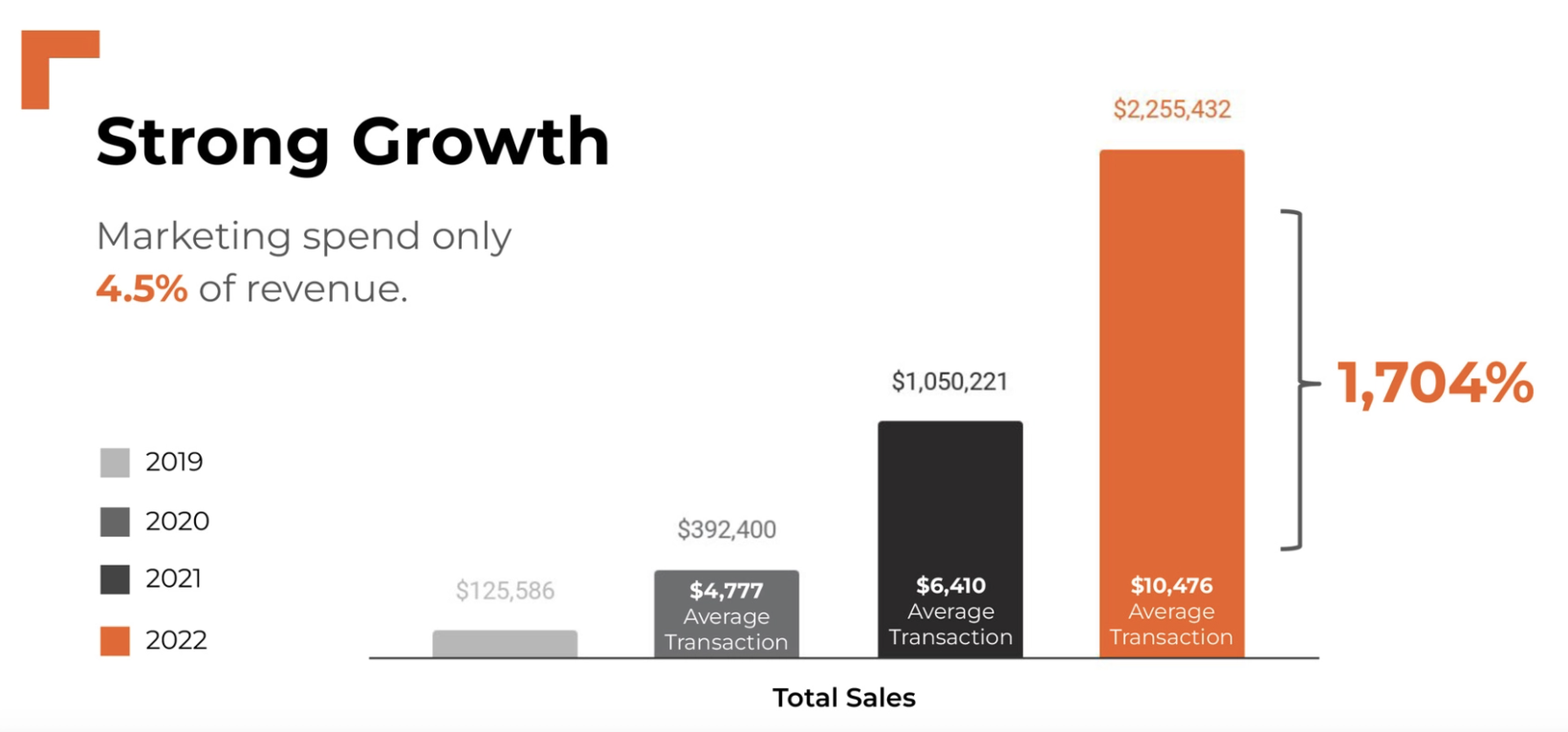

At Perimtec, our track record speaks or itself. We’ve consistently doubled out sales year-over-year, showing our product appeal and team’s dedication and excellence.

Efficient Marketing Spend

Despite our impressive growth, our marketing expenditure has been astoundingly efficient. With only 4.5% of our revenue directed toward marketing, we’ve managed to achieve significant market penetration and brand recognition.

Future Projections

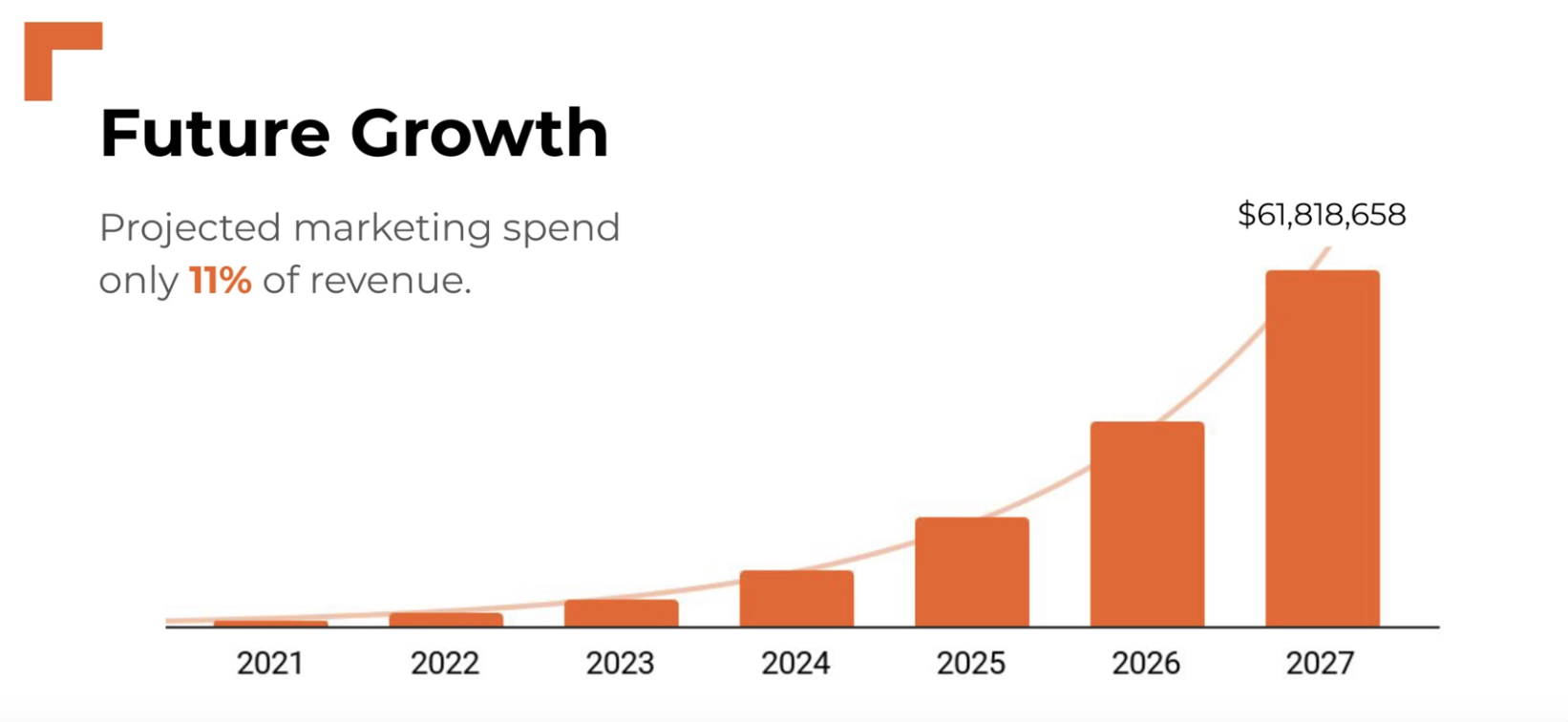

As we look to the future, we’re gearing up to amplify our reach even further. Our projected marketing spend is set to increase to 11% of our revenue. With this strategic investment, we anticipate a staggering 2,641% growth by 2027.

Market Projection

Fencing Forward: Market Demand r Enhancing Fencing Solutions

According to a report by Grand View Research on the US fencing market, the industry showcases promising growth trends and emerging opportunities.

Market Size and Growth: With the U.S. fencing market valued at USD 8.20 billion in 2021 and a projected CAGR of 5.0% through 2030, Perimtec is strategically positioned to capitalize on this upward trajectory, offering innovative fencing solutions that cater to modern demand.

Sustainability in Focus: As the industry witnesses a 6.9% CAGR growth in plastic and composite fences, driven by recyclable properties. Perimtec’s commitment to quality and durability aligns with this shift towards eco-friendly fencing solutions.

Residential Sector Growth: The residential sector, which contributed to 33.6% of the market revenue in 2021 and is projected to grow at a CAGR of 5.3%, underscores the increasing demand for secure and aesthetically pleasing fencing. Perimtec’s unique designs and customizable options cater to this growing residential need.

Regional Opportunities: The souther US region, with a revenue share of USD 3.2 billion, is a focal point of growth, especially with its 5.8% projected CAGR. Perimtec’s innovative fencing systems are primed to meet the regions rising demand, especially in agricultural applications, offering both functionality and style.

Competition

As a distributor of unique, high-end modern fence solutions, Perimtec operates in a competitive market. The primary competitors for Perimtec would be local fencing installers or contractors who offer installation services along with their own range of fencing products. These companies often have established local networks and may have a loyal customer base due to their longstanding presence in the area. They have experience working with different types of fencing materials, such as wood, metal, vinyl, or composite, but a lot of times, their material is low quality.

Traction & Customers

Perimtec has been growing significantly year-over-year since they were founded in 2019. In 2019, the company saw total sales of $125,586. In 2020, sales grew to $392,400 with an average transaction amount of $4,777. From 2020 to 2021, there was an increase to sales by about 167%. In 2021, total sales were $1,050,221 with an average transaction amount of $6,410. Lastly, from 2021 to 2022, Perimtec saw sales growth of about 114%. Their 2022 sales were $2,255,432 with an average transaction amount of $10,476. Since 2019, Perimtec has seen total sales growth of about 1,700%!

Their growth since 2019 only includes about 4.5% of revenue being spent on marketing. Perimtec plans to increase their marketing spend to 11% of their revenue in the next few years, hopefully driving growth even higher in the next few years.

Investors

Investment Opportunity

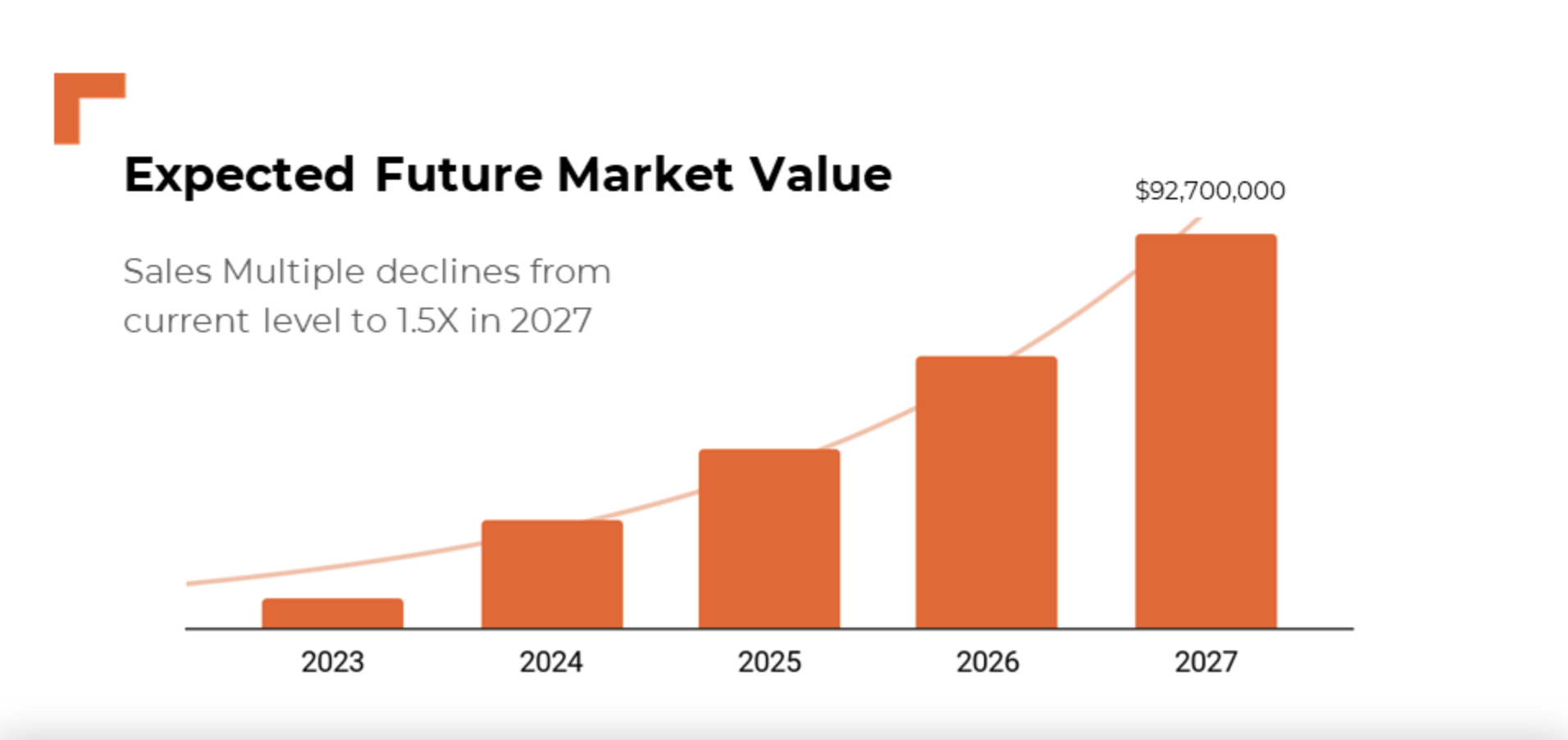

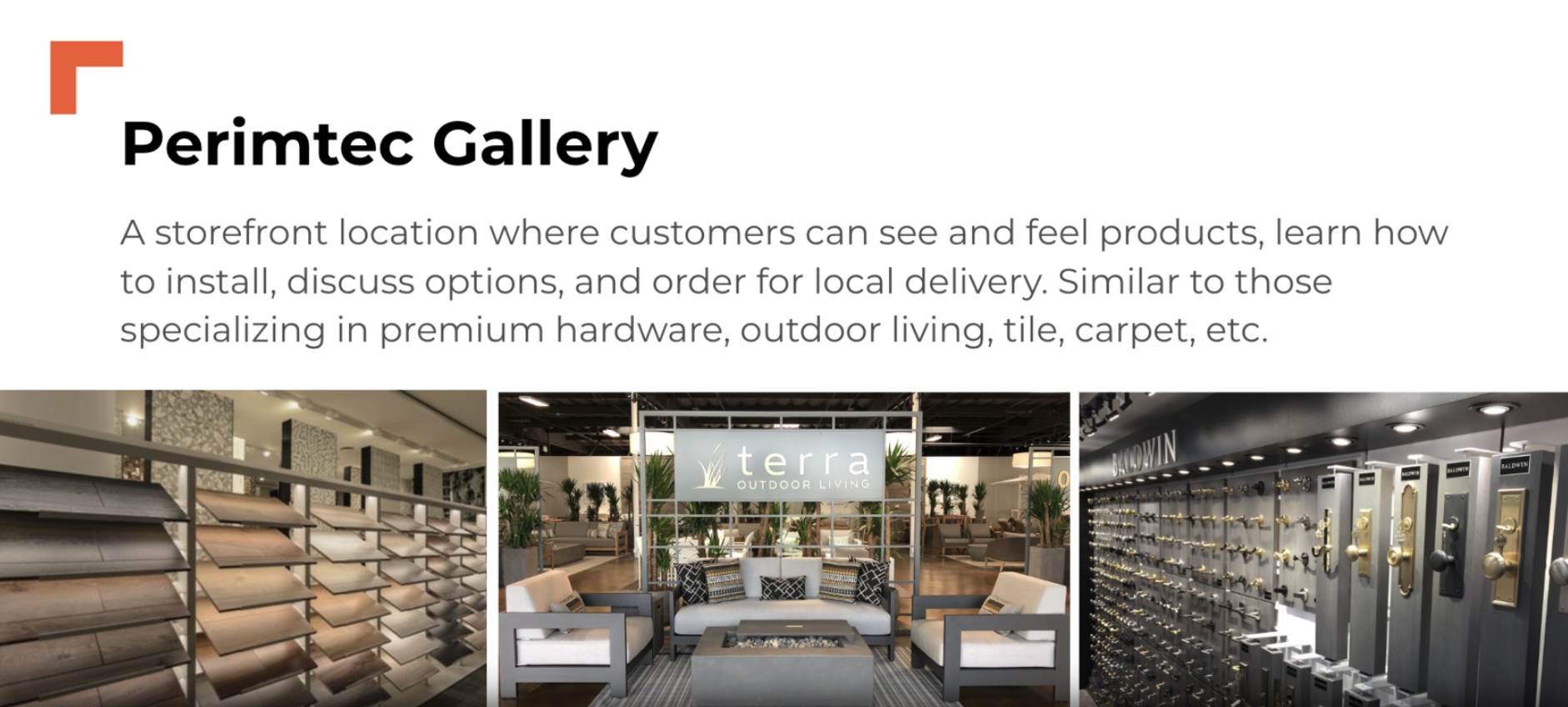

Perimtec, with its proven concept, is poised for transformative growth. Our vision is to establish 13 galleries/storefronts across the U.S., offering customers a tactile experience with our products. By investing, you’re not only tapping into a solution that fills existing market gaps, but also fueling our ambitious expansion strategy.

Expansion Plan: Our galleries will be more than mere warehouses. Envision spaces similar to premium hardware or outdoor living showrooms, where consumers can engage in our fencing products, understanding their quality and versatility first hand.

Purpose: While our online sales have been robust with zero returns, we recognize the value of physical interaction. Offering a space for customers to see, touch, and explore configurations ensures they make informed decisions, reducing any hesitancy associated with online purchases.

Scalability and Reach: The proposed 13 galleries will be strategically located, each serving an expansive 600-mile radius. This ensures our top-tier service and products are accessible to a vast customer base.

Projected Impact on Profits: With this expansion, we anticipate our profits to more than double.

Terms

Perimtec LLC (“Perimtec,” the “Company,” “we,” or “us”), an Oklahoma limited liability company formed on October 19, 2018, is holding the following offering:

Up to $1,234,998 in Class B Units at $6.00 with a minimum target amount of $19,998.00.

Offering Minimum: $19,998.00 | 3,333 Class B Units

Offering Maximum: $1,234,998.00 | 205,833 Class B Units

Type of Security Offered: Class B Units

Purchase Price of Security Offered: $6.00

Minimum Investment Amount: $498.00 | 83 Class B Units

The Minimum Individual Purchase Amount accepted under this Regulation CF Offering is $498. The Company must reach its Target Offering Amount of $19,998 by April 1st, 2024 (the “Offering Deadline”). Unless the Company raises at least the Target Offering Amount of $19,998 under the Regulation CF offering by the Offering Deadline, no securities will be sold in this Offering, investment commitments will be cancelled, and committed funds will be returned.

Bonuses:

Product Discounts

Tier 1: $1,000 or More

3% discount off lowest offered price at time of product purchase.

Tier 2: $3,000 or More

5% discount off lowest offered price at time of product purchase.

Tier 3: $5,000 or More

7% discount off lowest offered price at time of product purchase.

Tier 4: $10,000 or More

10% discount off lowest offered price at time of product purchase.

*Investments can only qualify for one tier per investor.

Bonus Shares:

First 20 investors of $1,500 or more will receive 12.5%** bonus shares. All subsequent investments of $1,500 or more will receive 10%** bonus shares. Investments must occur before midnight GMT September 29, 2023.

* In order to receive awards from an investment, one must submit a single investment in the same offering that meets the minimum award requirement. Bonus shares from awards will not be granted if an investor submits multiple investments that, when combined, meet the award requirement. All awards occur when the offering is completed.

** All bonus shares will be rounded up to the next whole number.

Risks

Please be sure to read and review the Offering Statement. A crowdfunding investment involves risk. You should not invest any funds in this offering unless you can afford to lose your entire investment.

In making an investment decision, investors must rely on their examination of the issuer and the terms of the offering, including the merits and risks involved. These securities have not been recommended or approved by any federal or state securities commission or regulatory authority. The U.S. Securities and Exchange Commission does not pass upon the merits of any securities offered or the terms of the offering, nor does it pass upon the accuracy or completeness of any offering document or literature.

These securities are offered under an exemption from registration; however, the U.S. Securities and Exchange Commission has not made an independent determination that these securities are exempt from registration.

Neither PicMii Crowdfunding nor any of its directors, officers, employees, representatives, affiliates, or agents shall have any liability whatsoever arising from any error or incompleteness of fact or opinion in, or lack of care in the preparation or publication of, the materials and communication herein or the terms or valuation of any securities offering.

The information contained herein includes forward-looking statements. These statements relate to future events or future financial performance and involve known and unknown risks, uncertainties, and other factors that may cause actual results to be materially different from any future results, levels of activity, performance, or achievements expressed or implied by these forward-looking statements. You should not place undue reliance on forward-looking statements since they involve known and unknown risks, uncertainties, and other factors, which are, in some cases, beyond the company’s control and which could, and likely will materially affect actual results, levels of activity, performance, or achievements. Any forward-looking statement reflects the current views with respect to future events and is subject to these and other risks, uncertainties, and assumptions relating to operations, results of operations, growth strategy, and liquidity. No obligation exists to publicly update or revise these forward-looking statements for any reason or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

Security Type:

Equity Security

Price Per Share

$6.00

Shares For Sale

205,833

Post Money Valuation:

$7,177,458

Investment Bonuses!

Product Discounts

Tier 1: $1,000 or More

3% discount off lowest offered price at time of product purchase.

Tier 2: $3,000 or More

5% discount off lowest offered price at time of product purchase.

Tier 3: $5,000 or More

7% discount off lowest offered price at time of product purchase.

Tier 4: $10,000 or More

10% discount off lowest offered price at time of product purchase.

*Investments can only qualify for one tier per investor.

Bonus Shares:

First 20 investors of $1,500 or more will receive 12.5%** bonus shares. All subsequent investments of $1,500 or more will receive 10%** bonus shares. Investments must occur before midnight GMT September 29, 2023.

* In order to receive awards from an investment, one must submit a single investment in the same offering that meets the minimum award requirement. Bonus shares from awards will not be granted if an investor submits multiple investments that, when combined, meet the award requirement. All awards occur when the offering is completed.

** All bonus shares will be rounded up to the next whole number.

Regulatory Exemption:

Regulation Crowdfunding – Section 4(a)(6)

Deadline:

April 1, 2024

Minimum Investment Amount:

$498.00

Target Offering Range:

$19,998.00-$1,234,998

*If the sum of the investment commitments does not equal or exceed the minimum offering amount at the offering deadline, no securities will be sold and investment commitments will be cancelled returned to investors.

Scott Hudson

Founder

BackgroundBusiness Management Professional with 15+ years of experience leveraging exceptional business and operational experiences with extensive trading and origination expertise to create world class environments.

Brett Williams

Founder

BackgroundBrett Williams is a Technology Solutions Executive with over 25 years of experience in managing teams, implementing solutions, leading organizations and getting projects and organizations started from the ground up.

Jentry Workman

VP of Operations

BackgroundShe has been with the company since its inception and has taken increased responsibility in each role. Jentry has a bachelor’s degree in marketing from Northeastern State University and has worked in diverse roles including coordinator of trade shows for a large aerospace company (Nordam) and managing the inside sales and customer service departments for a national packaging company (Omni Packaging). Jentry also spent time as a classroom teacher for a middle school (St. Mark Lutheran).

Legal Company Name

Perimtec

Location

12808 South Memorial Dr. #107

Bixby, Oklahoma 74008

Number of Employees

7

Incorporation Type

LLC

State of Incorporation

Oklahoma

Date Founded

October 19, 2018

Raises half the minimum amount

Perimtec has raised half of the target offering amount on October 27, 2023. $15,324 has been raised at this time.

Raises 100% of the minimum amount

Perimtec has raised the target offering amount on March 17, 2024. $20,322 has been raised at this time.Investors should be aware that the Issuer can now conduct rolling closes if they wish. If the Issuer decides to do so, you will be notified and given time to cancel your investment.