We have the first Vertical-Axis Wind Turbine built for turbulent Mid-Level wind 15′ to 100’ above the ground. This trillion-dollar resource is inaccessible to traditional turbines. Being first to being able to add short turbines under tall turbines has advantages. One is that others will want to license our new patents to cost-effectively make their own compact, durable turbines. Raising $350,000 puts us on track to start certifying two Wind Harvester™ 4.0 turbines in the summer of 2024.

Raised 100 % of minimum

Funding Raised

$155,070

Funding Goal

$10,000-$1,000,000

Days Left to Invest

Closed

Wind Harvest

We have the first Vertical-Axis Wind Turbine built for turbulent Mid-Level wind 15′ to 100’ above the ground. This trillion-dollar resource is inaccessible to traditional turbines. Being first to being able to add short turbines under tall turbines has advantages. One is that others will want to license our new patents to cost-effectively make their own compact, durable turbines. Raising $350,000 puts us on track to start certifying two Wind Harvester™ 4.0 turbines in the summer of 2024.

Raised 100 % of minimum

Funding Raised

$155,070

Funding Goal

$10,000-$1,000,000

Days Remaining

Closed

Business Description

We will sell our compact, energy-dense Wind Harvester™ turbines directly to customers in the U.S. Our regional distributors and manufacturing licensees in other countries will sell them to higher energy using facilities, renewable energy project developers and existing wind farm owners.

Wind Harvest will also make income from extended warranties, service agreements, wind farm and vertical-axis wind turbine (“VAWT”) placement computer modeling. In addition, many of our projects will earn tax credits and developer fees.

Wind Harvest will be the leading designer of turbines for turbulence. The most profitable part of the business should be from licensing patents to others who will want to make short, durable vertical axis wind turbines for the newly opened mid-level wind markets around the world.

Reasons to Invest:

1. Our smaller turbines cleverly capture huge amounts of mid-level wind that larger wind turbines miss.

2. Investors in this offering receive 7% interest and a potential 3X to 20X equity-based upside.

3. We make 4X more profit on each megawatt of sales than large turbine manufacturers.

4. In many places, Wind Harvesters will produce the cheapest energy available.

5. 300,000 MWs of our turbines can be added to wind farms and power 180,000,000 homes for 70 years.

6. Seven key patents are pending, with more to be filed. Many will want to license our IP.

Problem

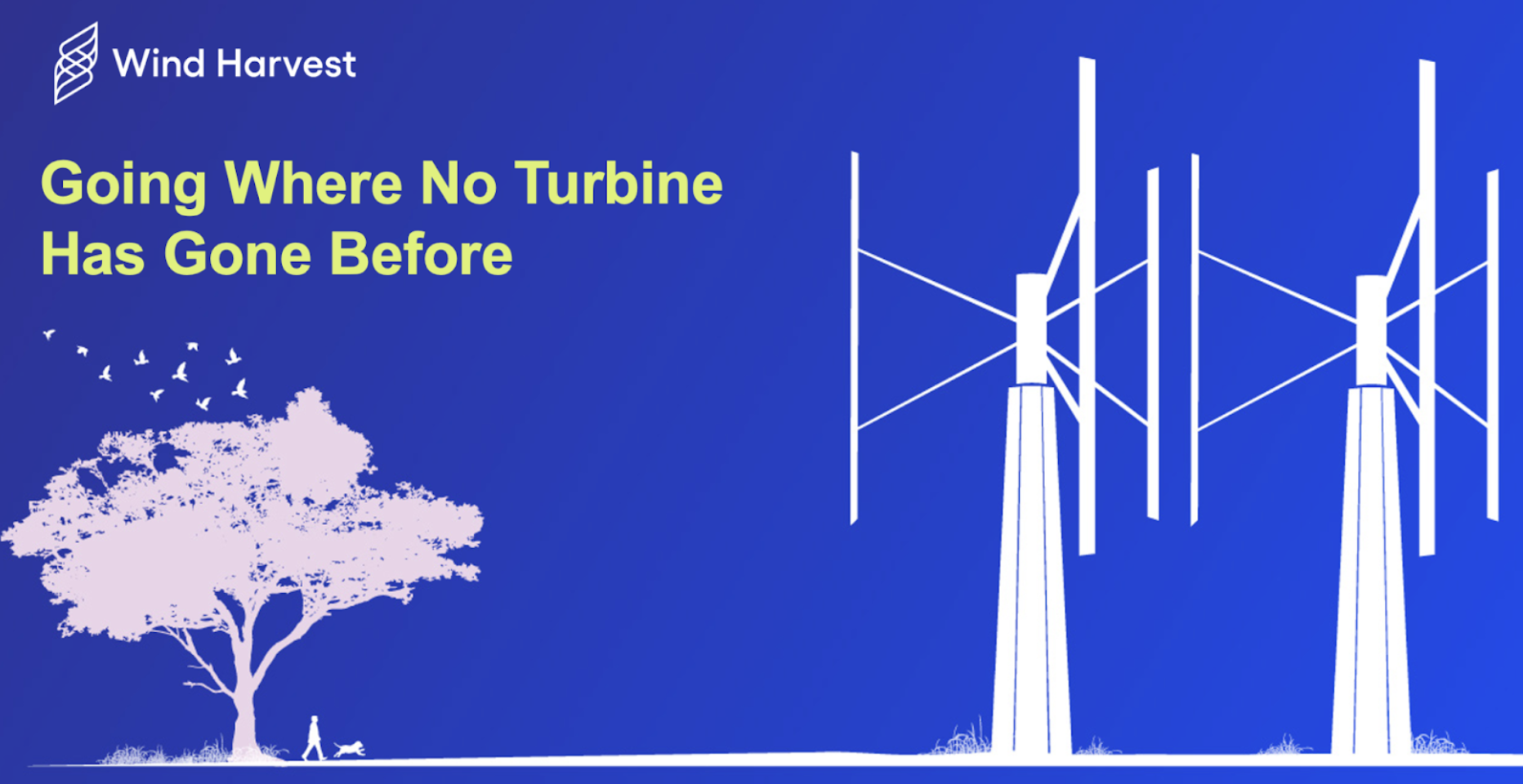

Problem: Excellent Wind Resources Are Unusable By Existing Technology

Mid-level wind can be exceptionally energetic but too turbulent for utility-scale, traditional turbines to harvest. Over 20% of wind farms operate on ridgelines, passes, and other places where there are excellent wind speeds below 100’ above the ground that cannot presently be used.

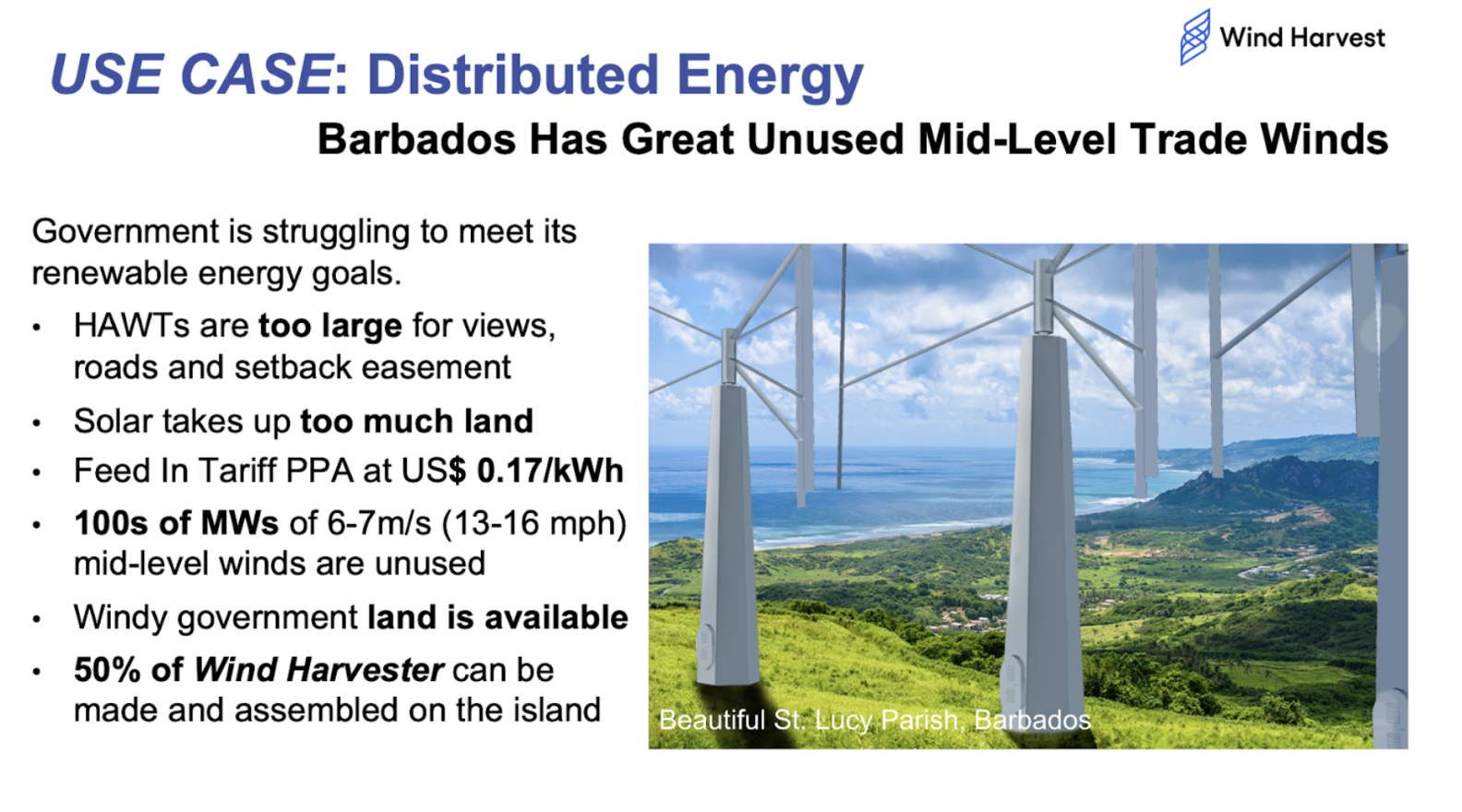

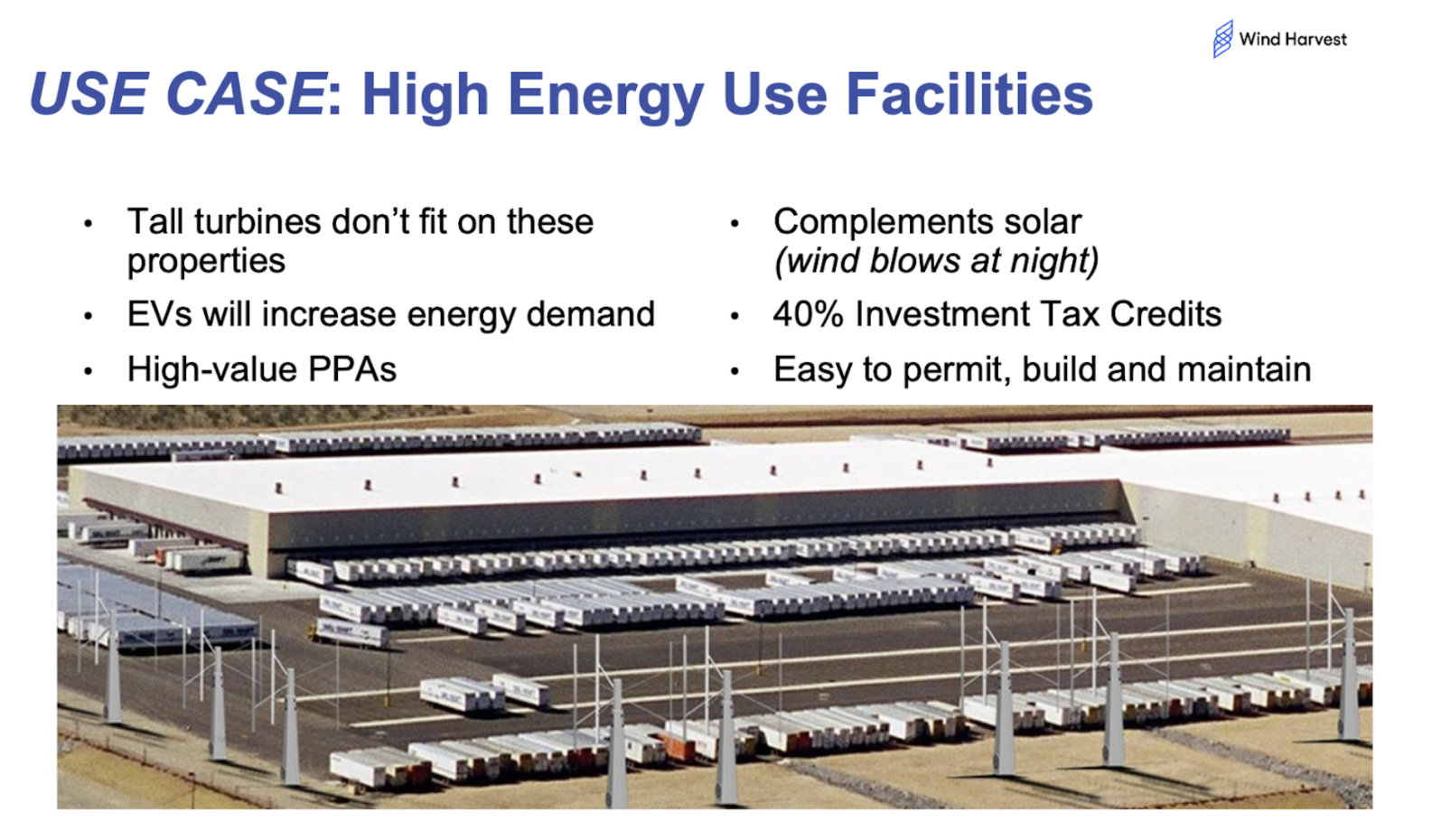

Many other windy properties cannot secure permits because, at 300 to 500 feet tall, traditional turbines can impact views, aviation, roads, and setback easements.

Solution

Solution: Our Turbines

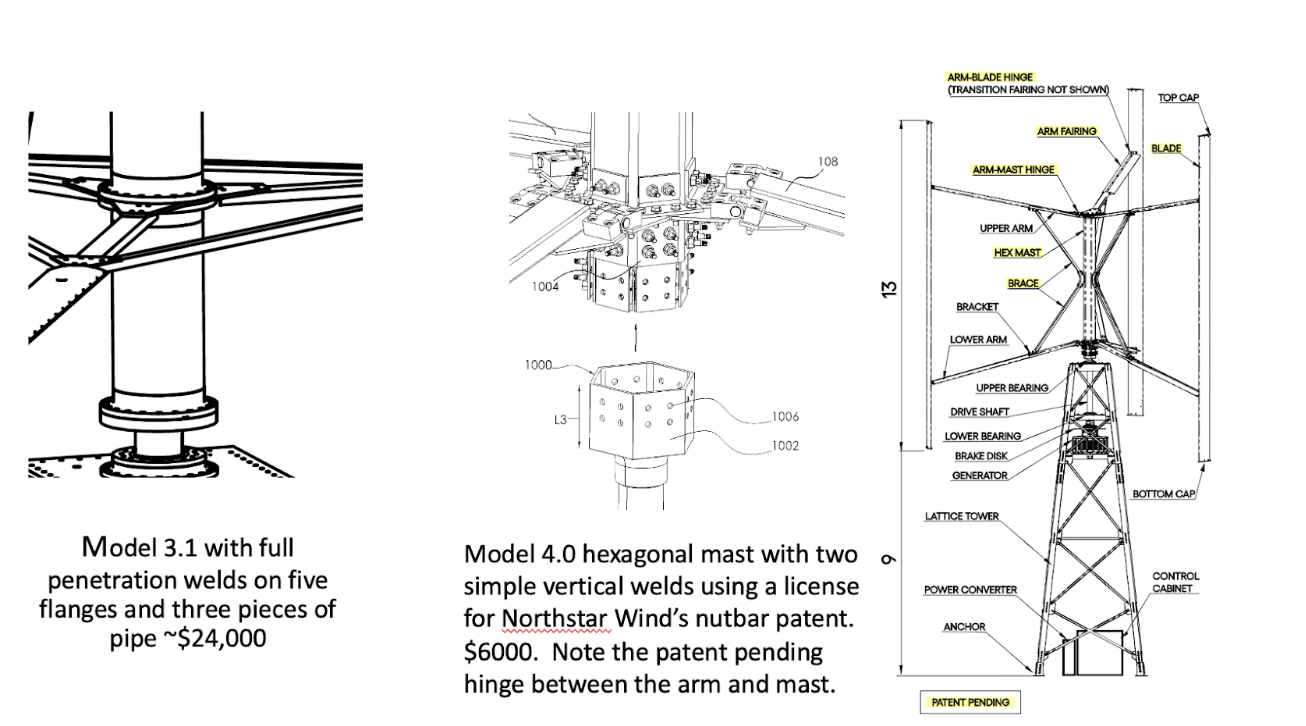

Our short, energy-dense turbines survive and thrive in the gusting wind that swirls through the understories of wind farms, beneath the tall turbines. Wind Harvesters can do this because they have two arms per blade connected to a vertically aligned mast while propeller-type turbines have one connection from the blade to a horizontally aligned drive shaft.

Our prototypes and field-validated “aeroelastic” modeling prove Wind Harvesters’ effectiveness and durability. These relatively simple machines have advantages:

– Patented innovations (below) save money and increase energy output.

– Many components can be made locally which increases jobs and public support for Wind Harvester projects in places like Barbados.

– Bird and Bat Friendly: Their 3-dimensional shape and slower moving blades make them easier for wildlife to see and avoid than the 2-d propeller-type turbines.

– 99% recyclable with steel, and aluminum parts that will last over 70 years.

– Extruded, mass-manufactured, and inexpensive aircraft aluminum blades.

The breakthrough that makes Wind Harvesters the first “cantilevered” VAWT able to survive and thrive in turbulent conditions came from team member Dr. David Malcolm. He brought 40 years of vertical and horizontal axis wind turbine engineering and modeling experience to Wind Harvest. Our engineering team used data from Wind Harvester prototypes to confirm the accuracy of our new computer models that Dr. Malcolm helped develop. This validationwas a historic milestone for H-type VAWTs.

We field-tested many prototypes to learn all that we have about VAWTs. Most of our new innovations have their roots in the work of co-founder Bob Thomas and his son Dean. Their Windstar prototypes and the breakthrough 530G array in Palm Springs proved the Coupled Vortex Effect.

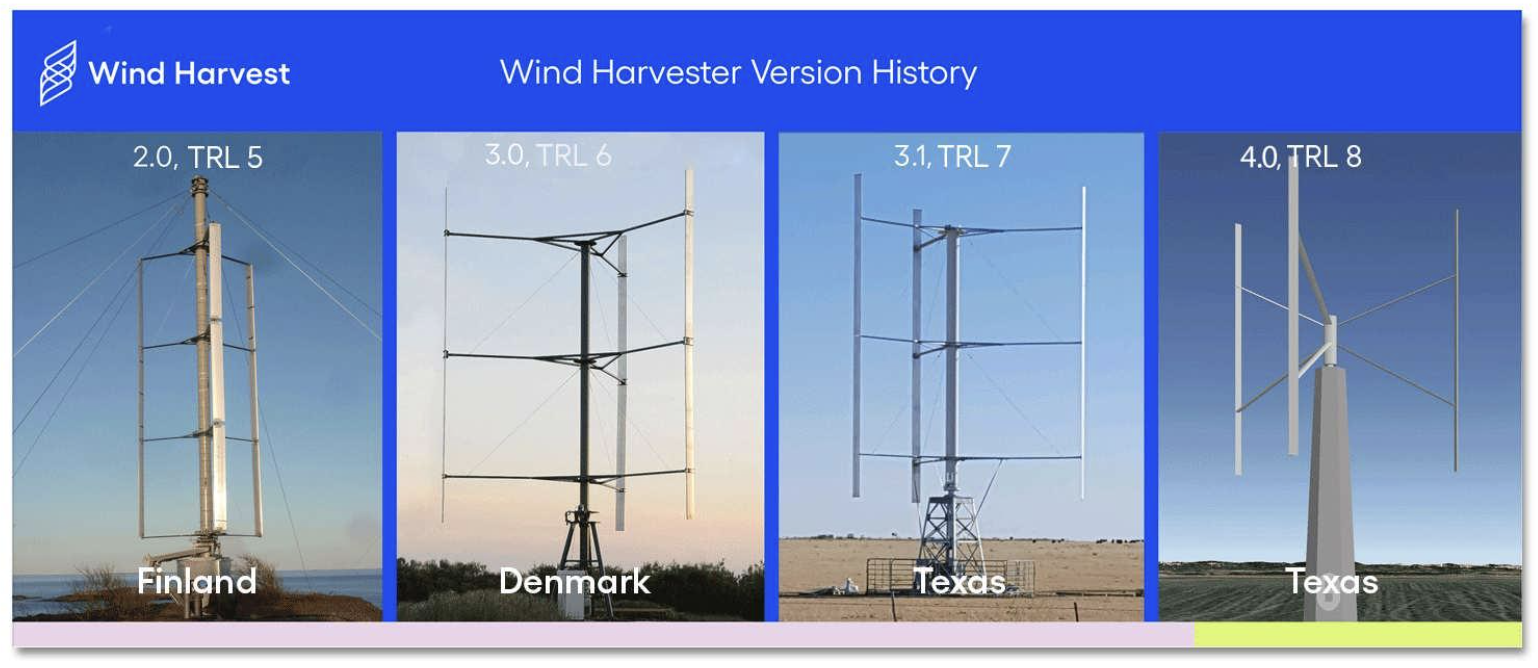

Our crowdfunding offerings raised the capital needed to make, install and test our Wind Harvester 3.1 at the UL Advanced Wind Turbine Testing Facility in Texas. There it completed Technology Readiness Level (TRL 7), operating a full scale prototype in industry conditions of highly turbulent wind.

With funding, we will install two 4.0 Wind Harvesters in early summer 2024 and begin third-party certification (TRL 8). Upon one more verification of the accuracy of our engineering models, we will order turbines for projects in development that will allow us to complete the last step in the commercialization process. TRL 9 is achieved when banks have sufficient data from operating turbines that they will finance our customers’ multi-million dollar projects.

Business Model

How We Make Money

Sell Wind Harvester: The price of each Wind Harvester will initially include an average markup of $70,000. On a per MW basis, this produces ~4X the net sales income than traditional wind farm turbines.

License Our Intellectual Property: With seven patents pending and a pipeline of future IP, we are confident that many others will want to license our innovations. It will be tough to make VAWTs as large, durable and efficient as ours without licensing our hinge connection, hex mast and blade patents.

Develop Projects: At least until banks will loan millions of dollars to our customers, we are in the renewable energy project development business. We make money when we sell Wind Harvesters to those projects, and we benefit from the tax credits and subsidies that projects realize.

Market Projection

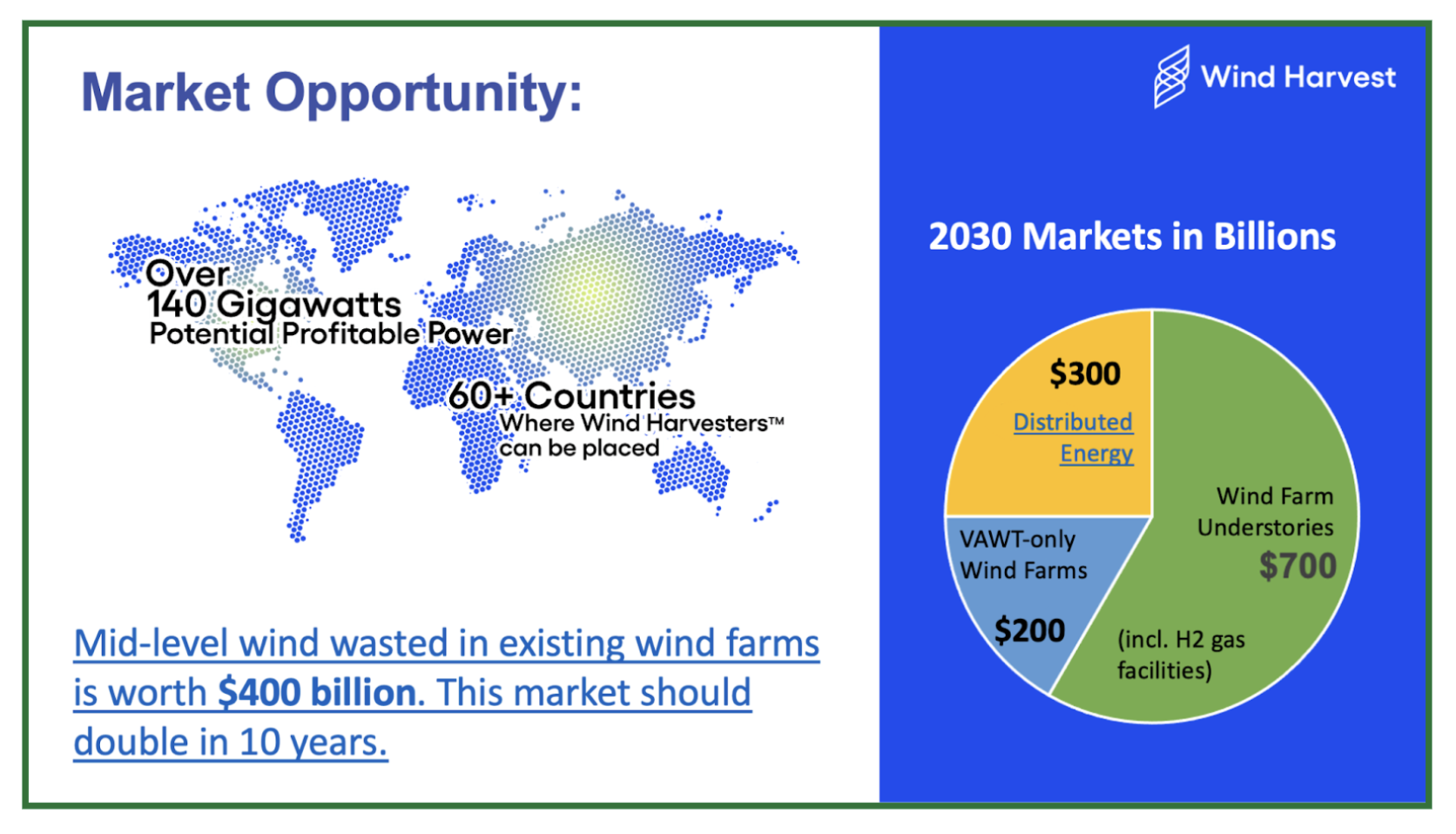

Primary Market: Wind Farms

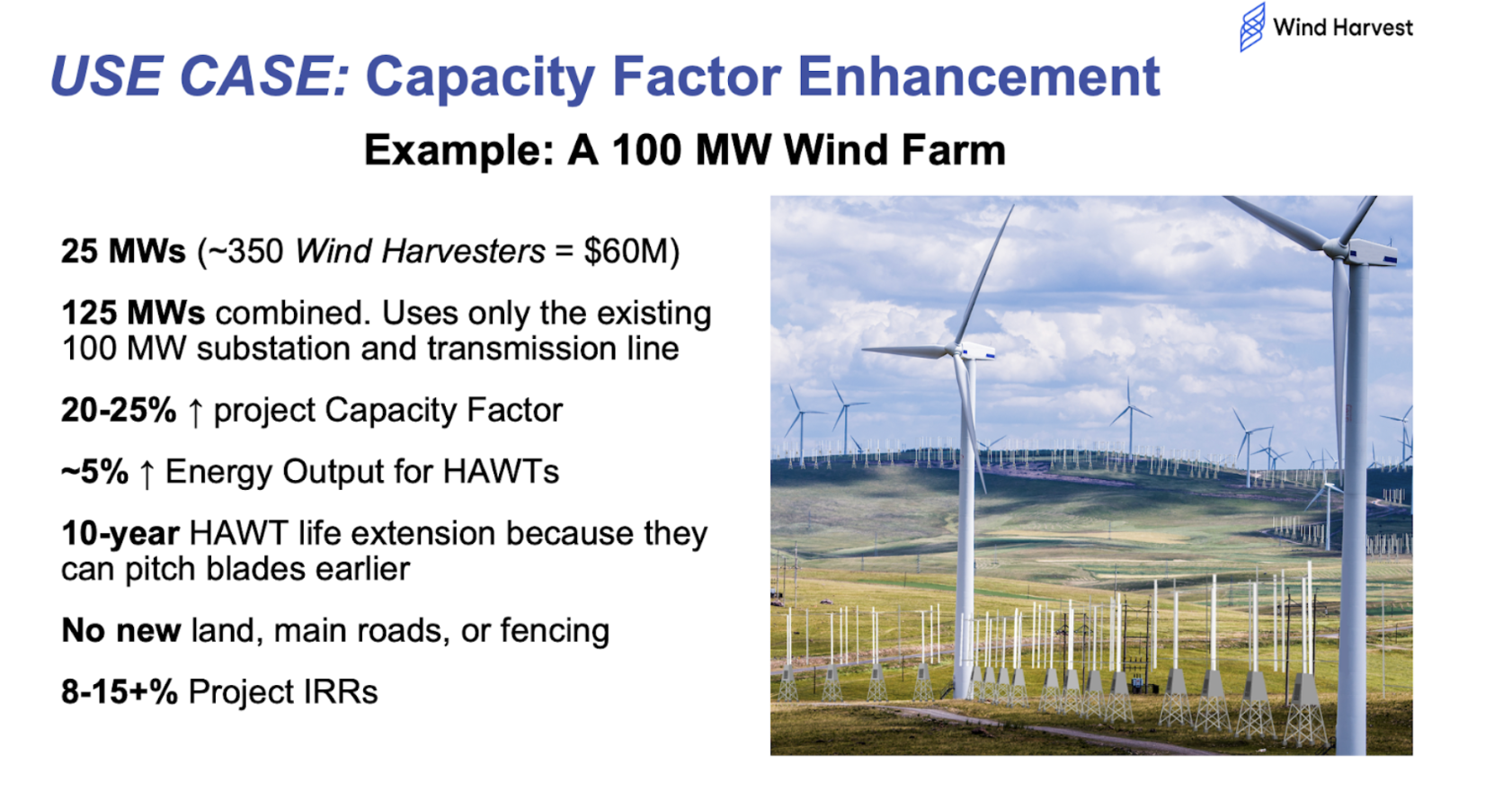

The need for climate restoration is increasing the urgency for governments and economies to transition to renewable energy. The easiest and most lucrative place to build new wind farms is in the “understories” of existing ones with great mid-level wind resources.

Research shows that 20% of wind farms will have strong enough wind near the ground to profitably install VAWTs under their taller turbines.

Research from CalTech and other universities shows that VAWTs like Wind Harvesters and traditional turbines can synergistically work together. They can be placed such that they cause faster wind to move through each other’s rotors and produce 10% more energy.

Competition

Competition and Licensing Our Proprietary Technology

Wind Harvesters will be the first certified, utility-scale VAWT that is designed to operate in turbulence. We believe other turbine manufacturers will need to license our patents to make durable and cost-effective VAWT’s.

Licensing and strategic collaboration offers Wind Harvest ways to leverage other companies’ capital and experience to dramatically increase the speed at which mid-level wind resources are developed. The wide open, mid-level wind market is so vast that major international companies will find it efficient and profitable to license our patents when they make their own VAWTs.

Our Guiding Principles

It is not often that a company at our advanced stage in the technology commercialization process remains privately held and is the first to an enormous untapped market. Even less frequent is the opportunity for the average person to invest early, before the company becomes a household name. We believe we will provide a sizable return for our investors. and have a significant impact on our climate by helping to drive down the cost of renewable energy

Seize the opportunity! And help us bring to the world the first turbine that can handle turbulence.

Traction & Customers

Our first sale will include the existing Model 3.1 and initially two Wind Harvester 4.0s installed at the UL Advanced Wind Turbine Testing Facility in Texas. This $1.3 million dollar project will be sold to a new company Wind Harvest sets up. It will be eligible for over $500,000 in tax credits and accelerated depreciation.

Before we can sell thousands of Wind Harvesters to wind farm owners, we need to prove that they are wildlife friendly, compatible with tall turbines, and bank financeable. We expect to accomplish much of this in 2025. In the meantime, we are developing projects that open up new distributed energy markets with our turbines.

Investors

Wind Harvest International Inc. through its subsidiary Wind Harvest Pilot Project Inc. has conducted a Regulation CF/506c offering in 2020-2021 that raised $1.94M. It conducted a second Reg CF/506c offering starting in October 2022 that ended in January 2023 and raised $470,000.

Terms

Promissory Notes offered by Wind Harvest Pilot Project Inc. come with a Security Guaranty from the parent company Wind Harvest International Inc (WHI). The first $93,270 in Notes receive an 8% interest. The remaining Notes receive a 7% interest payment made annually 60 days after the end of the year. The Notes have a Maturity Date of Dec. 31, 2027. For each $1 invested, the Note Holder receives pro-rata proceeds from the sale of 2.5 shares of WHI common stock from warrants with an exercise price of $0.01 each. The current share price is $0.09 each.

For More Information

The FAQs on our business plans, technology, sales and markets, 6-year financial predictions, and windharvest.com website provide more information on how we plan to get from where we are now to $1 billion in sales in five years. Another source of information is our Form C (a link to that is on this page). Send your questions, comments, and feedback to info@windharvest.

You are cautioned not to place undue reliance on forward-looking statements made here. These statements are based on the current beliefs, expectations, and assumptions of our management and are subject to significant risks and uncertainties that are beyond our ability to predict or control and could cause actual results to differ. These risk factors include, but are not limited to, the risks identified in our current Form C, filed with the SEC. The cautionary language in our Form C regarding forward-looking statements is incorporated herein by reference and applies to the statements in this release.

Risks

As an investor, please be sure to read and review the Offering Statement. If you have any unanswered questions, please be sure to utilize the communication channel on this page to ask the issuer questions.

A crowdfunding investment involves risk. You should not invest any funds in this offering unless you can afford to lose your entire investment.

In making an investment decision, investors must rely on their examination of the issuer and the terms of the offering, including the merits and risks involved. These securities have not been recommended or approved by any federal or state securities commission or regulatory authority. The U.S. Securities and Exchange Commission does not pass upon the merits of any securities offered or the terms of the offering, nor does it pass upon the accuracy or completeness of any offering document or literature.

These securities are offered under an exemption from registration; however, the U.S. Securities and Exchange Commission has not made an independent determination that these securities are exempt from registration.

Neither PicMii Crowdfunding nor any of its directors, officers, employees, representatives, affiliates, or agents shall have any liability whatsoever arising from any error or incompleteness of fact or opinion in, or lack of care in the preparation or publication of, the materials and communication herein or the terms or valuation of any securities offering.

The information contained herein includes forward-looking statements. These statements relate to future events or future financial performance and involve known and unknown risks, uncertainties, and other factors that may cause actual results to be materially different from any future results, levels of activity, performance, or achievements expressed or implied by these forward-looking statements. You should not place undue reliance on forward-looking statements since they involve known and unknown risks, uncertainties, and other factors, which are, in some cases, beyond the company’s control and which could, and likely will materially affect actual results, levels of activity, performance, or achievements. Any forward-looking statement reflects the current views with respect to future events and is subject to these and other risks, uncertainties, and assumptions relating to operations, results of operations, growth strategy, and liquidity. No obligation exists to publicly update or revise these forward-looking statements for any reason or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

Security Type:

Debt Security

Annual Interest Rate

7%

Maturity Date

December 31, 2027

Post Money Valuation:

N/A – Debt Raise

Investment Bonuses!

Profit Share Kicker: For each $1 invested, the Note Holder receives pro-rata proceeds from the sale of 2.5 shares of WHI common stock from warrants with an exercise price of $0.01 each.

Regulatory Exemption:

Regulation Crowdfunding – Section 4(a)(6)

Deadline:

January 1, 2024

Minimum Investment Amount:

$100

Target Offering Range:

$10,000-$1,000,000

*If the sum of the investment commitments does not equal or exceed the minimum offering amount at the offering deadline, no securities will be sold and investment commitments will be cancelled returned to investors.

Kevin Wolf

CEO and Co-founder

BackgroundExpert on vertical axis wind turbines and markets. Raised $10M for Wind Harvest. Previous COO and a key investor in Wind Harvest. Chair of the CA Clean Money Action Fund to reduce the influence of big money in politics. “We must bring down CO2 levels and restore our climate in order for humanity and nature to flourish. To achieve this goal, we need inexpensive and long-lasting renewable energy supplies. Our Wind Harvesters will boost the growth of wind energy and make a significant positive impact on climate change.”

Alana Steele

Project Development

BackgroundAlana Steele has over 30 years of experience in the energy industry and was previously COO of Western Wind. She runs our project development team.

Christine Nielson

President, Wind Harvest Pilot Project

BackgroundOrganic entrepreneur, Climate activist, Founder of Coyuchi Inc., the first U.S. company to manufacture and sell quality organic cotton textiles.

Dr David Malcolm

Principal Engineer

Background40+ year career at forefront of the design and engineering of both horizontal axis (propeller-type) and vertical axis wind turbines. David has extensive experience in the aeroelastic modeling and developed Wind Harvest’s Eole suite of H-type VAWTs.

Rob Wheelock

Strategy & Business Development

BackgroundDuring his 48 years of comprehensive experience in planning, organizing, financing, and managing entrepreneurial businesses, Wheelock served as the chief financial executive for a renewable energy company for ten years.

Cornelius Fitzgerald

Board Member

Background15+ years strategy and execution in finance and renewable energy. Large project leader for Wind Harvest. Co-founder and president Clean Energy Holdings, LLC that is developing wind, solar and hydrogen gas renewable energy projects.

Dr Olamide Ajala

Principal Engineer

BackgroundMechanical engineer. Vertical axis wind turbine aeroelastic modeling expert. Leader of the engineering team.

Dr. Ariana Marshall

Caribbean Resilient Ecosystems Manager

BackgroundLeads efforts to develop our projects and analyze the cumulative environmental, cultural and economic impacts for the large installations of the Wind Harvester we will install on Caribbean islands such as Barbados where she lives.

Jeffrey Willis

Consulting and Production Manager

BackgroundAn inventor with numerous wind related patents and an expert in manufacturing with a wealth of experience from 20 years of working in the wind industry, he oversees our v.3.1 pilot project and the engineering and manufacturing of our v3.2 turbine.

Mark Chang

Electrical Engineer

BackgroundMark is a talented Electrical Engineer for Wind Harvest. Mark has a mind for complexity, math, and detail. He developed the controls for our models 1.0 and 2.0 and model 3.1.

Antonio Ojeda

Chief Engineer

BackgroundWith ten plus years engineering experience and problem-solving, he led the mechanical engineering of the Wind Harvester v3.1 and co-authored its four Design Evaluation documents. Now a consulting engineer.

Jeff Olson

Mechanical Engineer

BackgroundExperienced engineer that provided on-site installation with prototypes v1.0 and 2.0. Made all recent SolidWorks drawings for v3.0 and 3.1. Now a consulting engineer.

Omar Garcia

Field and Mechanical Engineer

BackgroundOmar began as on-site engineering intern for our Model 3.1. We were so pleased with his work that when he recently graduated with a Mechanical Engineering degree from West Texas A&M University, we hired him to join our team full time.

Jen Hoover

Investor Relations

BackgroundShe has worked in a number of varied roles within the sustainability sector. She holds a Master’s degree in Textiles, with a focus on environmental aspects of wool production

Legal Company Name

Wind Harvest

Location

712 Fifth St.

Davis, California 95616

Number of Employees

6

Incorporation Type

C-Corp

State of Incorporation

DE

Date Founded

January 6, 2006

Raises half the minimum amount

Wind Harvest has raised half of the target offering amount on October 27, 2023. $147,070 has been raised at this time.

Raises 100% of the minimum amount

Wind Harvest has raised the target offering amount on October 27, 2023. $147,070 has been raised at this time.Investors should be aware that the Issuer can now conduct rolling closes if they wish. If the Issuer decides to do so, you will be notified and given time to cancel your investment.