Introducing The SmartScreen Restaurant Personalization Platform (“SmartScreen”) is a game-changer for restaurant marketing. Its proprietary technology makes it easy to quickly deploy personalized, integrated digital dining experiences across all guest communications channels through personalized menu recommendations, personalized content, triggered pop ups, emails, and digital advertising – all with ease!

Raised 0 % of minimum

Funding Raised

$0

Funding Goal

$9,999.00-$123,997.50

Days Left to Invest

Closed

SmartScreen

Introducing The SmartScreen Restaurant Personalization Platform (“SmartScreen”) is a game-changer for restaurant marketing. Its proprietary technology makes it easy to quickly deploy personalized, integrated digital dining experiences across all guest communications channels through personalized menu recommendations, personalized content, triggered pop ups, emails, and digital advertising – all with ease!

Raised 0 % of minimum

Funding Raised

$0

Funding Goal

$9,999.00-$123,997.50

Days Remaining

Closed

Business Description

SmartScreen is aiming to revolutionize the restaurant industry with its cutting-edge Personalization Platform.

The technology combines artificial intelligence (AI), machine learning (ML), and operations research (OR) methodologies to generate business insights, meet business objectives while managing constraints, and to increase guest satisfaction.

SmartScreen offers products & services for restaurant owners and brands who are dissatisfied with current customer communication, personalization and marketing strategies and tactics that are not relevant, cost too much, cannot be measured, and lead to unintended usually negative guest experiences. SmartScreen is the only restaurant specific personalization and sales optimization platform that increases online order conversions and profitability, upsells drive thru orders and increases new and repeat visits.

SmartScreen is a communication channel, application and hardware agnostic and can optimize upsell opportunities by giving guest personalized recommendations in a relevant presentation through any communication channel. The technology combines artificial intelligence (AI), machine learning (ML) and operations research (OR) methodologies to generate business insights, meet business objectives while managing constraints as well as to increase guest satisfaction.

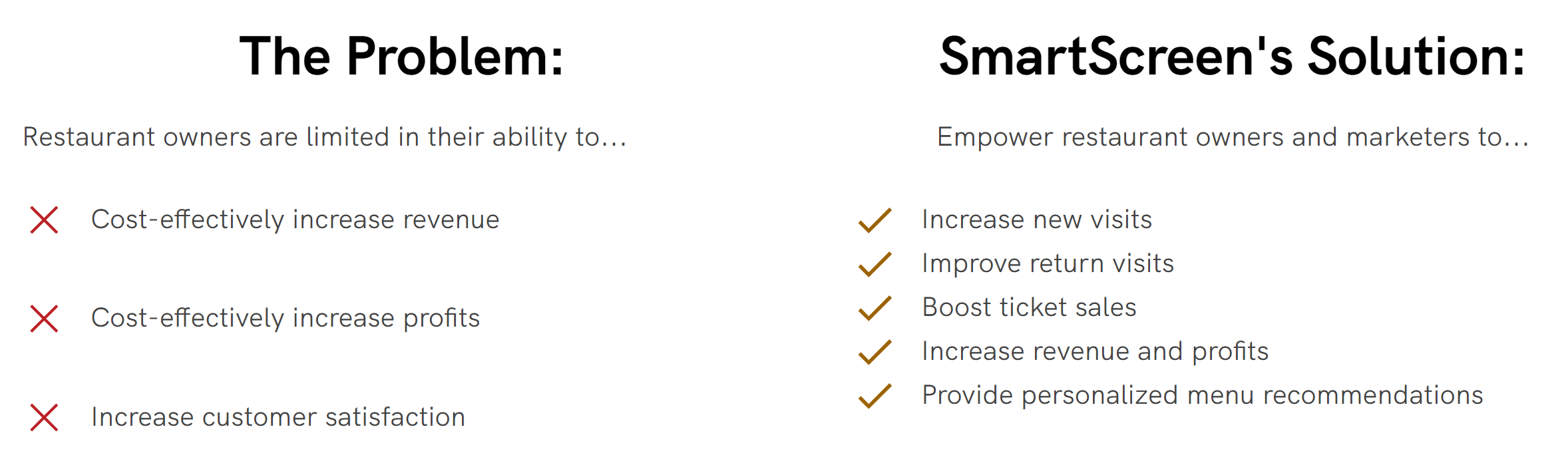

Problem

There are many problems with the current online and in store digital dining experience, which SmartScreen is addressing. Some Include:

1. Lack of Personalization in Digital Dining: Traditional digital dining platforms often struggle to provide personalized recommendations to customers. Without a deep understanding of each diner’s preferences and desires, these platforms fail to offer relevant products, leading to reduced customer engagement and satisfaction.

2. Inefficient Data Utilization: Many dining platforms collect vast amounts of data from diners’ activities but lack the capability to analyze and leverage it effectively. As a result, valuable insights about customer behavior and preferences go untapped, hindering the ability to deliver accurate and personalized recommendations.

3. Customer Experience Challenges: Customers are inundated with an overwhelming array of choices in the digital dining landscape. This abundance of options can lead to decision fatigue and frustration, resulting in lower conversion rates and reduced customer loyalty.

4. Complex Implementation Processes: Integrating personalized recommendation systems into digital dining platforms can be complex and time-consuming. Existing solutions may require significant technical expertise, leading to delays in implementation and increased costs for businesses.

5. Limited Adaptability and Customization: Many recommendation systems lack the flexibility needed to cater to the unique branding and customer base of different restaurants and digital dining platforms. This lack of adaptability hampers the ability to deliver a seamless and cohesive user experience.

6. Missed Revenue Opportunities: Without personalized product recommendations, dining platforms miss out on opportunities to upsell and cross-sell to customers effectively. This hinders revenue growth and leaves money on the table.

7. Inadequate Real-time Insights: The inability to capture and analyze real-time behavioral data of diners means missed opportunities to engage with customers at critical moments, leading to reduced conversion rates and potential loss of valuable customers.

Solution

SmartScreen addresses these challenges by offering a powerful and adaptive solution that analyzes diners’ activities and preferences in real-time. By combining Transactional, Contextual, and Behavioral data through their SMART data stratum, SmartScreen provides a complete dataset for precise and relevant recommendations.

Their easy-to-use and fast interface, coupled with vast adaptability and modification capabilities, streamlines the implementation process for digital dining platforms, enabling them to deliver personalized product recommendations seamlessly throughout the customer journey. With SmartScreen’s solution, businesses can enhance customer experience, drive engagement, increase revenue, and gain a competitive edge in the dynamic digital dining market.

Unique to the SmartScreen approach is a restaurant gets personalization without privatization concerns as no customer data is required. Loyalty programs enhance the optimization but are not required and other sensitive data issues are resolved setting SmartScreen up for international expansion where privatization concerns are of the utmost importance.

Investment Opportunity

Investing in SmartScreen presents an exciting opportunity to revolutionize the digital dining landscape. With their cutting-edge recommendation system, the startup is poised to disrupt the industry by providing personalized, data-driven solutions that enhance customer experiences, drive revenue growth, and create a strong competitive edge for businesses in the dynamic digital dining market.

Business Model

The SmartScreen Business Model is quite simple with multiple revenue streams. We charge per channel that we are optimizing such as digital signage, online ordering, or email marketing. If a client wants to use all of the channels, then there is one annual license fee. The fee is $1,200.00 per year per channel per location or $4,995.00 a year per location for all channels.

There are additional revenue streams based on the channel and the application such as advertising revenue. Since the SmartScreen solution can be used for ads for menu items, merchandise and advertisements, once a restaurant is using the system, they can advertise local surrounding visits and charge for that advertising such as the Cleaners next door, etc. SmartScreen the restaurant will share that revenue at a 70%/30% split for SmartScreen.

Market Projection

The restaurant software market is a rapidly growing and dynamic sector that caters to the needs of restaurants, cafes, bars, and other foodservice establishments. The increasing adoption of digital technologies, rising demand for efficient restaurant management solutions, and the growing trend of online food ordering are the primary factors driving the market’s expansion. Below is a brief analysis of the restaurant software market, based on available sources up to September 2021.

1. Market Size and Growth: The global restaurant software market has been experiencing significant growth over the past few years. According to a report by Grand View Research, Inc., the market size was valued at approximately $3.6 billion in 2020 and was projected to grow at a compound annual growth rate (CAGR) of around 8.2% from 2021 to 2028 [Source: Grand View Research, Inc.].

2. Key Drivers: a. Digital Transformation: Restaurants are embracing technology to streamline operations, enhance customer experiences, and optimize resource utilization. b. Demand for Contactless Solutions: The COVID-19 pandemic accelerated the adoption of contactless ordering, payment, and delivery solutions in the foodservice industry. c. Inventory Management: Software solutions that aid in inventory tracking, reducing wastage, and managing supplies efficiently are in high demand. d. Data Analytics: Restaurants are leveraging data-driven insights to make informed decisions, enhance menu offerings, and implement targeted marketing strategies.

3. Software Types: a. Point-of-Sale (POS) Systems: POS software is a fundamental tool that handles payment processing, order management, and customer data. b. Online Ordering and Delivery Platforms: With the rise of food delivery services, restaurants seek software solutions to manage online orders, track deliveries, and integrate with popular delivery apps. c. Inventory and Supply Chain Management: Restaurants require software to manage inventory levels, track stock movements, and optimize supply chain processes. d. Table Reservation and Waitlist Management: Reservation software helps restaurants streamline table management and handle customer reservations efficiently.

4. Regional Analysis: North America and Europe have been leading the restaurant software market, primarily due to the early adoption of technology in the foodservice industry. Asia-Pacific is also witnessing significant growth, fueled by the increasing number of restaurants, rising disposable incomes, and the surge in online food delivery services.

Competition

There are three types of competitors:

1. Direct – There is not any direct restaurant specific personalization and optimization platform similar to SmartScreen.

2. Historic eCommerce personalization platforms are the largest of which is dynamic yield which was sold to McDonald’s in 2019 for 300 million and then resold to Mastercard in 2022 for undisclosed amount. They will sell to restaurants but are still 99 percent eCommerce and there is probably some sort of competition clause with McDonald’s so they sell to other large QSR’s. Although they are very worthy, they are over kill for restaurants and much more complex. Other personalization companies could go into restaurants, but the market is really to small for them compared to the eCommerce market. We will move into eCommerce after making way in the restaurant and hospitality space.

3. The third and strongest competitors are the other restaurant applications themselves as most all of the applications from online ordering to websites and Mobile applications try and say they have ai generated recommendations; however, the problem is that they are not user generated and only work for that application. SmartScreen actually helps these online order platforms and mobile order platforms as they are there to sell the most for their clients. This is quite common in ecommerce and will become the norm in restaurant ordering platforms.

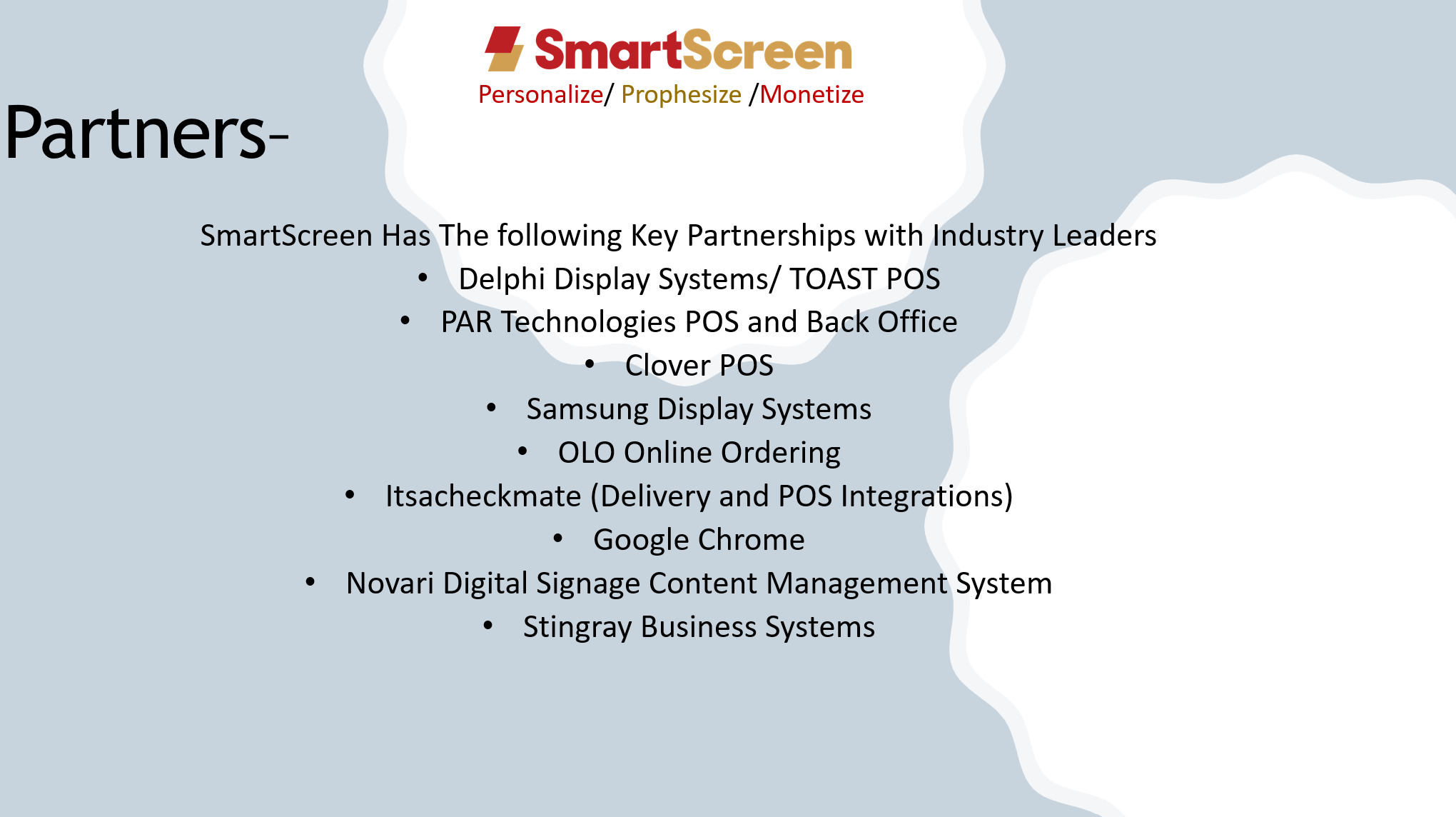

Traction & Customers

SmartScreen is currently working with over 10 clients that have around 300 locations combined. These are leads that were received at the National Restaurant Show where SmartScreen officially launched in May 2023. SmartScreen has created prototypes for leading brands such as Boston Market and AMYs Drive Thru. SmartScreen was a finalist in the 2022 Restaurant Technology Network Start Up Alley Awards at the Multi Unit Technology show in Las Vegas which is where major operators of QSR and fast casual restaurants go to learn about the latest technology.

Investors

The Company has been self-funded by its three leaders to date, remaining entirely bootstrapped. SmartScreen is now utilizing the Regulation Crowdfunding exemption to conduct this offering of Units.

Terms

SmartScreen LLC (“SmartScreen,” the “Company,” “we,” or “us”), a Nevada limited liability company formed on April 9, 2020, is holding the following offering:

Up to $123,997.50 in Units at $49.50 with a minimum target amount of $9,999.00.

Offering Minimum: $9,999.00 | 202 Units

Offering Maximum: $123,997.50 | 2,505 Units

Type of Security Offered: Units

Purchase Price of Security Offered: $49.50

Minimum Investment Amount (per investor): $247.50

The Minimum Individual Purchase Amount accepted under this Regulation CF Offering is $247.50. The Company must reach its Target Offering Amount of $9,999.00 by April 1st, 2024 (the “Offering Deadline”). Unless the Company raises at least the Target Offering Amount of $10,000 under the Regulation CF offering by the Offering Deadline, no securities will be sold in this Offering, investment commitments will be cancelled, and committed funds will be returned.

Bonus:

Investors who invest $1,200 or more will be able to utilize the software for one channel at one location for one year.

Risks

Please be sure to read and review the Offering Statement. A crowdfunding investment involves risk. You should not invest any funds in this offering unless you can afford to lose your entire investment.

In making an investment decision, investors must rely on their examination of the issuer and the terms of the offering, including the merits and risks involved. These securities have not been recommended or approved by any federal or state securities commission or regulatory authority. The U.S. Securities and Exchange Commission does not pass upon the merits of any securities offered or the terms of the offering, nor does it pass upon the accuracy or completeness of any offering document or literature.

These securities are offered under an exemption from registration; however, the U.S. Securities and Exchange Commission has not made an independent determination that these securities are exempt from registration.

Neither PicMii Crowdfunding nor any of its directors, officers, employees, representatives, affiliates, or agents shall have any liability whatsoever arising from any error or incompleteness of fact or opinion in, or lack of care in the preparation or publication of, the materials and communication herein or the terms or valuation of any securities offering.

The information contained herein includes forward-looking statements. These statements relate to future events or future financial performance and involve known and unknown risks, uncertainties, and other factors that may cause actual results to be materially different from any future results, levels of activity, performance, or achievements expressed or implied by these forward-looking statements. You should not place undue reliance on forward-looking statements since they involve known and unknown risks, uncertainties, and other factors, which are, in some cases, beyond the company’s control and which could, and likely will materially affect actual results, levels of activity, performance, or achievements. Any forward-looking statement reflects the current views with respect to future events and is subject to these and other risks, uncertainties, and assumptions relating to operations, results of operations, growth strategy, and liquidity. No obligation exists to publicly update or revise these forward-looking statements for any reason or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

Security Type:

Equity Security

Price Per Share

$49.50

Shares For Sale

2,505

Post Money Valuation:

$9,124,088

Investment Bonuses!

Investors who invest $1,200 or more will be able to utilize the software for one channel at one location for one year.

Regulatory Exemption:

Regulation Crowdfunding – Section 4(a)(6)

Deadline:

April 1, 2024

Minimum Investment Amount:

$247.50

Target Offering Range:

$9,999.00-$123,997.50

*If the sum of the investment commitments does not equal or exceed the minimum offering amount at the offering deadline, no securities will be sold and investment commitments will be cancelled returned to investors.

James Reed

CEO & Co Founder

BackgroundJames is a 30-year strategic executive with a unique blend of both corporate and start-up experience. James’s specialty is leading the sales and marketing efforts of fortune 500 spinouts under the companies venture capital umbrellas. He has done this with Xerox, UPS, Nokia and with a USPS privatization startup called SmartMail. SmartMail was sold to DHL for 480 million dollars. In addition to these accomplishments, James has started several of his own companies including the pre-curser to SmartScreen called Smart Page which he co-founded with Pat Moore. SmartPage was the first Bayesian Data Mining eCommerce analytics and predictive technology personalization company founded in 2004. As Senior VP of Strategic Alliances he lead the strategic assessment of new business opportunities and partnerships. James designed & implemented an integrations partner program that met the needs of Altametrics’ business models. By understanding market dynamics and having keen knowledge and awareness of competitive products, solutions and service offerings, James demonstrated competence across a broad spectrum that included but was not limited to new product launch, product positioning, pricing, partner program development and strategic planning. He led this area of the business in the identification, evaluation, structuring, and negotiations of potential partnerships for the company and oversee the success of the alliances and execution of our partnered programs. He continuously improved efficiencies, processes, procedures and personnel in all areas of responsibility to keep pace with the growth of the company.

Laura Ali

SVP Sales & Marketing

BackgroundLaura Marie Ali is a proven Sales Executive having demonstrated sales leadership success at Fortune 100 companies such as Xerox Corporation and RR Donnelley. She also has led two start-ups to successful IPOs heading up sales at Document Sciences Corporation (a Xerox Venture Capital company) and Smartmail which was sold to DHL for $480,000,000. Laura has worked with James in two other successful ventures Recently she headed up her own sales and digital marketing company – Triple Win Sales – which helps private sector companies develop and execute results driven sales and marketing strategies.

Patrick Moore

Chief Data Scientist & Co Founder

BackgroundPat Moore is a Cornell Statistician with vast experience. Pat has run Data Science teams at American Express, Rakuten, New York Times and Bloomberg as well as a few start-ups. Pat’s teams have conducted thousands of online experiments, built thousands of predictive models, designed several semi-automated analytics platforms, designed a few recommender systems and designed one completely automated analytics platform. All with the objective of revenue maximization. Pat is an expert at designing specifications for engineers to build AI platforms. Pat leads a team that develops statistical models for a variety of purposes using structured as well as unstructured data on a Big Data platform. I also design ML software to develop data science driven software for use by non-data scientists. Currently I work with Bigquery, Hive and Rapidminer, but have worked extensively with SQL, SAS and Matlab in the past. I have also used C++, Python and R at times.

Legal Company Name

SmartScreen

Location

5439 Cokesbury Road

Fuquay Varina, North Carolina 27526

Number of Employees

3

Incorporation Type

LLC

State of Incorporation

Nevada

Date Founded

April 9, 2020